Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I don't know how to compute some numbers, I put the red circle, could you put the journal entry and T-account to explain it And

I don't know how to compute some numbers, I put the red circle, could you put the journal entry and T-account to explain it

And NO 4 (major repair $33000, I also not really understand it(what's meaning, is that meaning the number 33000 is put the debited about accumulated depreciation account?).

12/31/12 12/31/11

company A accumulated depreciation (180 140

company B accumulated depreciation 20 40

what's meaning for both? what's the difference? about cash flow, is will also be added in the operating section?

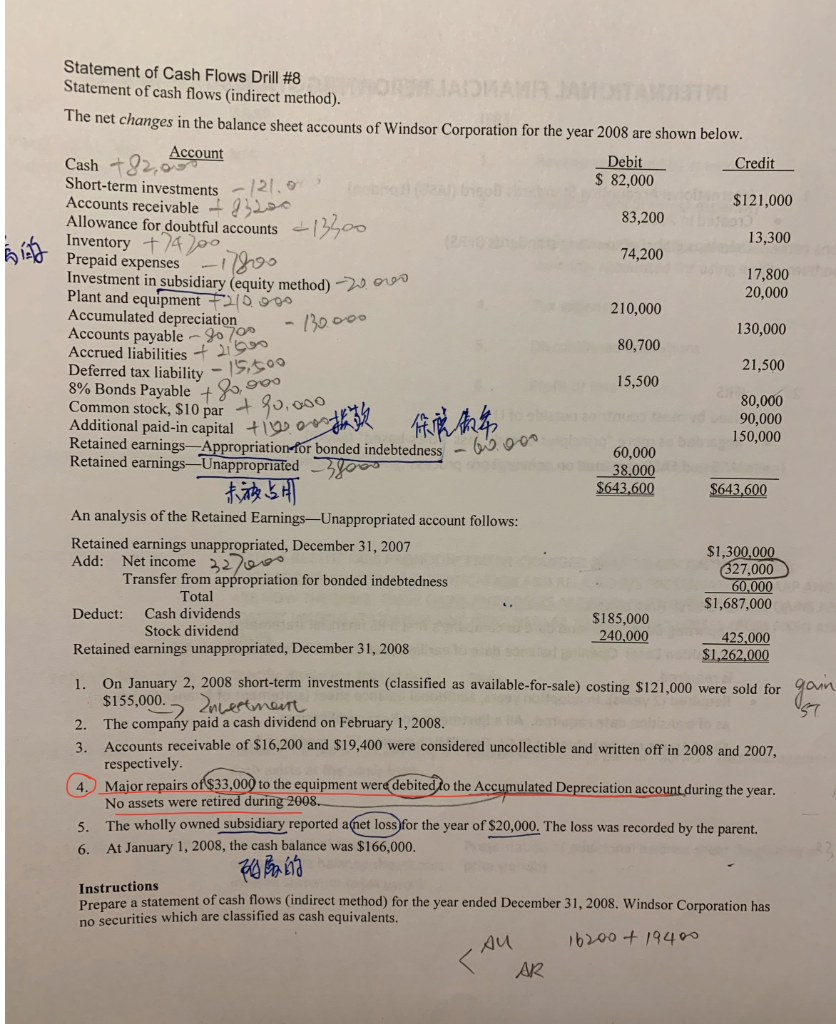

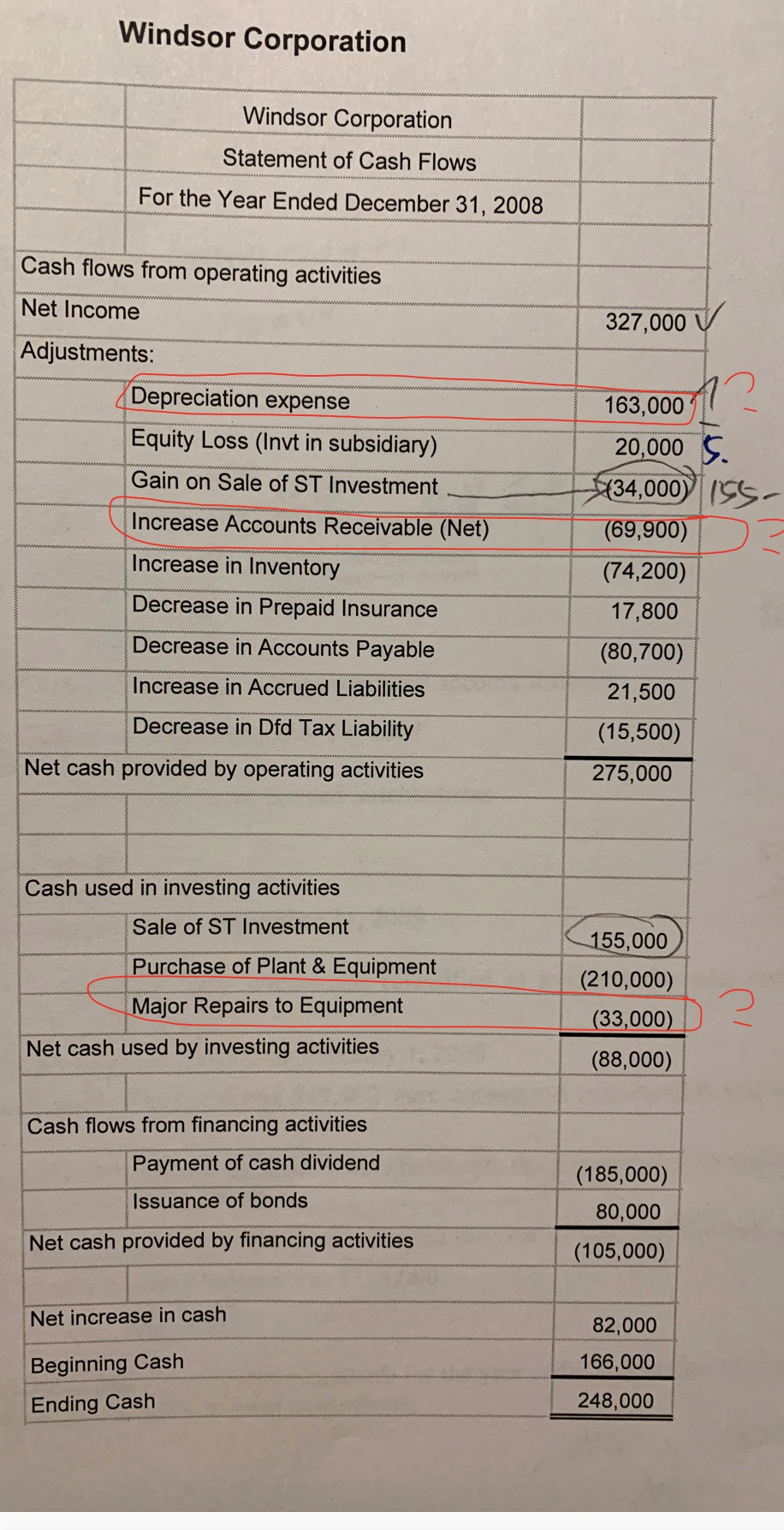

Statement of Cash Flows Drill #8 Statement of cash flows (indirect method). The net changes in the balance sheet accounts of Windsor Corporation for the year 2008 are shown below. Cash +82,00 Account Debit Credit Short-term investments - 121.0 $ 82,000 Accounts receivable +9100 $121,000 Allowance for doubtful accounts - 13500 83,200 Inventory + 7400 13,300 74,200 Prepaid expenses -17h00 17,800 Investment in subsidiary (equity method) 2. over Plant and equipment F20.00 20,000 210,000 Accumulated depreciation - 130.00 Accounts payable - 40700 130,000 80,700 Accrued liabilities + 1 Deferred tax liability - 1 21,500 15,500 8% Bonds Payable +8,90 80,000 Common stock, $10 par + 90. 90,000 Additional paid-in capital t o oth 150,000 Retained earnings-Appropriation for bonded indebtedness - w ou 60,000 Retained earnings-Unappropriated 38000 38,000 the A $643,600 $643.600 An analysis of the Retained Earnings-Unappropriated account follows: Retained earnings unappropriated, December 31, 2007 $1,300,000 Add: Net income 3270 327,000 Transfer from appropriation for bonded indebtedness 60,000 Total $1,687,000 Deduct: Cash dividends $185,000 Stock dividend 240,000 425,000 Retained earnings unappropriated, December 31, 2008 $1,262,000 1. On January 2, 2008 short-term investments (classified as available-for-sale) costing $121,000 were sold for young $155,000. ZnLeetmeitt 2. The company paid a cash dividend on February 1, 2008. 3. Accounts receivable of $16,200 and $19,400 were considered uncollectible and written off in 2008 and 2007, respectively. 4. Major repairs of $33,000 to the equipment were debited to the Accumulated Depreciation account during the year. No assets were retired during 2008. 5. The wholly owned subsidiary reported a net loss for the year of $20,000. The loss was recorded by the parent. 6. At January 1, 2008, the cash balance was $166,000. Habang Instructions Prepare a statement of cash flows (indirect method) for the year ended December 31, 2008. Windsor Corporation has no securities which are classified as cash equivalents. AU 16200+ 19400 7 AR Windsor Corporation Windsor Corporation Statement of Cash Flows For the Year Ended December 31, 2008 327,000 V Cash flows from operating activities Net Income Adjustments: Depreciation expense Equity Loss (Invt in subsidiary) Gain on Sale of ST Investment Increase Accounts Receivable (Net) Increase in Inventory Decrease in Prepaid Insurance Decrease in Accounts Payable Increase in Accrued Liabilities Decrease in Dfd Tax Liability Net cash provided by operating activities 163,0001 - 20,000 5. (34,000) 1557 (69,900) (74,200) 17,800 (80,700) 21,500 (15,500) 275,000 Cash used in investing activities Sale of ST Investment Purchase of Plant & Equipment Major Repairs to Equipment Net cash used by investing activities 155,000 (210,000) (33,000) (88,000) Cash flows from financing activities Payment of cash dividend Issuance of bonds Net cash provided by financing activities (185,000) 80,000 (105,000) Net increase in cash 82,000 166,000 Beginning Cash Ending Cash 248,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started