Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I do need some help identifying the information requested. Please help! CITY OF BELLINGHAM Government Wide Statement of Activities For the Year Ended December 31,

I do need some help identifying the information requested. Please help!

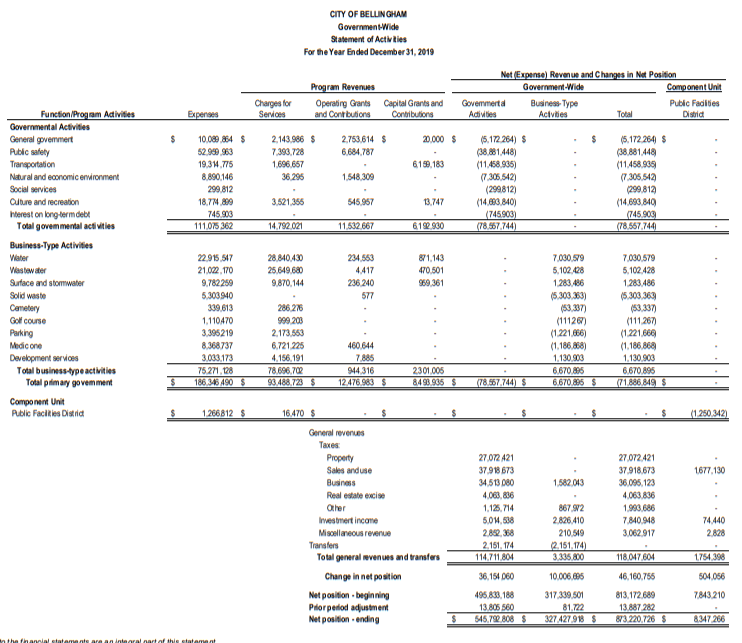

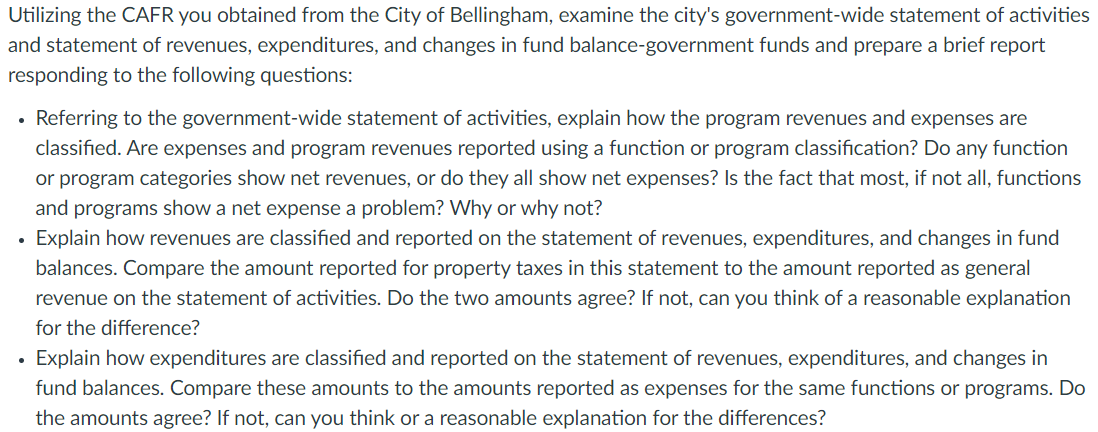

CITY OF BELLINGHAM Government Wide Statement of Activities For the Year Ended December 31, 2019 Net (Expense) Revenue and Changes in Net Position Government-Wide Component Unit Government Business Type Pubic Fasilities Advies Actvities Total Distid Program Revenues Operating Grants Capital Grants and and Contributions Contributions Charges for Services Expenses $ 20.000 $ $ 2.143.986 $ 7.393.728 1.696.657 36.296 2.753,614 $ 6.684787 10.089 854 $ 52.989 963 19.344.775 8.890146 299.812 18.709 745.903 111.075 362 6199.183 1.548.300 (5.172 264) $ (38,881.448) (11.458,935) (7,306,542) (299812) (14.683.840) (745903) (78.567.744) (5.172 264 $ (38.881.448 (11.458.939 (7.305.542 (299.812 (14.693.840 (745.908 (78.567.744 3.521.356 545.957 13.747 14.792.021 11.532.667 6192.900 Function/Program Activities Governmental Activities General government Public Safety Transportation Natural and economic environment Social services Culture and recreation herest on long term debe Total govem mental activities Business-Type Activities Vater Wastewater Surface and stomwater Solid waste Cemetery Golf course Parking Medicone Development services Total business-type activities Total primary govem ment Component Unit Public Facies Dild 28.840.430 25.649.680 9.870.144 234.553 4.417 236240 577 871,143 470.501 969,361 22.915.517 21.022 170 9.782259 5,303940 339.613 1.110470 3.395219 8.368737 3.033.173 75271,128 186.346 490$ 286 276 999 203 2.173.563 6.721.225 4.156,191 78,696,702 93.488.723 $ 7.000.579 5.102.128 1.283.486 (5,303.363) (53.337) (111267) (1.221.666) (1.186.868) 1.130.903 6,670,895 6.670.895 $ 7.030.579 5.102.428 1.283.486 (5,303.363 (53.337) (111267) (1.221666 (1.186.868 1.130.903 6,670,895 (71.886.819 $ 460 644 7 885 944.316 12.476.983 $ 2301005 8493.935 $ (78.557.744) $ 1.266812 $ 16.470 $ (1.250.342) 1677.130 1.582 043 General revenues Taxes Property Sales and use Business Real estate excise Other Investment income Miscellaneous revenue Transfers Total general revenues and transfers Change in net position Net position beginning Pror period adjustment Net position - ending 27.072421 37.918,673 36.095.123 4.063.836 1.993.686 7.840.948 3.062 917 27.072 421 37.918 673 34,513 080 4.063.836 1.125.714 5.04.538 2.892.358 2.151.174 114.711.804 36,154060 496.833.188 13.805560 545.79.808 $ 867.912 2826.410 210.519 (2.151.174) 3.335.800 74.440 2828 118.047.604 1754398 10.006.695 504.056 46.160.756 813.172.689 13.887 282 873.220.726 $ 317 339.501 81.722 327.427.918 $ 7.843.210 $ 8347200 nanal statements are an internar af this statement Utilizing the CAFR you obtained from the City of Bellingham, examine the city's government-wide statement of activities and statement of revenues, expenditures, and changes in fund balance-government funds and prepare a brief report responding to the following questions: Referring to the government-wide statement of activities, explain how the program revenues and expenses are classified. Are expenses and program revenues reported using a function or program classification? Do any function or program categories show net revenues, or do they all show net expenses? Is the fact that most, if not all, functions and programs show a net expense a problem? Why or why not? Explain how revenues are classified and reported on the statement of revenues, expenditures, and changes in fund balances. Compare the amount reported for property taxes in this statement to the amount reported as general revenue on the statement of activities. Do the two amounts agree? If not, can you think of a reasonable explanation for the difference? Explain how expenditures are classified and reported on the statement of revenues, expenditures, and changes in fund balances. Compare these amounts to the amounts reported as expenses for the same functions or programs. Do the amounts agree? If not, can you think or a reasonable explanation for the differencesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started