Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I do not need a whole memo written but how would I go about these questions? Please link FASB codification numbers on where the information

I do not need a whole memo written but how would I go about these questions? Please link FASB codification numbers on where the information is found. Please comment if you have questions.

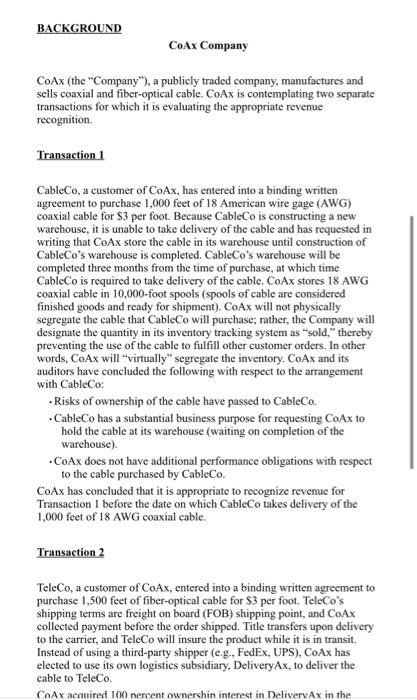

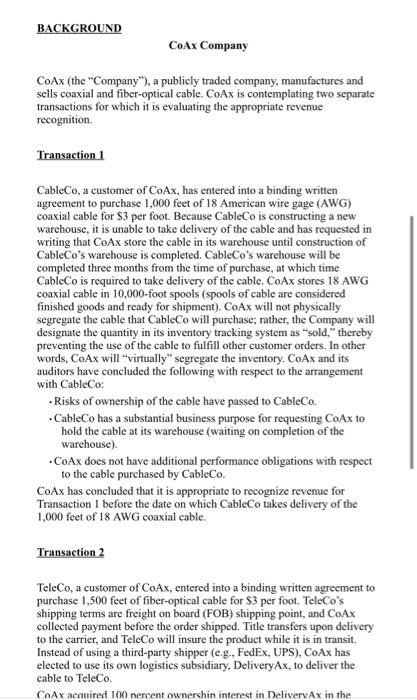

collected payment before the order shipped. Title transfers upon delivery to the carrier, and TeleCo will insure the product while it is in transit. Instead of using a third-party shipper (e.g., FedEx, UPS), CoAx has clected to use its own logistics subsidiary, DeliveryAx, to deliver the cable to TeleCo. CoAx acquired 100 percent ownership interest in DeliveryAx in the previous year. DeliveryAx provides an array of shipping services to third- party customers outside the cable industry. Only 2 percent of DeliveryAx's shipping revenue is expected to be derived from transactions with CoAx in the current year. REQUIREMENTS: You are a new accountant for the CoAx (the Company). The Company's Controller, Mr. Tony Stark, asks you to prepare an accounting memo to address both of the following questions: a) Is it appropriate for CoAx to recognize revenue associated with Transaction / before the date on which CableCo takes delivery of the 1,000 feet of 18 AWG coaxial cable? To answer the above question, consider the following: . What is a bill-and-hold arrangement according to the Codification. Provide the codification reference (e.g. ASC 305-10-55-2). . What are the criteria that a bill-and-hold arrangement must meet to conclude that revenue recognition is appropriate before a product has shipped? Provide the codification reference. Provide strong and persuasive arguments to support your answer, i.e. make a strong case/argument by connecting the criteria with the facts given in the case b) Is it appropriate to recognize revenue upon transfer of the inventory to DeliveryAx in Transaction 2? Provide strong and persuasive arguments to support your answer, and provide the codification reference that you use as the basis of your conclusion Page 1 of 3 BACKGROUND CoAx Company CoAx (the "Company"), a publicly traded company, manufactures and sells coaxial and fiber-optical cable. CoAx is contemplating two separate transactions for which it is evaluating the appropriate revenue recognition Transaction 1 CableCo, a customer of CoAx, has entered into a binding written agreement to purchase 1,000 feet of 18 American wire gage (AWG) coaxial cable for $3 per foot. Because CableCo is constructing a new warehouse, it is unable to take delivery of the cable and has requested in writing that CoAx store the cable in its warehouse until construction of CableCo's warehouse is completed. CableCo's warehouse will be completed three months from the time of purchase, at which time CableCo is required to take delivery of the cable. CoAx stores 18 AWG coaxial cable in 10,000-foot spools (spools of cable are considered finished goods and ready for shipment). CoAx will not physically segregate the cable that CableCo will purchase; rather, the Company will designate the quantity in its inventory tracking system as "sold," thereby preventing the use of the cable to fulfill other customer orders. In other words, CoAx will "virtually" segregate the inventory. CoAx and its auditors have concluded the following with respect to the arrangement with CableCo: - Risks of ownership of the cable have passed to CableCo. CableCo has a substantial business purpose for requesting Coax to hold the cable at its warehouse (waiting on completion of the warehouse) CoAx does not have additional performance obligations with respect to the cable purchased by CableCo. CoAx has concluded that it is appropriate to recognize revenue for Transaction I before the date on which CableCo takes delivery of the 1,000 feet of 18 AWG coaxial cable. Transaction 2 TeleCo, a customer of Cox, entered into a binding written agreement to purchase 1,500 feet of fiber-optical cable for $3 per foot. TeleCo's shipping terms are freight on board (FOB) shipping point, and COAX collected payment before the order shipped. Title transfers upon delivery to the carrier, and TeleCo will insure the product while it is in transit. Instead of using a third-party shipper (e.g., FedEx, UPS). CoAx has elected to use its own logistics subsidiary, DeliveryAx, to deliver the cable to TeleCo. COAX acauired 100 percent ownershin interest in Delivery Ax in the Objectives of the Case: (1) To give students the opportunity to use FASB Codification Research System to determine and analyze criteria for recognizing revenue. (2) To give students the opportunity to practice writing persuasive argument. Research Database: Use the FASB Accounting Standards Codification Research System to research the authoritative literature (FASB pronouncements) relevant to the issues in question. The web link and login information of the database is available on CANVAS. General Instructions: 1. Read the document: "How to write an accounting issue memo.' 2. Prepare an accounting memo (see the case requirements on page 3). a. Your responses must be clear, concise, supported with persuasive arguments, and free from grammatical and spelling errors. b. There is no minimum or maximum limit on the length of your response. c. I have posted three samples of accounting issues memo on Canvas for your reference. d. Review the evaluation rubric for this assignment, so you can see how your memo will be graded

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started