Question

I don't know how to find the last years of the stock. I look at the answers that the helpers on here post and then

I don't know how to find the last years of the stock. I look at the answers that the helpers on here post and then I work backwards to learn how they found the answer.

All of the data that I have has been provided. Please use the following information to answer the question, please don't use information from someone else's question.

These are all the directions I was given. I have done some of the work but I don't know how to continue and I'd like to verify that I did the work right. Please show me how to do this as I'm trying to learn, yet every time I post this question someone reports me or says there isn't enough information...This is all the information I have.

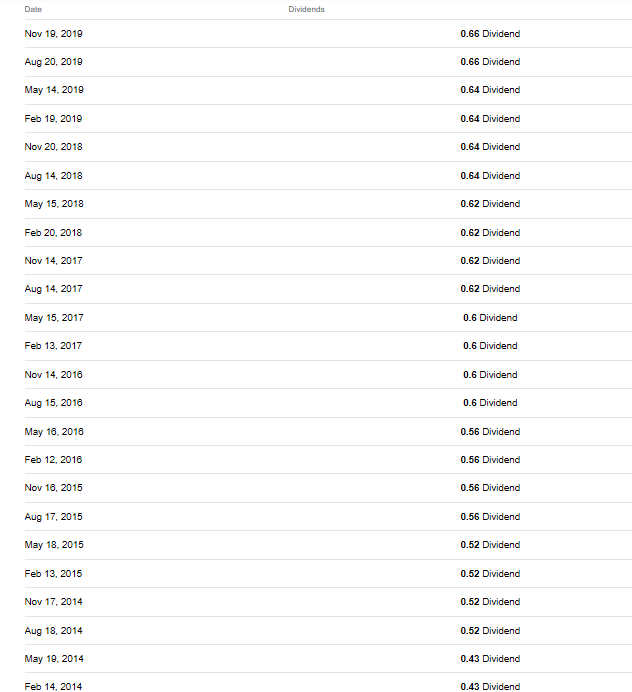

Use the last five years of Target's stocks to calculate the following.

Part A-Fundamental Valuation:

1. Estimate a growth rate for your firm's Dividends per Share.

2. Assume a 12.5% discount rate.

3. Calculate an estimated value of a share of the stock using the constant-growth model, also known as the Gordon growth model.

4. Compare and contrast your valuation results with the current share price in the market.

5. Respond to this question: What changes in the variables would be necessary in your valuation to best approximate the market valuation?

Part B - Relative Valuation:

1. Estimate a growth rate for your firm's Earnings per Share (EPS).

2. Determine an applicable Price-Earnings (P/E) ratio for your firm in 5 years.

3. Calculate an estimated value of a share of the stock in 5 years using the P/E ratio model.

4. Respond to this question: Would you characterize your stock as undervalued or overvalued? Explain.

5. Respond to this question: Based on your valuations in parts A and B, would you invest in this stock? Explain

Date Dividends Nov 10, 2010 0.66 Dividend Aug 20, 2010 0.66 Dividend May 14 0.64 Dividend 2010 Feb 10, 2010 Nov 20, 2018 0.64 Dividend 0.64 Dividend Aug 14, 2018 0.64 Dividend May 15, 2018 0.62 Dividend Feb 20, 2018 0.62 Dividend Nov 14, 2017 0.62 Dividend Aug 14, 2017 0.62 Dividend May 15, 2017 0.6 Dividend Feb 13, 2017 0.6 Dividend Nov 14, 2016 0.6 Dividend Aug 15, 2010 0.6 Dividend May 10, 2010 0.56 Dividend Feb 12, 2016 0.56 Dividend Nov 10, 2015 0.56 Dividend Aug 17, 2015 0.56 Dividend May 18, 2015 0.52 Dividend Feb 13, 2015 0.52 Dividend Nov 17, 2014 0.52 Dividend Aug 18, 2014 0.52 Dividend May 19, 2014 0.43 Dividend Feb 14, 2014 0.43 Dividend Date Dividends Nov 10, 2010 0.66 Dividend Aug 20, 2010 0.66 Dividend May 14 0.64 Dividend 2010 Feb 10, 2010 Nov 20, 2018 0.64 Dividend 0.64 Dividend Aug 14, 2018 0.64 Dividend May 15, 2018 0.62 Dividend Feb 20, 2018 0.62 Dividend Nov 14, 2017 0.62 Dividend Aug 14, 2017 0.62 Dividend May 15, 2017 0.6 Dividend Feb 13, 2017 0.6 Dividend Nov 14, 2016 0.6 Dividend Aug 15, 2010 0.6 Dividend May 10, 2010 0.56 Dividend Feb 12, 2016 0.56 Dividend Nov 10, 2015 0.56 Dividend Aug 17, 2015 0.56 Dividend May 18, 2015 0.52 Dividend Feb 13, 2015 0.52 Dividend Nov 17, 2014 0.52 Dividend Aug 18, 2014 0.52 Dividend May 19, 2014 0.43 Dividend Feb 14, 2014 0.43 Dividend

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started