Answered step by step

Verified Expert Solution

Question

1 Approved Answer

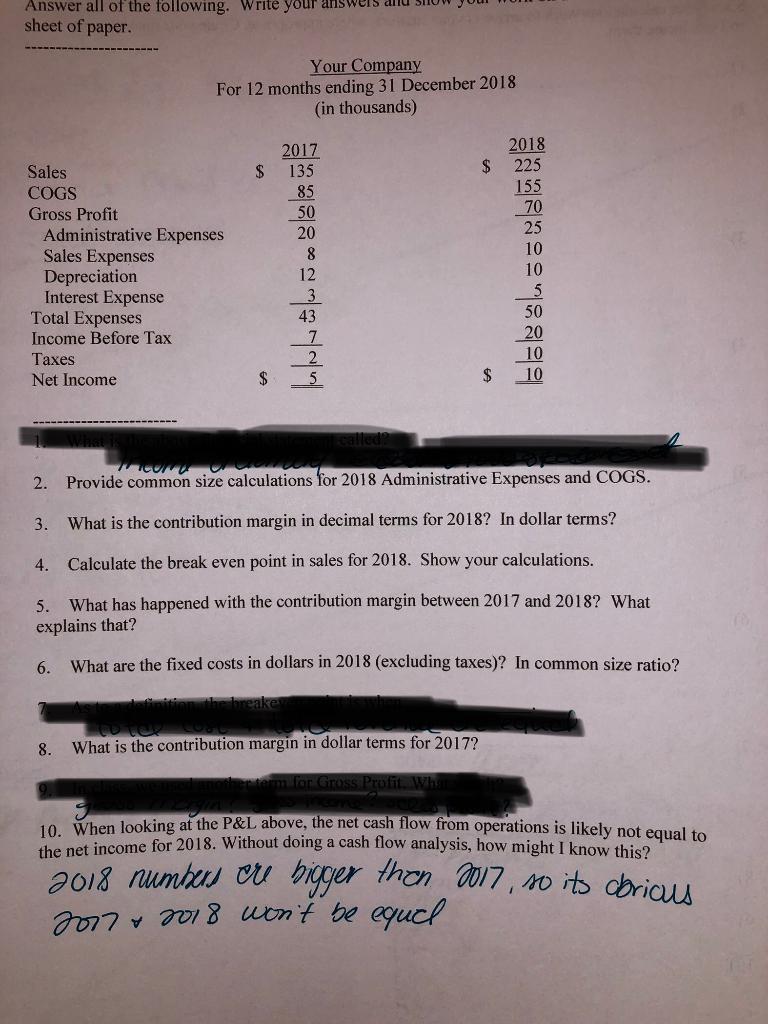

I desperately need help on this. Also #10 is just a guess, I'm not sure if it's right. Answer all of the following. Write your

I desperately need help on this. Also #10 is just a guess, I'm not sure if it's right.

Answer all of the following. Write your ans sheet of paper. Your Company For 12 months ending 31 December 2018 (in thousands) $ $ Sales COGS Gross Profit Administrative Expenses Sales Expenses Depreciation Interest Expense Total Expenses Income Before Tax Taxes Net Income 2017 135 85 50 20 8 12 2018 225 155 70 25 10 10 5 50 20 10 10 43 $ $ Coro 2. Provide common size calculations for 2018 Administrative Expenses and COGS. 3. What is the contribution margin in decimal terms for 2018? In dollar terms? 4. Calculate the break even point in sales for 2018. Show your calculations. 5. What has happened with the contribution margin between 2017 and 2018? What explains that? 6. What are the fixed costs in dollars in 2018 (excluding taxes)? In common size ratio? in the breaker 8. What is the contribution margin in dollar terms for 2017? m Tor Gross Profit Wh 10. When looking at the P&L above, the net cash flow from operations is likely not equal to the net income for 2018. Without doing a cash flow analysis, how might I know this? 2018 numbu on bigger then 2017, so its oricus 2017 & 2018 won't be equel Answer all of the following. Write your ans sheet of paper. Your Company For 12 months ending 31 December 2018 (in thousands) $ $ Sales COGS Gross Profit Administrative Expenses Sales Expenses Depreciation Interest Expense Total Expenses Income Before Tax Taxes Net Income 2017 135 85 50 20 8 12 2018 225 155 70 25 10 10 5 50 20 10 10 43 $ $ Coro 2. Provide common size calculations for 2018 Administrative Expenses and COGS. 3. What is the contribution margin in decimal terms for 2018? In dollar terms? 4. Calculate the break even point in sales for 2018. Show your calculations. 5. What has happened with the contribution margin between 2017 and 2018? What explains that? 6. What are the fixed costs in dollars in 2018 (excluding taxes)? In common size ratio? in the breaker 8. What is the contribution margin in dollar terms for 2017? m Tor Gross Profit Wh 10. When looking at the P&L above, the net cash flow from operations is likely not equal to the net income for 2018. Without doing a cash flow analysis, how might I know this? 2018 numbu on bigger then 2017, so its oricus 2017 & 2018 won't be equelStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started