Question

(i) Describe the three forms of the efficient market hypothesis. (ii) Consider the following statement, A volatile week in the stock market is likely to

(i) Describe the three forms of the efficient market hypothesis.

(ii) Consider the following statement, "A volatile week in the stock market is likely to be followed by another volatile week". Does this statement contradict the efficient market hypothesis and if so which form(s)?

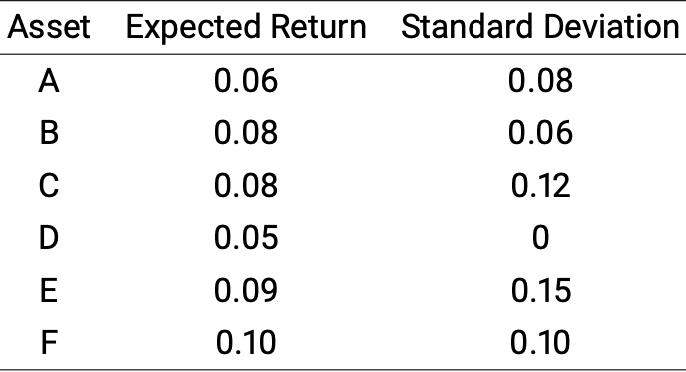

Consider a stock market that consists of Stock 1 and Stock 1 only. The table above shows the expected return and standard deviation for six assets. Asset A is the minimum variance portfolio formed from Stocks 1 and 2. Asset D is the risk-free asset. The remaining assets are portfolios that consist of the risk-free asset and Stocks 1 and 2 in varying quantities. Assume the CAPM holds and one of the assets in the table is the market portfolio. Explain which asset is the market portfolio.

c) Consider a European call option and a European put option on the same underlying asset (non-dividend paying). Both options have the same exercise price and mature on the same date in one year. Both options are currently at-the-money. Which option has the higher value? Explain, mathematically stating any assumptions you have made.

d) Consider a two-period binomial model (t = {0, 1, 2}), with a risky non-dividend paying stock, BP, which is currently trading for £2.90. In the first period the stock can go up by 30% or down by 10%. The same behaviour is also exhibited in the second period. The risk-free rate is 2% in the first period and 3% in the second period.

i) Using the risk-neutral pricing method what is the value today of a European call option on BP stock with maturity date t = 2 and exercise price £2?

ii) Consider a new option in the market which is path-dependent, with underlying stock BP. The new option has the following payoff function at the maturity date t = 2,

max(ST - Smin,0)

where ST is the price of BP at the maturity date t = 2 and Smin is the minimum stock price BP takes during the life of the option i.e., the minimum stock price BP realises on the path from t = 0 to t = 2. The option is European so can only be exercised at the maturity date.

Explain intuitively whether you expect this new option to have a value today higher, equal, or lower than the option in part ? What is the value today of this option?

Asset Expected Return Standard Deviation A B C D E EE F 0.06 0.08 0.08 0.05 0.09 0.10 0.08 0.06 0.12 0 0.15 0.10

Step by Step Solution

3.25 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

i The three forms of the efficient market hypothesis EMH are 1 Weak Form EMH This form of the hypothesis asserts that all publicly available information such as historical prices and trading volume is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started