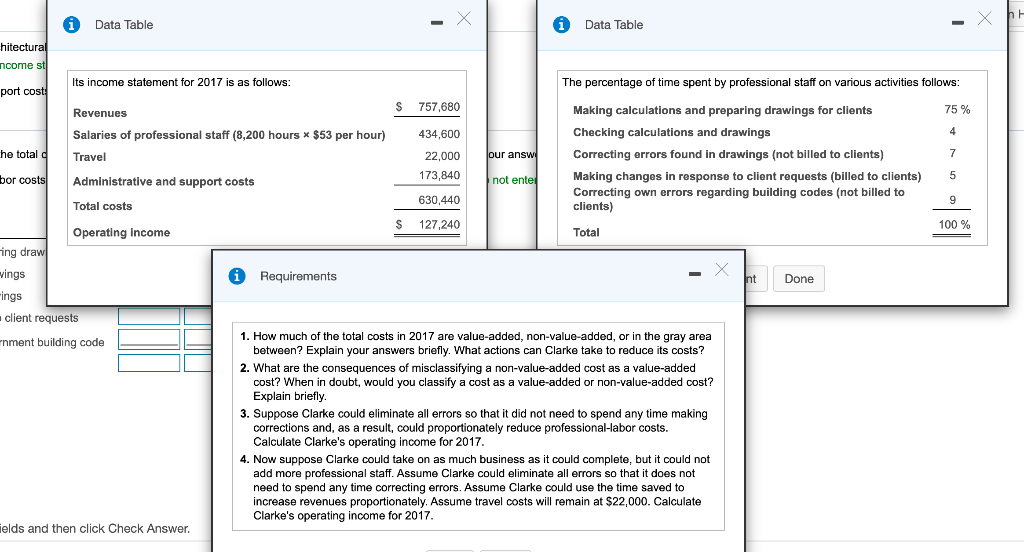

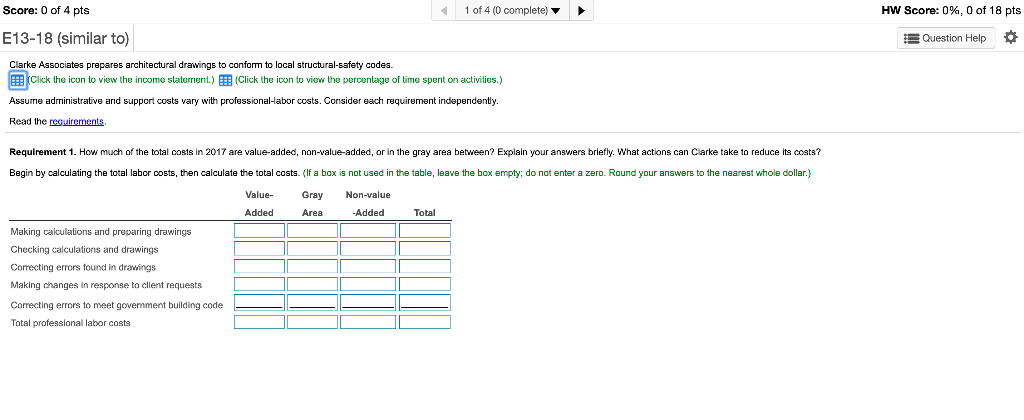

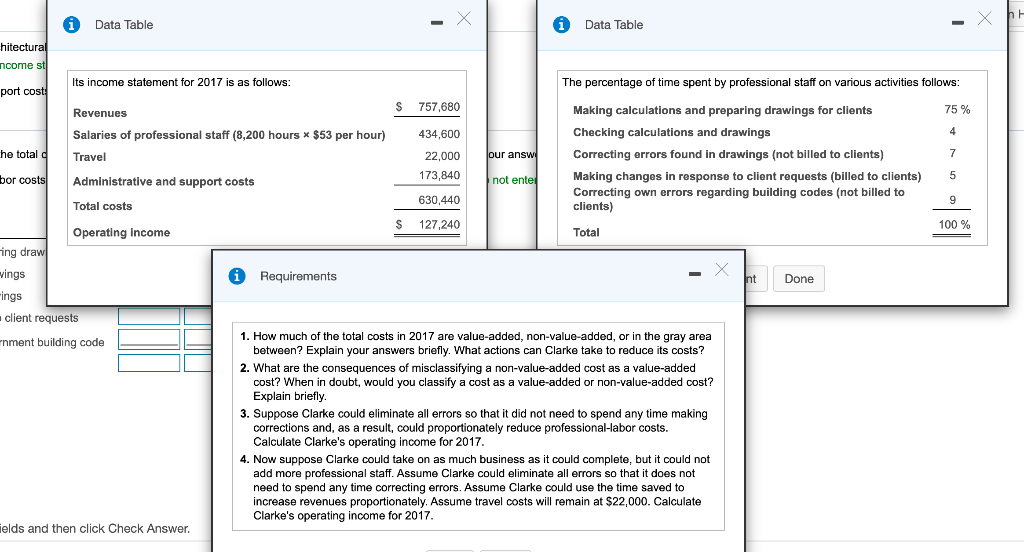

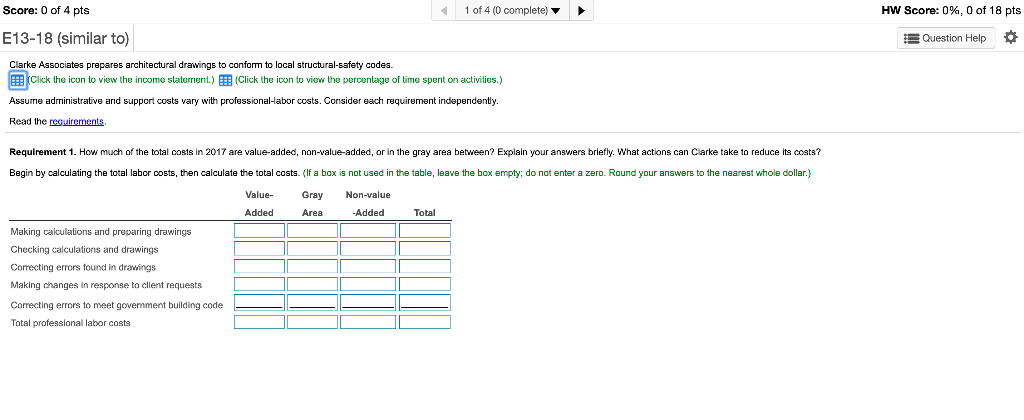

i Data Table i Data Table - X hitectural ncome st port cost Its income statement for 2017 is as follows: The percentage of time spent by professional staff on various activities follows: $ 757,680 Revenues 75 % Salaries of professional staff (8,200 hours * $53 per hour) Travel he total 434,600 22,000 173,840 our answ Making calculations and preparing drawings for clients Checking calculations and drawings Correcting errors found in drawings (not billed to clients) Making changes in response to client requests (billed to clients) Correcting own errors regarding building codes (not billed to clients) bor costs Administrative and support costs not ente Total costs 630,440 127,240 100 % Total Requirements - A nt Done Operating income ing draw wings rings client requests rnment building code 1. How much of the total costs in 2017 are value-added, non-value-added, or in the gray area between? Explain your answers briefly. What actions can Clarke take to reduce its costs? 2. What are the consequences of misclassifying a non-value-added cost as a value-added cost? When in doubt, would you classify a cost as a value-added or non-value-added cost? Explain briefly. 3. Suppose Clarke could eliminate all errors so that it did not need to spend any time making corrections and, as a result, could proportionately reduce professional-labor costs. Calculate Clarke's operating income for 2017. 4. Now suppose Clarke could take on as much business as it could complete, but it could not add more professional staff. Assume Clarke could eliminate all errors so that it does not need to spend any time correcting errors. Assume Clarke could use the time saved to increase revenues proportionately. Assume travel costs will remain at $22,000. Calculate Clarke's operating income for 2017. ields and then click Check Answer. | 1 of 4 (0 complete) Score: 0 of 4 pts E13-18 (similar to) HW Score: 0%, 0 of 18 pts Question Help Clarke Associates prepares architectural drawings to conform to local structural-safety codes. Click the icon to view the income statement.) (Click the icon to view the percentage of time spent on activities.) Assume administrative and support costs vary with professional-labor costs. Consider each requirement independently. Read the requirements Requirement 1. How much of the total costs in 2017 are value-added, non-value-added, or in the gray area between? Explain your answers briefly. What actions can Clarke take to reduce its costs? Begin by calculating the total labor costs, then calculate the total costs. (If a box is not used in the table, leave the box empty; do not enter a zero. Round your answers to the nearest whole dollar.) Value Added Gray Area Non-value Added Total Making calculations and preparing drawings Checking calculations and drawings Correcting errors found in drawings Making changes in response to client requests Correcting errors to meet government building code Total professional labor costs