i did #1 just need help with 2&3

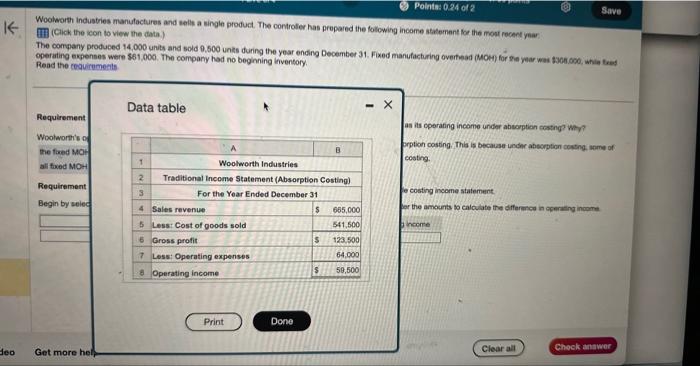

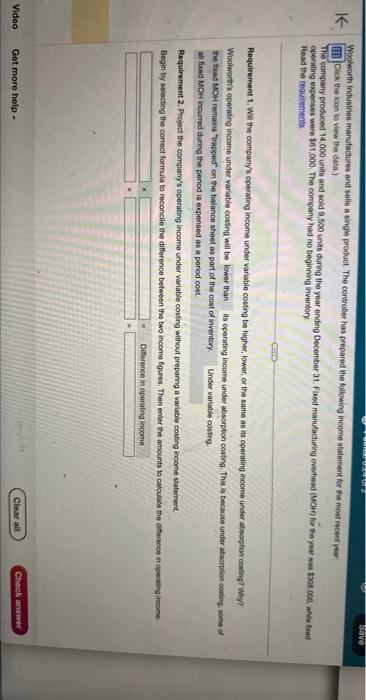

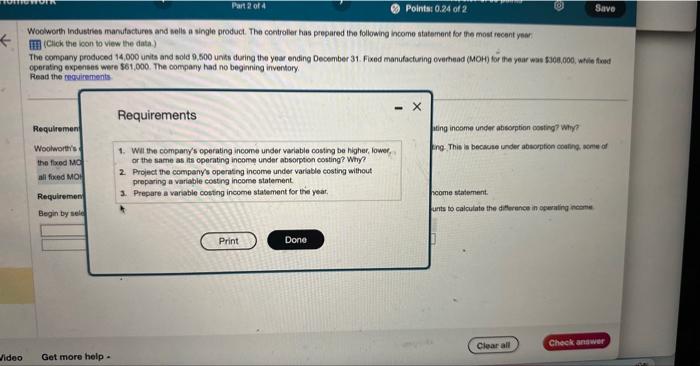

Wooworth Industries manufactures and selis a single product. The controler has prepared the following income statement for the most recent ynor IIH (Click the icon to view the data.) The company produced 14,000 units and sold 0,500 unks during the year ending December 31 . Fixed manufacturing overtand (MOH) for the year was f30ed,000. while fxed operating expenses were $61,000. The company had no beginning inventary Read the reguirements Requirements titing income under abeorption costing? Why? 1. Wal the company's coerating income under variable costing be higher, lower. Ing. This is becsuse under abigrption coanhe abme of or the same as its operating income under absorption costing? Why? all foced me 2. Project the company's operating income under varable costing without proparing a variable costing income statement. Requiremen 3. Prepare a variable costing income stasement for the yeat, yoome stadement. Jrts to calculate the difurance in oferaling incorte Woolworth industries manufactures and sells a wingle product. The controter has prepared the following income statement for the most rocect yaar III (Cick the icon to view the data.) The comqany produced 14,000 units and sold 0,500 unks during the year ending December 31. Fixed manufacturing overtead (Mow) for tein year was tson oco, whia teres operating expenses were 561,000 . The compary had no beginning inventory. Read the ceauiremerts Data table Requlrement as its cperafing income under absorption costing? Why? Woolaritis of the fixed MOe srption costing. This is because under abeorption costing. some of costing. le costing income statement. Wor the ameumts to calculate the differmed in ocerating inomme bincone Woolworth industries manufactures and sells a single product. The coctroller has prepared the following income statement for the moat recent year. Cick the icon to view the data.) operating expenses were $61,000. The company had no beginning invertory. Read the regurements Requirement 1. Wil the company' operating income under variable costing be higher, lower, or the same as its operating income under absoption casting? Why? Woolworth's ogeraing inoome under variable costing wili be its operating income under absarption costing. This is because under abocrption couting some of the fbed Mor remains "irapged" on the balanoe sheet as part of the cost of inventory. Under variable coisting. all fixed MOH inourred during the period is expensed as a period cost. Requirement 2. Project the compeny's operating income under variable costing without preparing a variable cossing income statement. Wooworth Industries manufactures and selis a single product. The controler has prepared the following income statement for the most recent ynor IIH (Click the icon to view the data.) The company produced 14,000 units and sold 0,500 unks during the year ending December 31 . Fixed manufacturing overtand (MOH) for the year was f30ed,000. while fxed operating expenses were $61,000. The company had no beginning inventary Read the reguirements Requirements titing income under abeorption costing? Why? 1. Wal the company's coerating income under variable costing be higher, lower. Ing. This is becsuse under abigrption coanhe abme of or the same as its operating income under absorption costing? Why? all foced me 2. Project the company's operating income under varable costing without proparing a variable costing income statement. Requiremen 3. Prepare a variable costing income stasement for the yeat, yoome stadement. Jrts to calculate the difurance in oferaling incorte Woolworth industries manufactures and sells a wingle product. The controter has prepared the following income statement for the most rocect yaar III (Cick the icon to view the data.) The comqany produced 14,000 units and sold 0,500 unks during the year ending December 31. Fixed manufacturing overtead (Mow) for tein year was tson oco, whia teres operating expenses were 561,000 . The compary had no beginning inventory. Read the ceauiremerts Data table Requlrement as its cperafing income under absorption costing? Why? Woolaritis of the fixed MOe srption costing. This is because under abeorption costing. some of costing. le costing income statement. Wor the ameumts to calculate the differmed in ocerating inomme bincone Woolworth industries manufactures and sells a single product. The coctroller has prepared the following income statement for the moat recent year. Cick the icon to view the data.) operating expenses were $61,000. The company had no beginning invertory. Read the regurements Requirement 1. Wil the company' operating income under variable costing be higher, lower, or the same as its operating income under absoption casting? Why? Woolworth's ogeraing inoome under variable costing wili be its operating income under absarption costing. This is because under abocrption couting some of the fbed Mor remains "irapged" on the balanoe sheet as part of the cost of inventory. Under variable coisting. all fixed MOH inourred during the period is expensed as a period cost. Requirement 2. Project the compeny's operating income under variable costing without preparing a variable cossing income statement