Question

(i) Describe and interpret the assumptions related to the problem. (ii) Apply the appropriate mathematical model to solve the problem. (iii) Calculate the correct solution

(i) Describe and interpret the assumptions related to the problem. (ii) Apply the appropriate mathematical model to solve the problem. (iii) Calculate the correct solution to the problem. Submit all answers as percentages and round to two decimal places.

1. Fallax Corp. common stock is currently priced at $43.50 per share in the open market. Analysts expect Fallax to offer $1.75 per share in dividends at the end of next year, which is projected to grow at 5.2% indefinitely. What is Fallaxs cost of internal common equity?

2. Wellstock Corp. will issue new common stock. The companys existing common stock is selling for $26.50 per share and offered $2.25 per share in dividends at the end of last year. Dividends are expected to grow at an annual rate of 6% indefinitely. New issues of common stock will incur 8% of the current market price. What is the cost of the companys new commonstock?

I have provided an example of how the instructor would like for us to complete the assignment. Can someone please help?

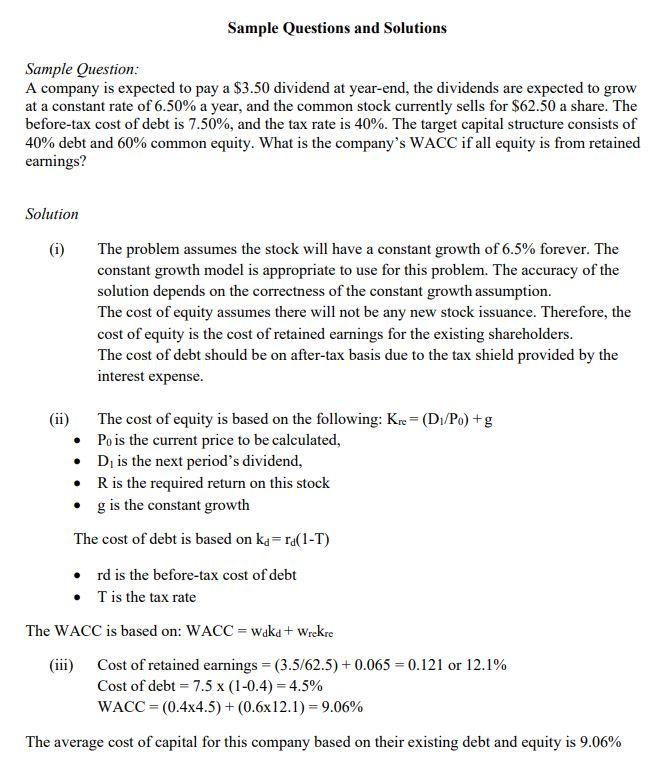

Sample Questions and Solutions Sample Question: A company is expected to pay a $3.50 dividend at year-end, the dividends are expected to grow at a constant rate of 6.50% a year, and the common stock currently sells for $62.50 a share. The before-tax cost of debt is 7.50%, and the tax rate is 40%. The target capital structure consists of 40% debt and 60% common equity. What is the company's WACC if all equity is from retained earnings? Solution (i) The problem assumes the stock will have a constant growth of 6.5% forever. The constant growth model is appropriate to use for this problem. The accuracy of the solution depends on the correctness of the constant growth assumption. The cost of equity assumes there will not be any new stock issuance. Therefore, the cost of equity is the cost of retained earnings for the existing shareholders. The cost of debt should be on after-tax basis due to the tax shield provided by the interest expense. The cost of equity is based on the following: Kre= (D/Po)+g Po is the current price to be calculated, D, is the next period's dividend, R is the required return on this stock g is the constant growth The cost of debt is based on ka=ra(1-T) rd is the before-tax cost of debt T is the tax rate The WACC is based on: WACC = wake + Wrekre (iii) Cost of retained earnings = (3.5/62.5) + 0.065 = 0.121 or 12.1% Cost of debt = 7.5 x (1-0.4)= 4.5% WACC = (0.4x4.5) + (0.6x12.1) = 9.06% The average cost of capital for this company based on their existing debt and equity is 9.06%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started