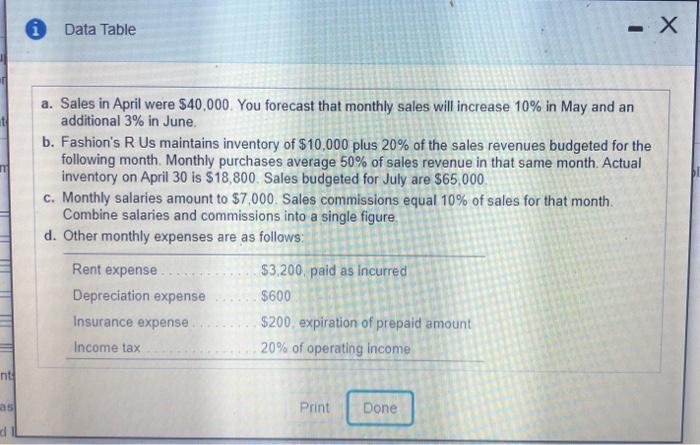

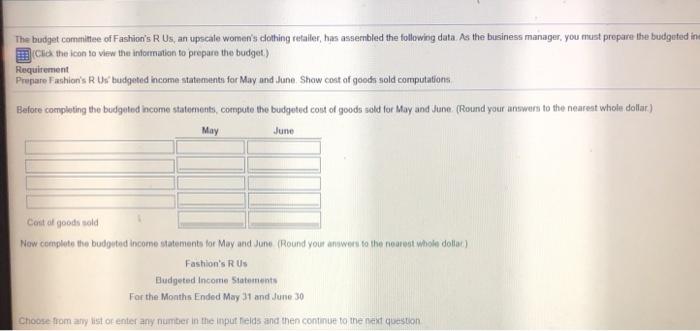

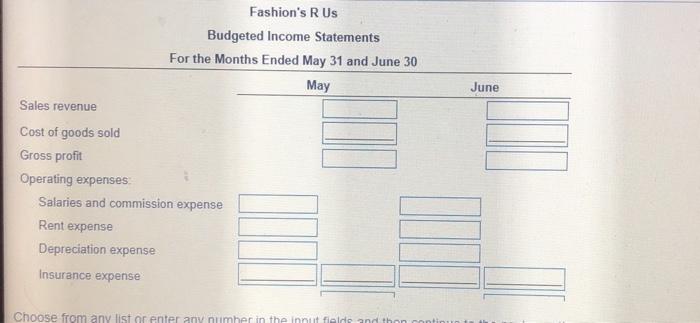

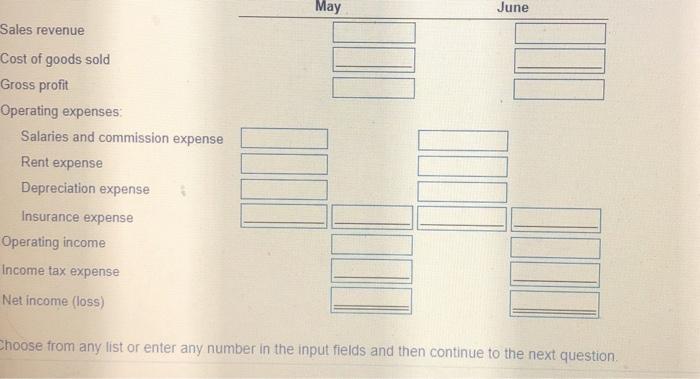

i Data Table -X a. Sales in April were $40,000. You forecast that monthly sales will increase 10% in May and an additional 3% in June. b. Fashion's R Us maintains inventory of $10,000 plus 20% of the sales revenues budgeted for the following month. Monthly purchases average 50% of sales revenue in that same month. Actual inventory on April 30 is $18,800. Sales budgeted for July are $65.000 C. Monthly salaries amount to $7,000. Sales commissions equal 10% of sales for that month. Combine salaries and commissions into a single figure. d. Other monthly expenses are as follows: Rent expense $3,200, paid as incurred Depreciation expense $600 Insurance expense $200. expiration of prepaid amount Income tax 20% of operating income nt as Print Done d The budget committee of Fashion's R Us an upscale women's clothing retailer, has assembled the following data. As the business manager, you must prepare the budgeted in 2 the icon to view the information to prepare the budget) Requirement Pruniare Fashion's R Us budgeted income statements for May and June Show cost of goods sold computations Before completing the budgeted Income statements, compute the budgeted cont of goods sold for May and Jun (Round your answers to the nearest whole dollar) May June Cost of goods sold Now.complete the budguted Income statements for May and June (Round your answers to the nearest whole dollar) Fashion's RUS Budgeted Income Statements For the Months Ended May 31 and June 30 Choose from any list of enter any number in the input Telds and then continue to the next question Fashion's R Us Budgeted Income Statements For the Months Ended May 31 and June 30 May June Sales revenue Cost of goods sold Gross profit Operating expenses Salaries and commission expense Rent expense Depreciation expense Insurance expense Choose from any list or enter any number in the innut falde and then May June Sales revenue TUL Cost of goods sold Gross profit Operating expenses Salaries and commission expense Rent expense Depreciation expense Insurance expense Operating income Income tax expense Net income (loss) Choose from any list or enter any number in the input fields and then continue to the next