Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I didn't understand how they solved b. and where this 2.9991 came from? discount 1 UL We e to fall by 60 per cent for

I didn't understand how they solved b. and where this 2.9991 came from?

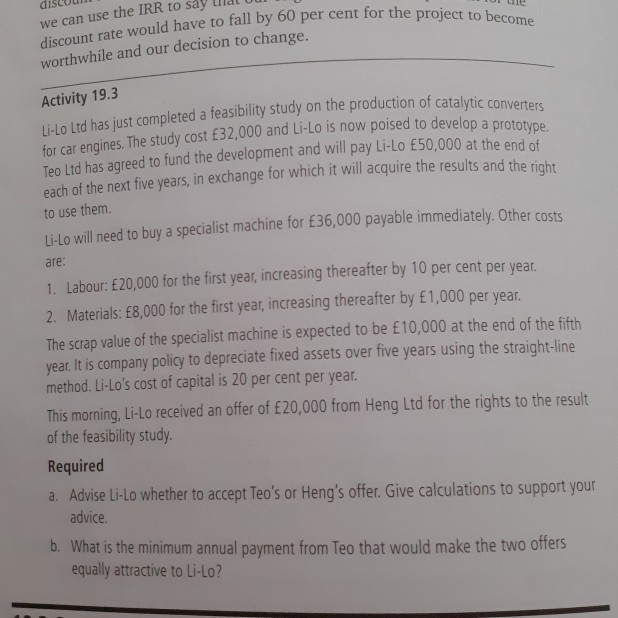

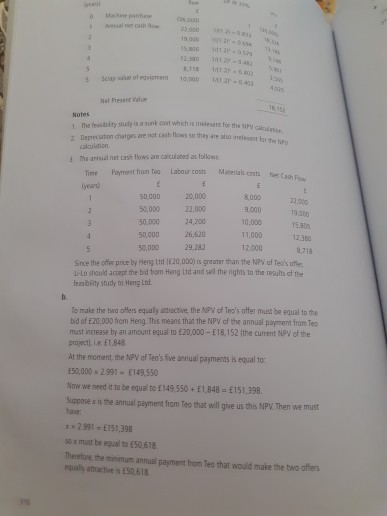

discount 1 UL We e to fall by 60 per cent for the project to become we can use the IRR to say tilde U discount rate would have to fall by 60 per worthwhile and our decision to change. on the production of catalytic converters Activity 19.3 Li-Lo Ltd has just completed a feasibility study on the production of catalyti for car engines. The study cost 32,000 and Li-Lo is now pois The study cost $32,000 and Li-Lo is now poised to develop a prototype Teo Ltd has agreed to fund the development and will pay Li-Lo 50,000 at the each of the next five years, in exchange for which it will acquire the results and the right to use them Li-Lo will need to buy a specialist machine for 36,000 payable immediately. Other costs are: 1. Labour: 20,000 for the first year, increasing thereafter by 10 per cent per year, 2. Materials: 8,000 for the first year, increasing thereafter by 1,000 per year. The scrap value of the specialist machine is expected to be 10,000 at the end of the fifth year. It is company policy to depreciate fixed assets over five years using the straight-line method. Li-Lo's cost of capital is 20 per cent per year. This morning, Li-Lo received an offer of 20,000 from Heng Ltd for the rights to the result of the feasibility study. Required a. Advise Li-Lo whether to accept Teo's or Heng's offer. Give calculations to support your advice. b. What is the minimum annual payment from Teo that would make the two offers equally attractive to Li-LO? S oftiment 10.000 Notes Tur i ty study is a sunt cost which is relean or they Dawson charges are not cas es so they are also calculation The annual net cash flow are calculated as follows Tine Payment fran Tea Labour costs Material tests 50,000 20,000 8.000 50.000 22.000 9.000 50.000 24,200 10.000 15, 50.000 26.620 11,000 12.30 50,000 29.222 12.000 8,718 Since the offer price by Heng Ltd (E20,000) is greater than the NPV of Teo's otte A-LO should accept the bid from Heng Ltd and sell the nights to the results of the feasibility study to Heng Ltd. To make the two ofers equally attractive, the NPV of Teo's offer must be equal to the bid of 20.000 from Heng. This means that the NPV of the annual payment from Teo must increase by an amount equal to 20,000 -18.152 (the current NPV of the project, i.e. 41848 At the moment, the NPV of Tea's five annual payments is equal to 50,000 2.991 - E149.550 Now we need it to be equal to 149.550 + E1848 = 151,398 Suppose x is the annual payment from Teo that will give us this NPV Then we must TX 2.991 - E151,395 so x must be equal to 50,618. Therefore the minimum annual payment from Tes that would make the two offers ayte is 150618Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started