Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I do you not understand how the correct answer is A. Why don't you carry forward theough year 3 to offset the $1,000 against $4,000.

I do you not understand how the correct answer is A. Why don't you carry forward theough year 3 to offset the $1,000 against $4,000. Please explain and be thorough. Thank you in advance

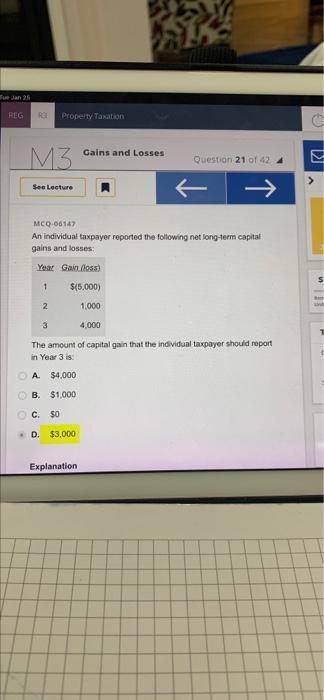

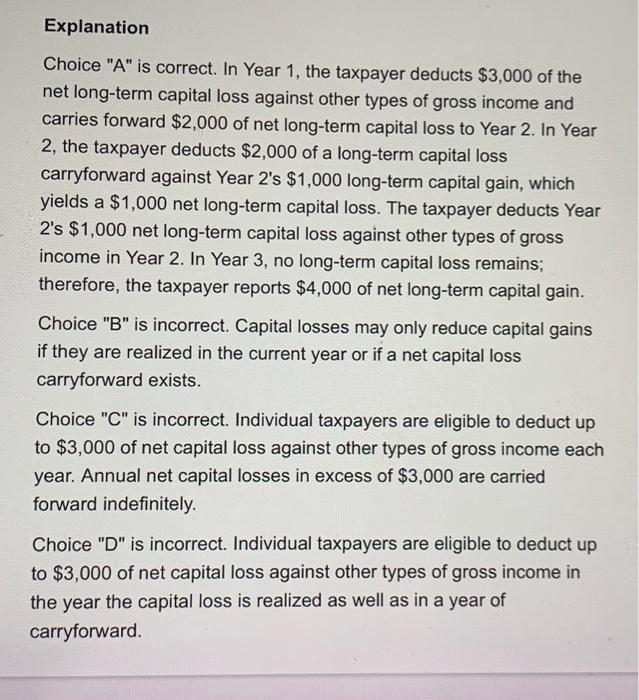

Fun REG Ra Property Taxation G M3 Gains and Losses Question 21 of 42 See Lecture E -> MCQ-06147 An individual taxpayer reported the following net long-term capitat gains and losses Year Gandoss) S 1 $45.000) 2 1.000 3 4,000 The amount of capital gain that the individual taxpayer should report in Year 3 is 1 A $4,000 B. $1,000 c SO D $3,000 Explanation Explanation Choice "A" is correct. In Year 1, the taxpayer deducts $3,000 of the net long-term capital loss against other types of gross income and carries forward $2,000 of net long-term capital loss to Year 2. In Year 2, the taxpayer deducts $2,000 of a long-term capital loss carryforward against Year 2's $1,000 long-term capital gain, which yields a $1,000 net long-term capital loss. The taxpayer deducts Year 2's $1,000 net long-term capital loss against other types of gross income in Year 2. In Year 3, no long-term capital loss remains; therefore, the taxpayer reports $4,000 of net long-term capital gain. Choice "B" is incorrect. Capital losses may only reduce capital gains if they are realized in the current year or if a net capital loss carryforward exists. Choice "C" is incorrect. Individual taxpayers are eligible to deduct up to $3,000 of net capital loss against other types of gross income each year. Annual net capital losses in excess of $3,000 are carried forward indefinitely Choice "D" is incorrect. Individual taxpayers are eligible to deduct up to $3,000 of net capital loss against other types of gross income in the year the capital loss is realized as well as in a year of carryforward

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started