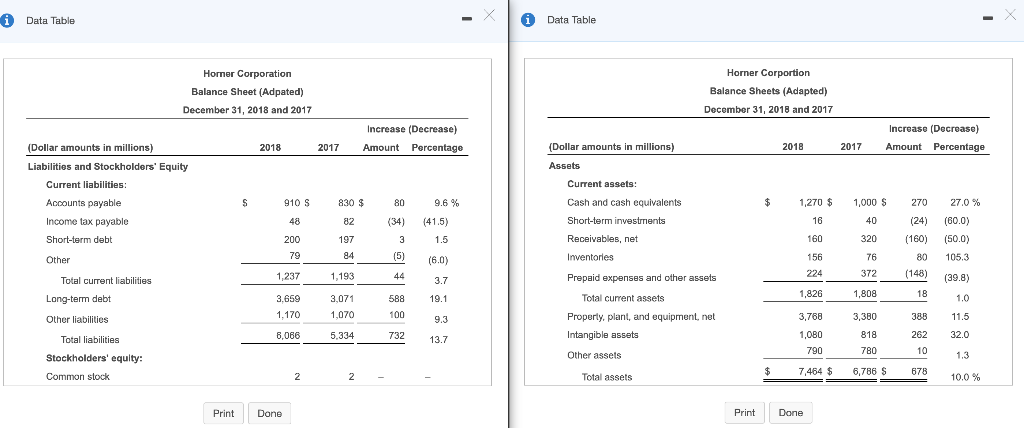

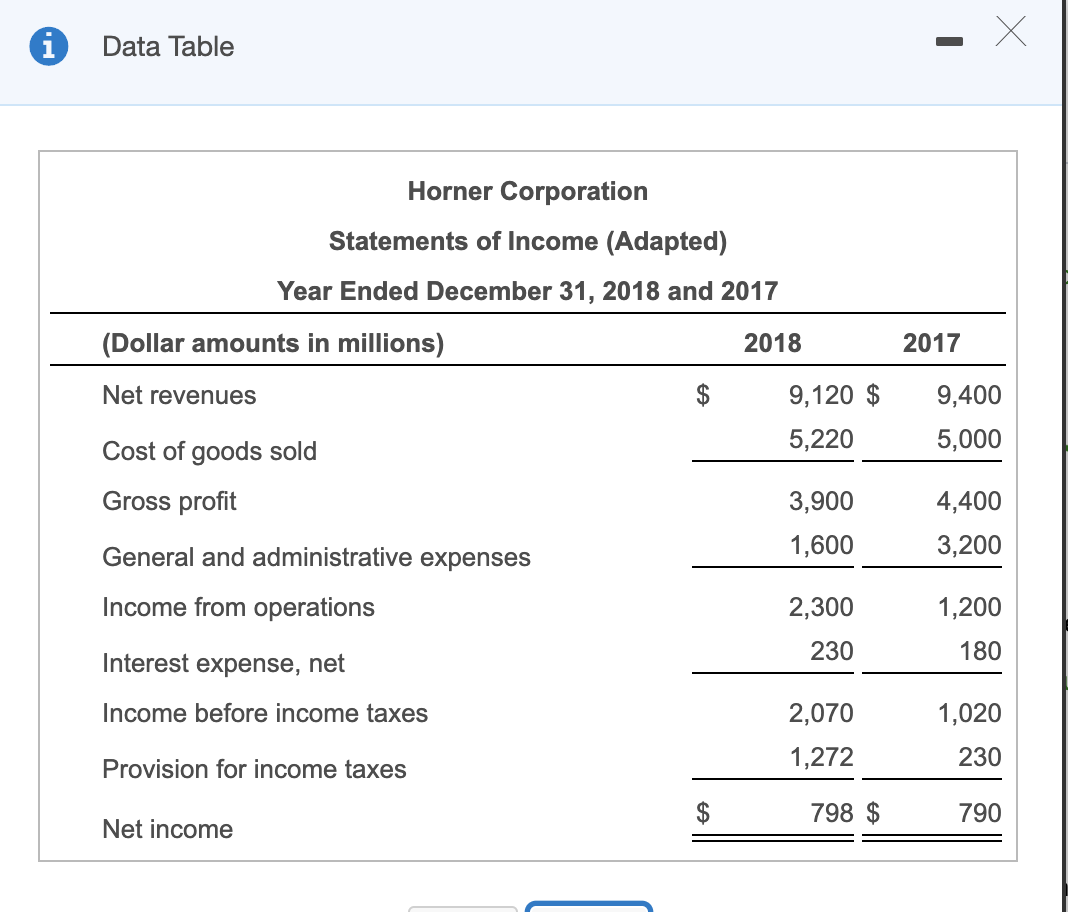

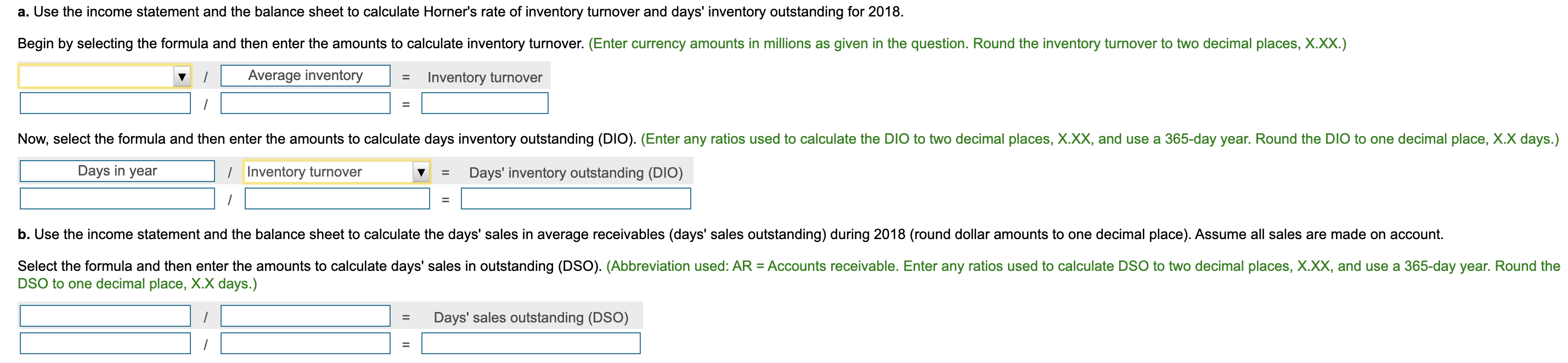

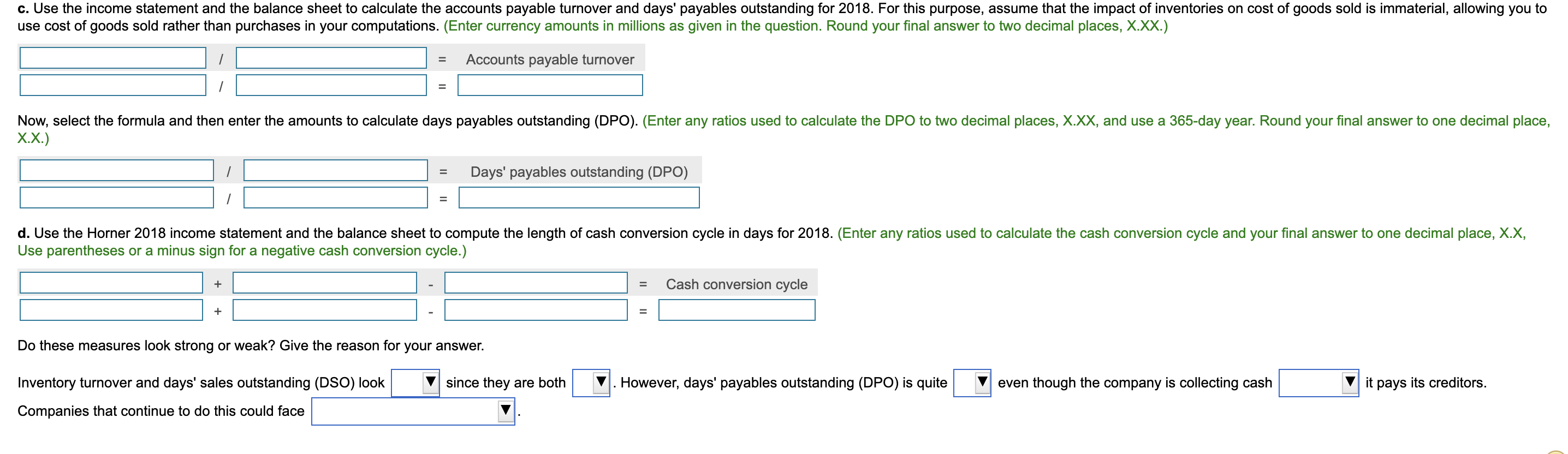

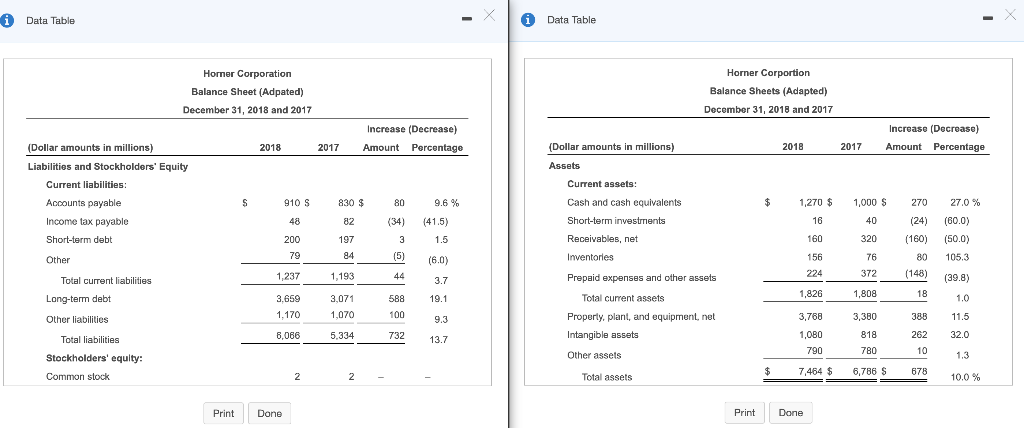

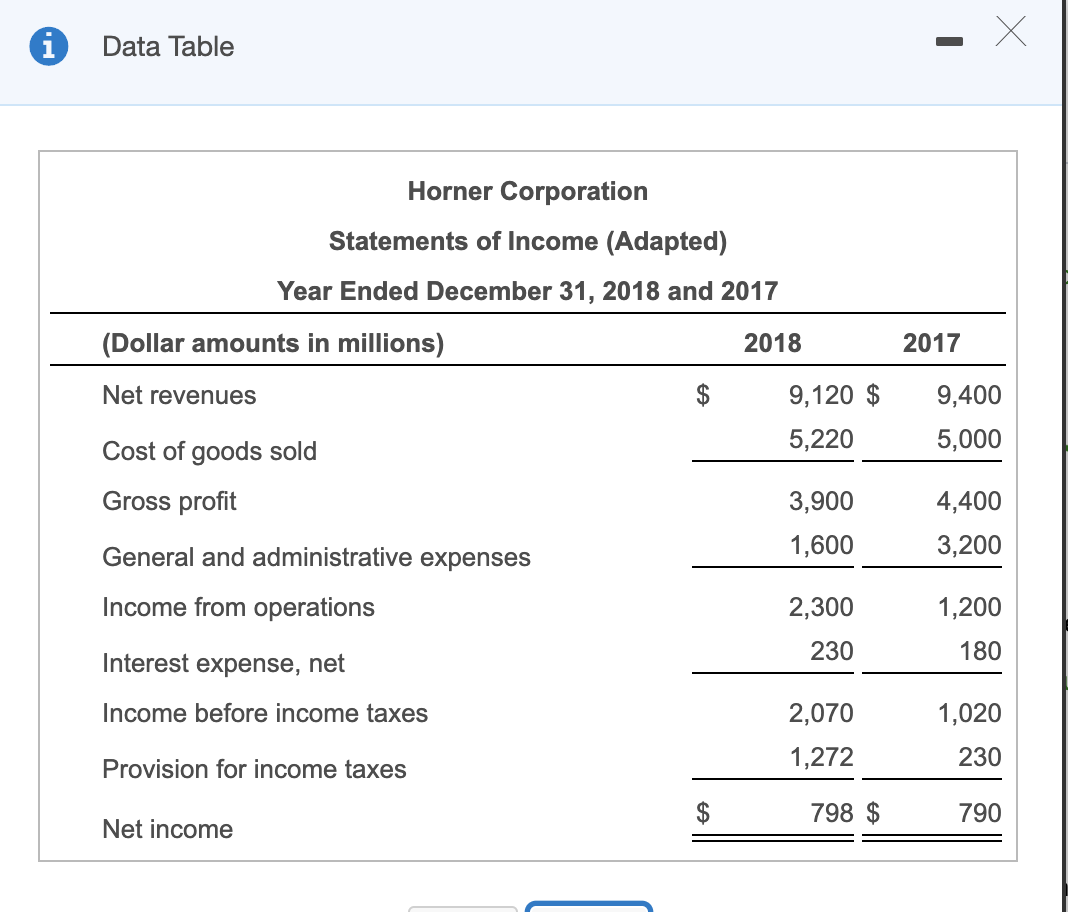

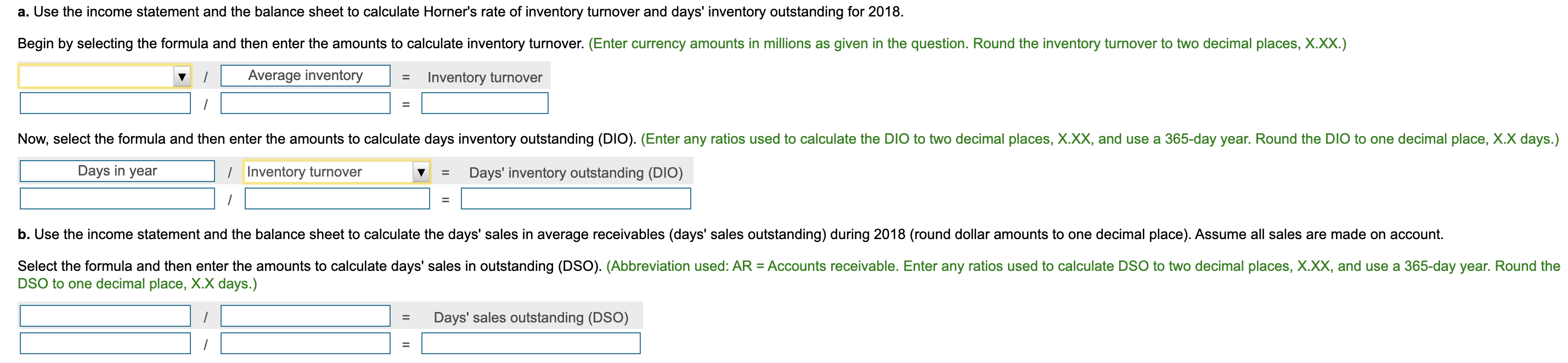

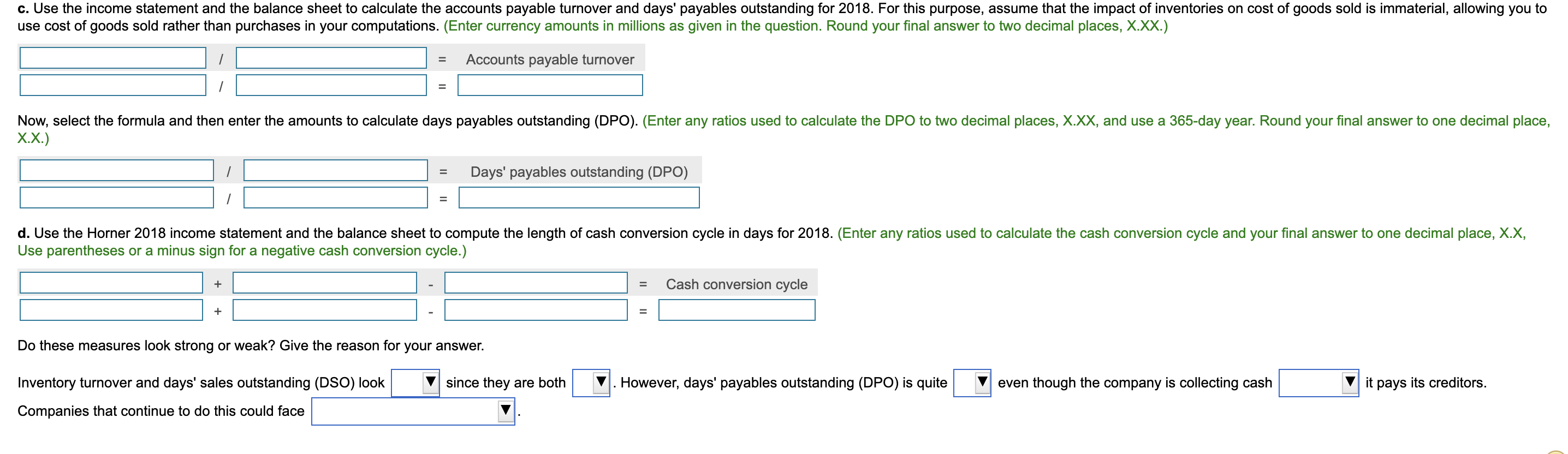

i Data Table - X Data Table - X Horner Corporation Balance Sheet (Adpated) December 31, 2018 and 2017 Horner Corportion Balance Sheets (Adapted) December 31, 2018 and 2017 Increase (Decrease) Amount Percentage Increase (Decrease) Amount Percentage 2018 2017 2018 2017 (Dollar amounts in millions) Liabilities and Stockholders' Equity (Dollar amounts in millions) Assets Current liabilities: Current assets: 910 S $ Accounts payable Income tax payable Short-term debt 830 $ 82 197 48 1,000 $ 40 80 (34) 3 (5) 9.6 % (41.5) 1.5 (6.0) Cash and cash equivalents Short-term investments Receivables, net 270 (24) (160) 80 200 1,270 $ 16 160 156 224 1,826 320 Other 79 Inventories 1,237 1,193 193 Total current liabilities 4 4 372 3.7 Prepaid expenses and other assets 27.0% (60.0) (50.0) 105.3 (39.8) 1.0 11.5 32.0 1,3 1,808 Long-term debt 3,659 1,170 3,071 1,070 Other liabilities Total current assets Properly, plant, and equipment, net Intangible assets 8,066 18 388 262 5.334 3,768 1,080 790 732 3,380 818 780 Total liabilities Stockholders' equity: Common stock Other assets - 2 2 - 7,464 $ 6,786 S 678 Total assets 10.0% Print Done Print Done Data Table Horner Corporation Statements of Income (Adapted) Year Ended December 31, 2018 and 2017 (Dollar amounts in millions) 2018 2017 Net revenues 9,120 $ 9,400 Cost of goods sold 5,2205,000 Gross profit 3,900 4,400 General and administrative expenses 1,600 3,200 Income from operations 2,300 1,200 230 Interest expense, net 180 Income before income taxes 2,070 1,020 1.272 230 Provision for income taxes 798 $ 790 Net income a. Use the income statement and the balance sheet to calculate Horner's rate of inventory turnover and days' inventory outstanding for 2018. Begin by selecting the formula and then enter the amounts to calculate inventory turnover. (Enter currency amounts in millions as given in the question. Round the inventory turnover to two decimal places, X.XX.) v il Average inventory = Inventory turnover Now, select the formula and then enter the amounts to calculate days inventory outstanding (DIO). (Enter any ratios used to calculate the DIO to two decimal places, X.XX, and use a 365-day year. Round the DIO to one decimal place, X.X days.) Days in year Inventory turnover = Days' inventory outstanding (DIO) b. Use the income statement and the balance sheet to calculate the days' sales in average receivables (days' sales outstanding) during 2018 (round dollar amounts to one decimal place). Assume all sales are made on account. Select the formula and then enter the amounts to calculate days' sales in outstanding (DSO). (Abbreviation used: AR = Accounts receivable. Enter any ratios used to calculate DSO to two decimal places, X.XX, and use a 365-day year. Round the DSO to one decimal place, X.X days.) = Days' sales outstanding (DSO) c. Use the income statement and the balance sheet to calculate the accounts payable turnover and days' payables outstanding for 2018. For this purpose, assume that the impact of inventories on cost of goods sold is immaterial, allowing you to use cost of goods sold rather than purchases in your computations. (Enter currency amounts in millions as given in the question. Round your final answer to two decimal places, X.XX.) = Accounts payable turnover Now, select the formula and then enter the amounts to calculate days payables outstanding (DPO). (Enter any ratios used to calculate the DPO to two decimal places, X.XX, and use a 365-day year. Round your final answer to one decimal place, X.X.) = Days' payables outstanding (DPO) d. Use the Horner 2018 income statement and the balance sheet to compute the length of cash conversion cycle in days for 2018. (Enter any ratios used to calculate the cash conversion cycle and your final answer to one decimal place, X.X, Use parentheses or a minus sign for a negative cash conversion cycle.) + = Cash conversion cycle + Do these measures look strong or weak? Give the reason for your answer. v since they are both V. However, days' payables outstanding (DPO) is quite even though the company is collecting cash it pays its creditors. Inventory turnover and days' sales outstanding (DSO) look Companies that continue to do this could face