I do not understand the meaning of these pictures.

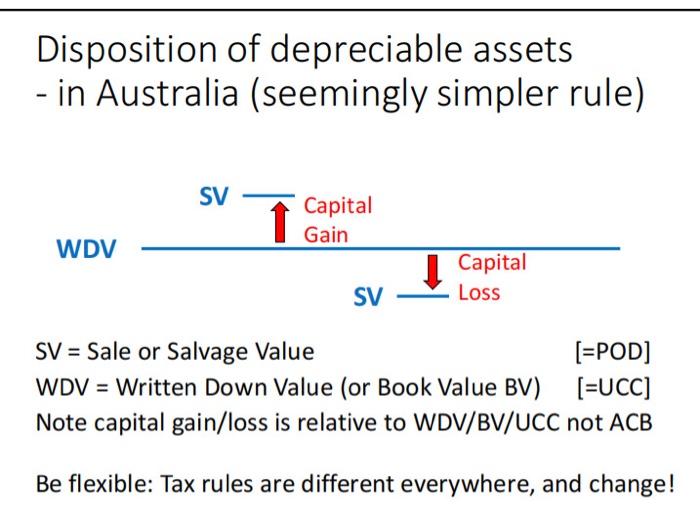

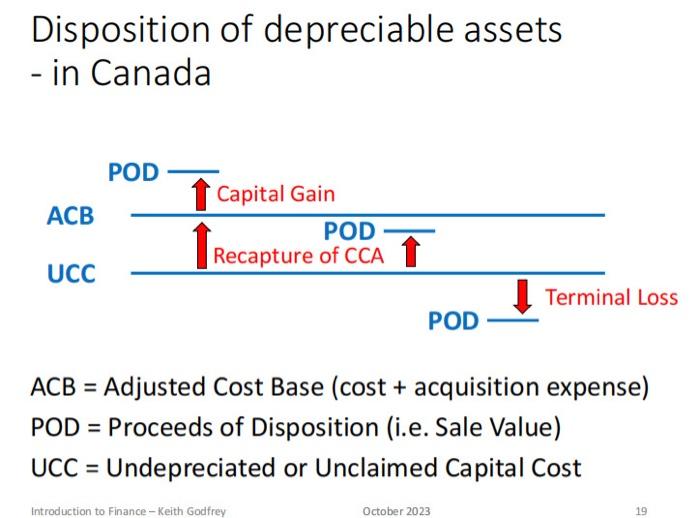

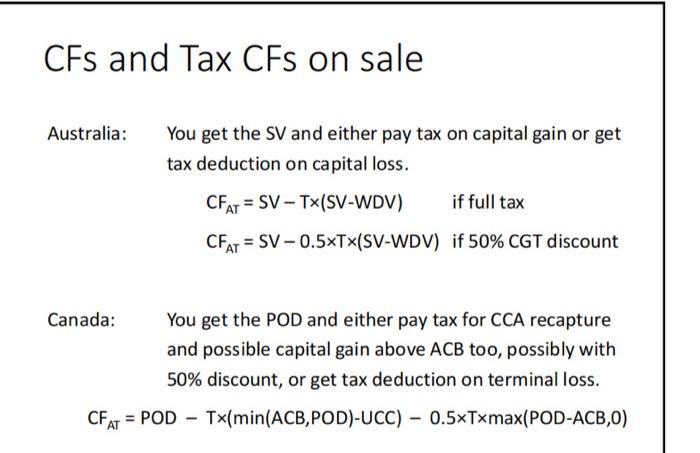

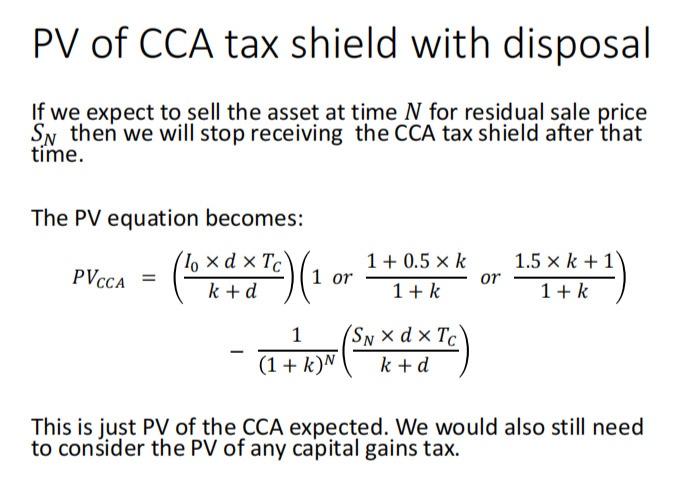

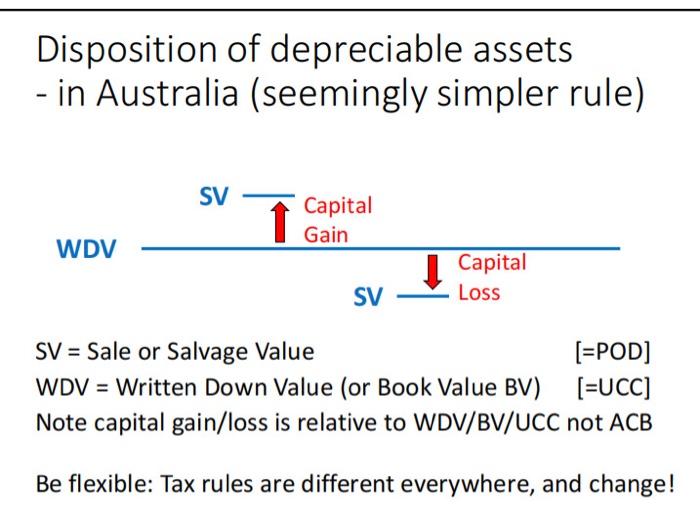

Disposition of depreciable assets - in Canada oss ACB= Adjusted Cost Base (cost + acquisition expense) POD= Proceeds of Disposition (i.e. Sale Value) UCC = Undepreciated or Unclaimed Capital Cost CFs and Tax CFs on sale Australia: You get the SV and either pay tax on capital gain or get tax deduction on capital loss. CFAT=SVT(SVWDV)CFAT=SV0.5T(SVWDV)iffulltaxif50%CGTdiscount Canada: You get the POD and either pay tax for CCA recapture and possible capital gain above ACB too, possibly with 50% discount, or get tax deduction on terminal loss. CFAT=PODT(min(ACB,POD)UCC)0.5Tmax(PODACB,0) Disposition of depreciable assets - in Australia (seemingly simpler rule) SV = Sale or Salvage Value [=POD] WDV = Written Down Value (or Book Value BV) [=UCC] Note capital gain/loss is relative to WDV/BV/UCC not ACB Be flexible: Tax rules are different everywhere, and change! PV of CCA tax shield with disposal If we expect to sell the asset at time N for residual sale price SN then we will stop receiving the CCA tax shield after that time. The PV equation becomes: PVCCA=(k+dI0dTC)(1or1+k1+0.5kor1+k1.5k+1)(1+k)N1(k+dSNdTC) This is just PV of the CCA expected. We would also still need to consider the PV of any capital gains tax. Disposition of depreciable assets - in Canada oss ACB= Adjusted Cost Base (cost + acquisition expense) POD= Proceeds of Disposition (i.e. Sale Value) UCC = Undepreciated or Unclaimed Capital Cost CFs and Tax CFs on sale Australia: You get the SV and either pay tax on capital gain or get tax deduction on capital loss. CFAT=SVT(SVWDV)CFAT=SV0.5T(SVWDV)iffulltaxif50%CGTdiscount Canada: You get the POD and either pay tax for CCA recapture and possible capital gain above ACB too, possibly with 50% discount, or get tax deduction on terminal loss. CFAT=PODT(min(ACB,POD)UCC)0.5Tmax(PODACB,0) Disposition of depreciable assets - in Australia (seemingly simpler rule) SV = Sale or Salvage Value [=POD] WDV = Written Down Value (or Book Value BV) [=UCC] Note capital gain/loss is relative to WDV/BV/UCC not ACB Be flexible: Tax rules are different everywhere, and change! PV of CCA tax shield with disposal If we expect to sell the asset at time N for residual sale price SN then we will stop receiving the CCA tax shield after that time. The PV equation becomes: PVCCA=(k+dI0dTC)(1or1+k1+0.5kor1+k1.5k+1)(1+k)N1(k+dSNdTC) This is just PV of the CCA expected. We would also still need to consider the PV of any capital gains tax