Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I do not follow up especially on the b part, please elaborate more. Thank you in advance. A. Mathenthenyana Tyre Services must choose between two

I do not follow up especially on the b part, please elaborate more. Thank you in advance.

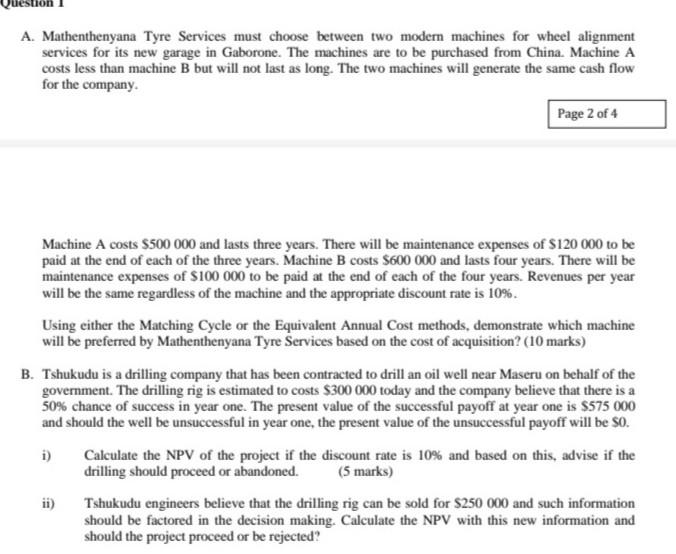

A. Mathenthenyana Tyre Services must choose between two modern machines for wheel alignment services for its new garage in Gaborone. The machines are to be purchased from China. Machine A costs less than machine B but will not last as long. The two machines will generate the same cash flow for the company. Page 2 of 4 Machine A costs $500 000 and last three years. There will be maintenance expenses of S120 000 to be paid at the end of each of the three years. Machine B costs $600 000 and lasts four years. There will be maintenance expenses of $100 000 to be paid at the end of each of the four years. Revenues per year will be the same regardless of the machine and the appropriate discount rate is 10%. Using either the Matching Cycle or the Equivalent Annual Cost methods, demonstrate which machine will be preferred by Mathenthenyana Tyre Services based on the cost of acquisition? (10 marks) B. Tshukudu is a drilling company that has been contracted to drill an oil well near Maseru on behalf of the government. The drilling rig is estimated to costs $300 000 today and the company believe that there is a 50% chance of success in year one. The present value of the successful payoff at year one is $575 000 and should the well be unsuccessful in year one, the present value of the unsuccessful payoff will be so. i) Calculate the NPV of the project if the discount rate is 10% and based on this, advise if the drilling should proceed or abandoned. (5 marks) ii) Tshukudu engineers believe that the drilling rig can be sold for $250 000 and such information should be factored in the decision making. Calculate the NPV with this new information and should the project proceed or be rejectedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started