Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I done both of these questions three seperate times and i always come up with the wrong answer... can someone explain to me the right

I done both of these questions three seperate times and i always come up with the wrong answer...

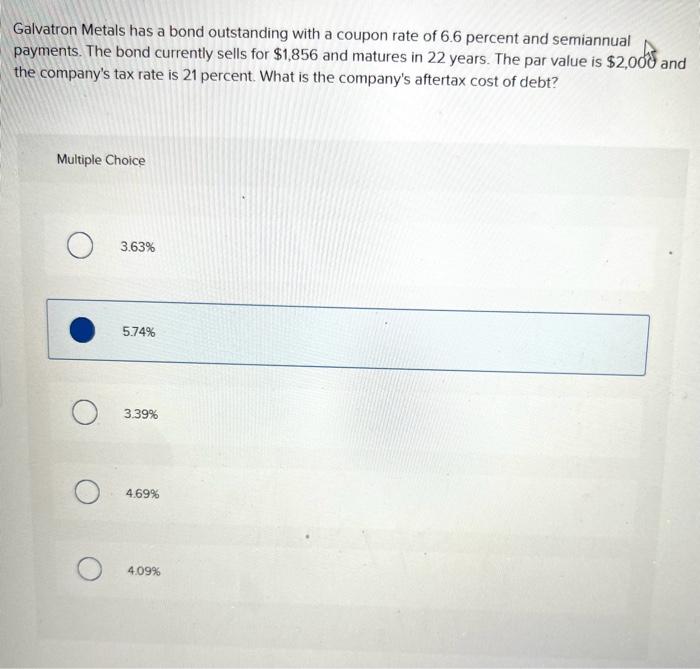

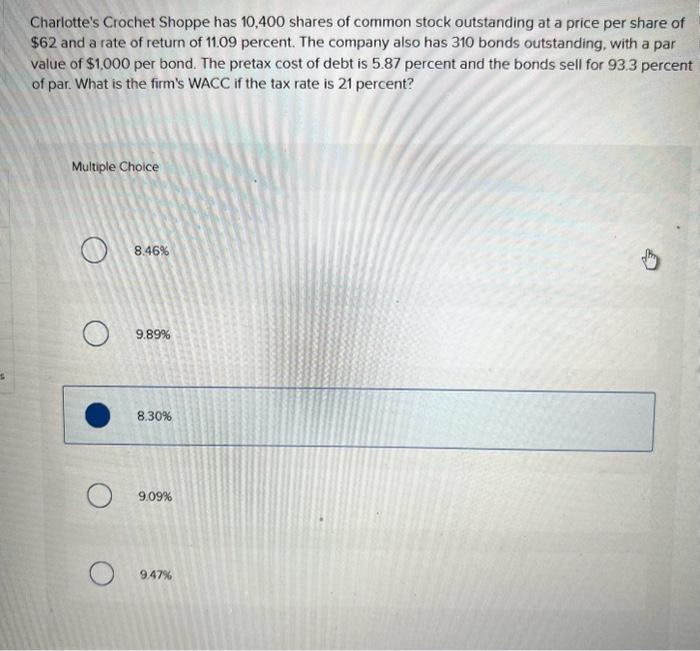

Galvatron Metals has a bond outstanding with a coupon rate of 6.6 percent and semiannual payments. The bond currently sells for $1,856 and matures in 22 years. The par value is $2,00% and the company's tax rate is 21 percent. What is the company's aftertax cost of debt? Multiple Choice 3.63% 5.74% 339% 4.69% 4.09% Charlotte's Crochet Shoppe has 10,400 shares of common stock outstanding at a price per share of $62 and a rate of return of 11.09 percent. The company also has 310 bonds outstanding, with a par value of $1,000 per bond. The pretax cost of debt is 5.87 percent and the bonds sell for 93.3 percent of par. What is the firm's WACC if the tax rate is 21 percent? Multiple Choice 8.46% 9.89% 8.30% 9.09% 9.47% can someone explain to me the right answer for these?

thanks in advance! :-)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started