I did the 1 and 2 part. I just need the adjusted trial balance, income statement and the balance sheet. Olease respond to the question as soon as you can.

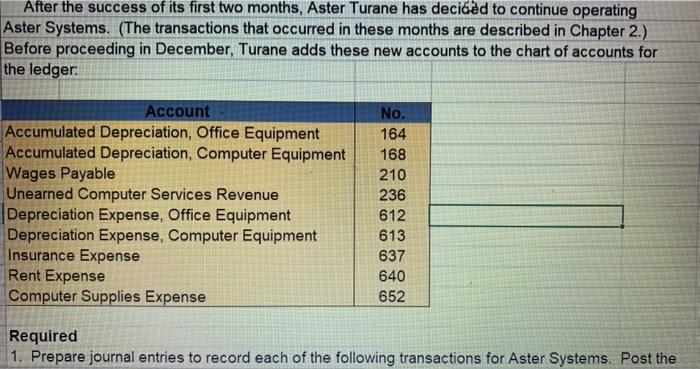

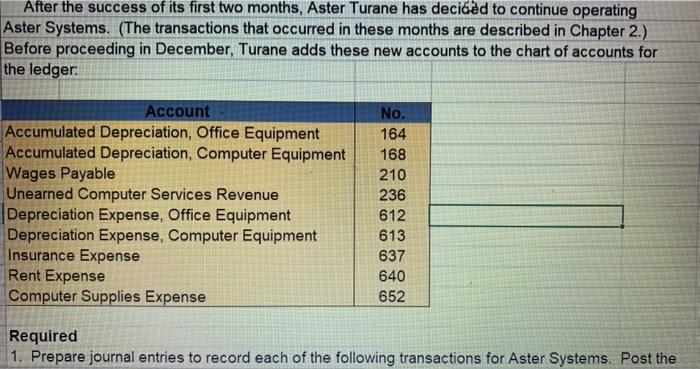

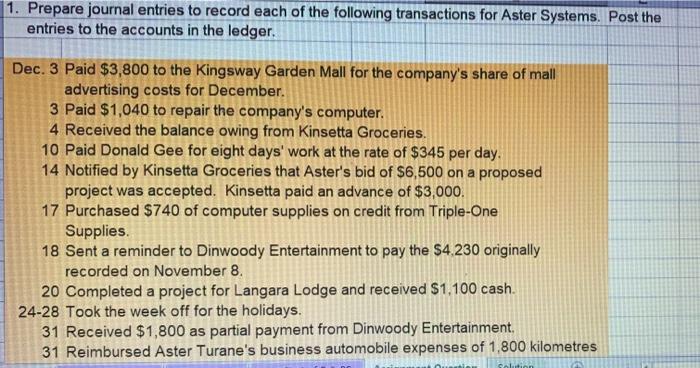

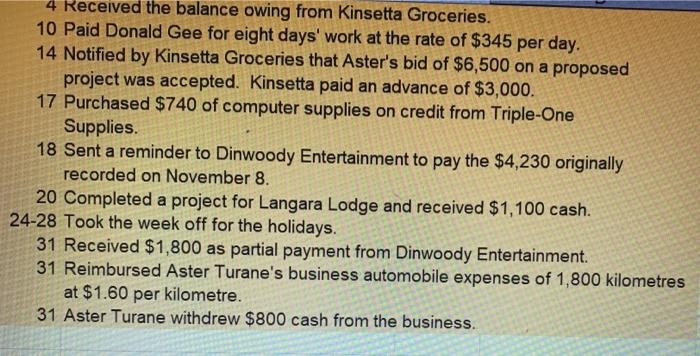

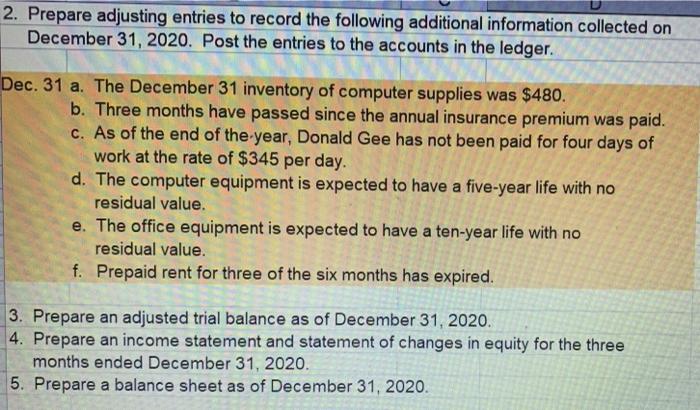

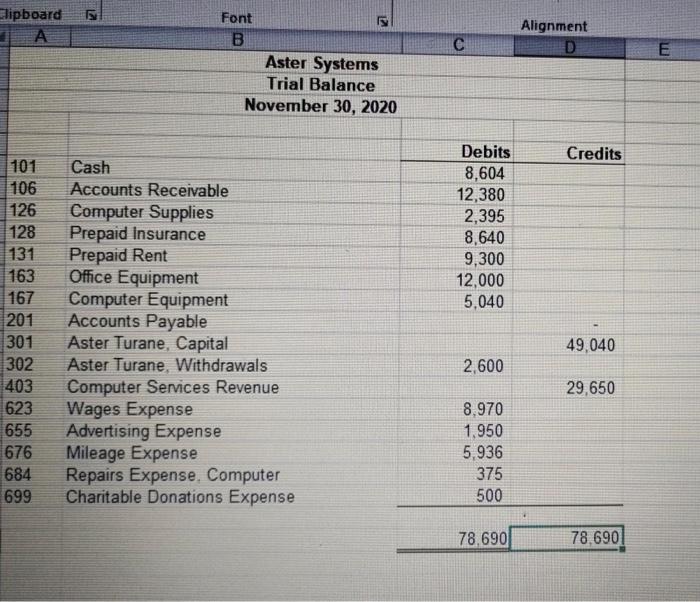

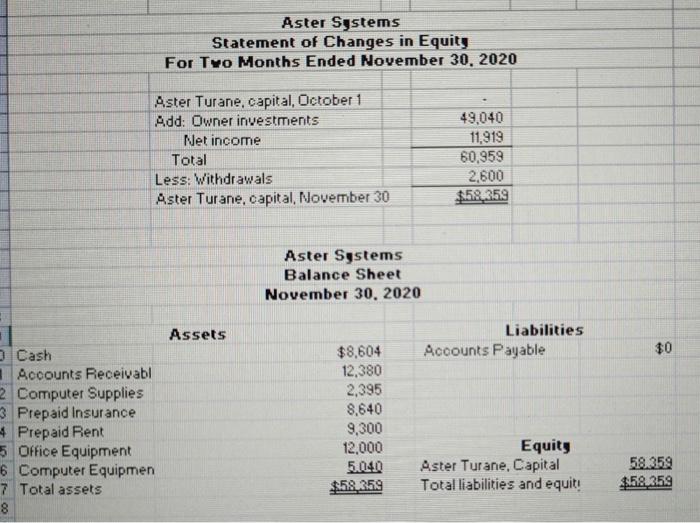

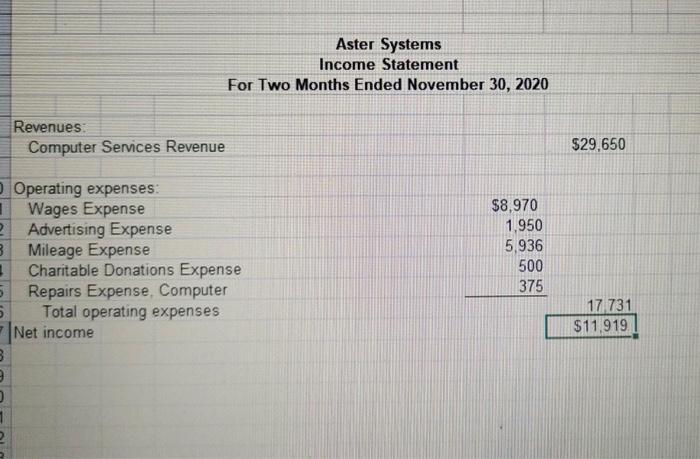

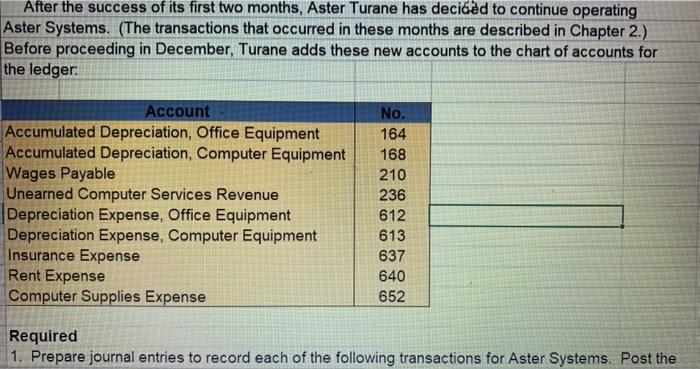

After the success of its first two months, Aster Turane has decided to continue operating Aster Systems. (The transactions that occurred in these months are described in Chapter 2.) Before proceeding in December, Turane adds these new accounts to the chart of accounts for the ledger: Account Accumulated Depreciation, Office Equipment Accumulated Depreciation, Computer Equipment Wages Payable Unearned Computer Services Revenue Depreciation Expense, Office Equipment Depreciation Expense, Computer Equipment Insurance Expense Rent Expense Computer Supplies Expense No. 164 168 210 236 612 613 637 640 652 Required 1. Prepare journal entries to record each of the following transactions for Aster Systems. Post the 1. Prepare journal entries to record each of the following transactions for Aster Systems. Post the entries to the accounts in the ledger. Dec. 3 Paid $3,800 to the Kingsway Garden Mall for the company's share of mall advertising costs for December. 3 Paid $1,040 to repair the company's computer. 4 Received the balance owing from Kinsetta Groceries. 10 Paid Donald Gee for eight days' work at the rate of $345 per day. 14 Notified by Kinsetta Groceries that Aster's bid of $6,500 on a proposed project was accepted. Kinsetta paid an advance of $3,000. 17 Purchased $740 of computer supplies on credit from Triple-One Supplies. 18 Sent a reminder to Dinwoody Entertainment to pay the $4.230 originally recorded on November 8. 20 Completed a project for Langara Lodge and received $1,100 cash. 24-28 Took the week off for the holidays. 31 Received $1,800 as partial payment from Dinwoody Entertainment, 31 Reimbursed Aster Turane's business automobile expenses of 1,800 kilometres 4 Received the balance owing from Kinsetta Groceries. 10 Paid Donald Gee for eight days' work at the rate of $345 per day. 14 Notified by Kinsetta Groceries that Aster's bid of $6,500 on a proposed project was accepted. Kinsetta paid an advance of $3,000. 17 Purchased $740 of computer supplies on credit from Triple-One Supplies. 18 Sent a reminder to Dinwoody Entertainment to pay the $4,230 originally recorded on November 8. 20 Completed a project for Langara Lodge and received $1,100 cash. 24-28 Took the week off for the holidays. 31 Received $1,800 as partial payment from Dinwoody Entertainment. 31 Reimbursed Aster Turane's business automobile expenses of 1,800 kilometres at $1.60 per kilometre. 31 Aster Turane withdrew $800 cash from the business. 2. Prepare adjusting entries to record the following additional information collected on December 31, 2020. Post the entries to the accounts in the ledger. Dec. 31 a. The December 31 inventory of computer supplies was $480. b. Three months have passed since the annual insurance premium was paid. c. As of the end of the year, Donald Gee has not been paid for four days of work at the rate of $345 per day. d. The computer equipment is expected to have a five-year life with no residual value. e. The office equipment is expected to have a ten-year life with no residual value. f. Prepaid rent for three of the six months has expired. 3. Prepare an adjusted trial balance as of December 31, 2020. 4. Prepare an income statement and statement of changes in equity for the three months ended December 31, 2020. 5. Prepare a balance sheet as of December 31, 2020. Flipboard Alignment D C Font B Aster Systems Trial Balance November 30, 2020 Credits Debits 8,604 12,380 2,395 8,640 9,300 12,000 5,040 101 106 126 128 131 163 167 201 301 302 403 623 655 676 684 699 Cash Accounts Receivable Computer Supplies Prepaid Insurance Prepaid Rent Office Equipment Computer Equipment Accounts Payable Aster Turane, Capital Aster Turane. Withdrawals Computer Services Revenue Wages Expense Advertising Expense Mileage Expense Repairs Expense. Computer Charitable Donations Expense 49,040 2,600 29,650 8.970 1,950 5,936 375 500 78,690 78.690 Aster Systems Statement of Changes in Equity For Two Months Ended November 30, 2020 Aster Turane, capital, October 1 Add: Owner investments Net income Total Less: Withdrawals Aster Turane, capital, November 30 49,040 11,919 60,959 2,600 3.58,259 Aster Systems Balance Sheet November 30, 2020 . Assets Liabilities Accounts Payable $0 Cash Accounts Receivabl 2 Computer Supplies 3 Prepaid Insurance Prepaid Rent 5 Office Equipment 6 Computer Equipmen 7 Total assets 8 $8,604 12,380 2,395 8,640 9,300 12,000 5.040 $59.359 Equity Aster Turane, Capital Total liabilities and equity 59.359 $59.359 Aster Systems Income Statement For Two Months Ended November 30, 2020 Revenues Computer Services Revenue $29,650 Operating expenses Wages Expense Advertising Expense 3 Mileage Expense 3 Charitable Donations Expense 5 Repairs Expense. Computer 5 Total operating expenses Net income 3 $8.970 1,950 5,936 500 375 17 731 $11.919 1 After the success of its first two months, Aster Turane has decided to continue operating Aster Systems. (The transactions that occurred in these months are described in Chapter 2.) Before proceeding in December, Turane adds these new accounts to the chart of accounts for the ledger: Account Accumulated Depreciation, Office Equipment Accumulated Depreciation, Computer Equipment Wages Payable Unearned Computer Services Revenue Depreciation Expense, Office Equipment Depreciation Expense, Computer Equipment Insurance Expense Rent Expense Computer Supplies Expense No. 164 168 210 236 612 613 637 640 652 Required 1. Prepare journal entries to record each of the following transactions for Aster Systems. Post the 1. Prepare journal entries to record each of the following transactions for Aster Systems. Post the entries to the accounts in the ledger. Dec. 3 Paid $3,800 to the Kingsway Garden Mall for the company's share of mall advertising costs for December. 3 Paid $1,040 to repair the company's computer. 4 Received the balance owing from Kinsetta Groceries. 10 Paid Donald Gee for eight days' work at the rate of $345 per day. 14 Notified by Kinsetta Groceries that Aster's bid of $6,500 on a proposed project was accepted. Kinsetta paid an advance of $3,000. 17 Purchased $740 of computer supplies on credit from Triple-One Supplies. 18 Sent a reminder to Dinwoody Entertainment to pay the $4.230 originally recorded on November 8. 20 Completed a project for Langara Lodge and received $1,100 cash. 24-28 Took the week off for the holidays. 31 Received $1,800 as partial payment from Dinwoody Entertainment, 31 Reimbursed Aster Turane's business automobile expenses of 1,800 kilometres 4 Received the balance owing from Kinsetta Groceries. 10 Paid Donald Gee for eight days' work at the rate of $345 per day. 14 Notified by Kinsetta Groceries that Aster's bid of $6,500 on a proposed project was accepted. Kinsetta paid an advance of $3,000. 17 Purchased $740 of computer supplies on credit from Triple-One Supplies. 18 Sent a reminder to Dinwoody Entertainment to pay the $4,230 originally recorded on November 8. 20 Completed a project for Langara Lodge and received $1,100 cash. 24-28 Took the week off for the holidays. 31 Received $1,800 as partial payment from Dinwoody Entertainment. 31 Reimbursed Aster Turane's business automobile expenses of 1,800 kilometres at $1.60 per kilometre. 31 Aster Turane withdrew $800 cash from the business. 2. Prepare adjusting entries to record the following additional information collected on December 31, 2020. Post the entries to the accounts in the ledger. Dec. 31 a. The December 31 inventory of computer supplies was $480. b. Three months have passed since the annual insurance premium was paid. c. As of the end of the year, Donald Gee has not been paid for four days of work at the rate of $345 per day. d. The computer equipment is expected to have a five-year life with no residual value. e. The office equipment is expected to have a ten-year life with no residual value. f. Prepaid rent for three of the six months has expired. 3. Prepare an adjusted trial balance as of December 31, 2020. 4. Prepare an income statement and statement of changes in equity for the three months ended December 31, 2020. 5. Prepare a balance sheet as of December 31, 2020. Flipboard Alignment D C Font B Aster Systems Trial Balance November 30, 2020 Credits Debits 8,604 12,380 2,395 8,640 9,300 12,000 5,040 101 106 126 128 131 163 167 201 301 302 403 623 655 676 684 699 Cash Accounts Receivable Computer Supplies Prepaid Insurance Prepaid Rent Office Equipment Computer Equipment Accounts Payable Aster Turane, Capital Aster Turane. Withdrawals Computer Services Revenue Wages Expense Advertising Expense Mileage Expense Repairs Expense. Computer Charitable Donations Expense 49,040 2,600 29,650 8.970 1,950 5,936 375 500 78,690 78.690 Aster Systems Statement of Changes in Equity For Two Months Ended November 30, 2020 Aster Turane, capital, October 1 Add: Owner investments Net income Total Less: Withdrawals Aster Turane, capital, November 30 49,040 11,919 60,959 2,600 3.58,259 Aster Systems Balance Sheet November 30, 2020 . Assets Liabilities Accounts Payable $0 Cash Accounts Receivabl 2 Computer Supplies 3 Prepaid Insurance Prepaid Rent 5 Office Equipment 6 Computer Equipmen 7 Total assets 8 $8,604 12,380 2,395 8,640 9,300 12,000 5.040 $59.359 Equity Aster Turane, Capital Total liabilities and equity 59.359 $59.359 Aster Systems Income Statement For Two Months Ended November 30, 2020 Revenues Computer Services Revenue $29,650 Operating expenses Wages Expense Advertising Expense 3 Mileage Expense 3 Charitable Donations Expense 5 Repairs Expense. Computer 5 Total operating expenses Net income 3 $8.970 1,950 5,936 500 375 17 731 $11.919 1