Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i dont know if you can see clear the last question pleae let me know Prrafo Now, let's go house shopping. After a down payment

i dont know if you can see clear the last question pleae let me know

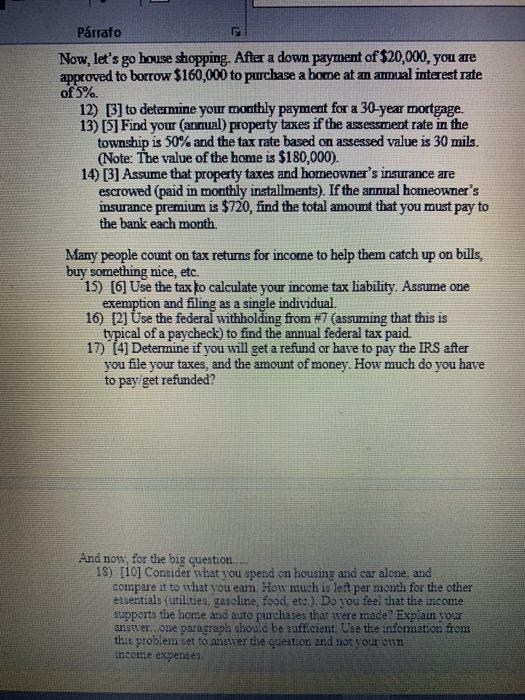

Prrafo Now, let's go house shopping. After a down payment of $20,000, you are approved to borrow $160,000 to purchase a bome at an annual interest rate of 5% 12) [3] to determine your monthly payment for a 30-year mortgage. 13) [5] Find your (annual) property taxes if the assessment rate in the township is 50% and the tax rate based on assessed value is 30 mils. (Note: The value of the home is $180,000). 14) [3] Assume that property taxes and homeowner's insurance are escrowed (paid in monthly installments). If the annual homeowner's insurance premium is $720, find the total amount that you must pay to the bank each month Many people count on tax retums for income to help them catch up on bills, buy something nice, etc. 15) [6] Use the tax to calculate your income tax liability. Assume one exemption and filing as a single individual 16) [2] Use the federal withholding from #7 (assuming that this is typical of a paycheck) to find the annual federal tax paid. 17) (4) Determine if you will get a refund or have to pay the IRS after you file your taxes, and the amount of money. How much do you have to pay get refunded? And now, for the big question..... 18) (10] Consider what you spend on housing and car alone, and compare it to what you eam. How much is left per month for the other essentials (utilities, zasoline, food, etc.). Do you feel that the income supports the home and auto purchases that were made? Explain your answer...one paragraph should be sufficient. Ese the infomation om this problem set to answer the question and not your own income expenses Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started