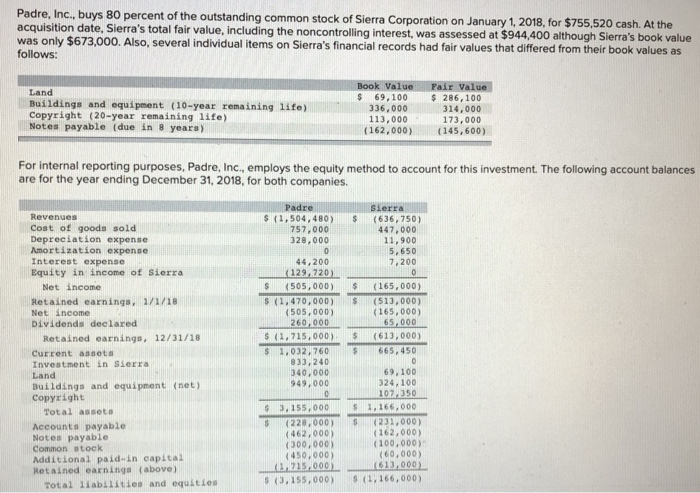

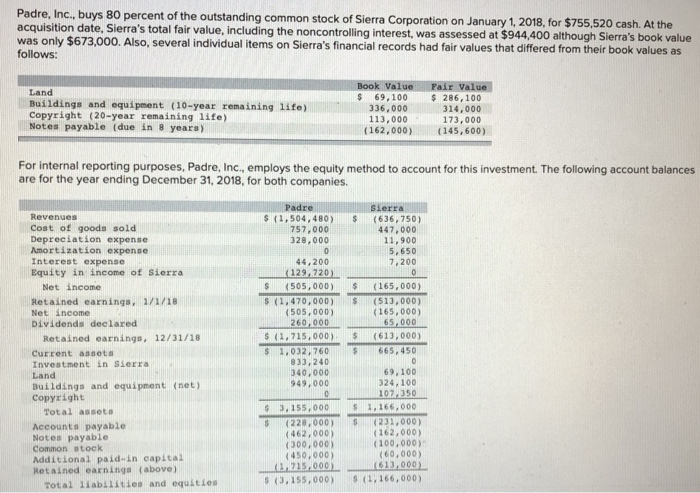

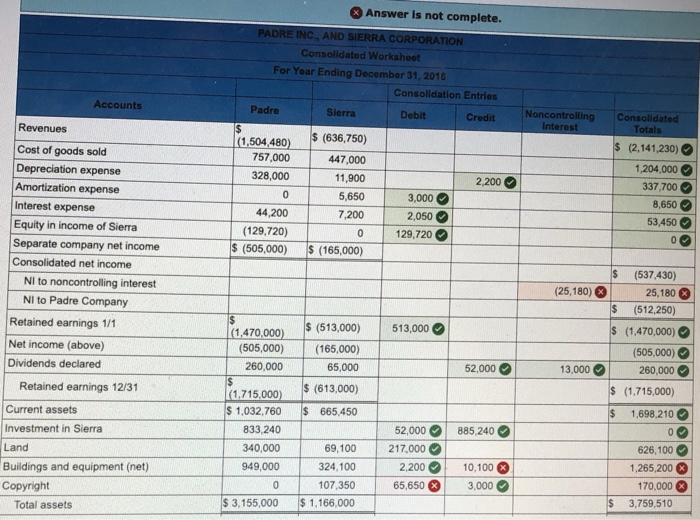

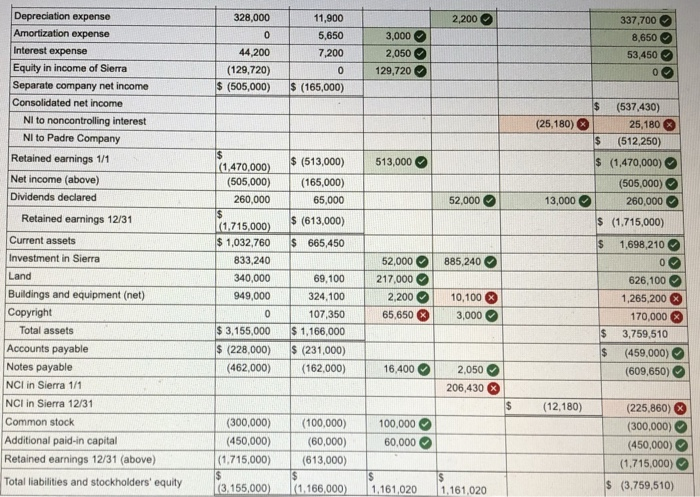

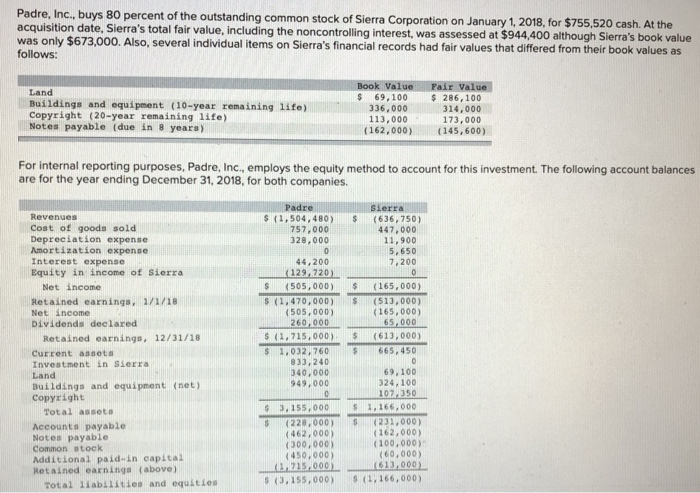

I dont know what Im doing wrong..

Answer Is not complete. Consolidated Worksheot For Year Ending December 31, 2018 Consolidation Entries Accounts Padre Sierra Debit Credit Noncontrolling Consolidated Revenues Cost of goods sold Depreciation expense Amortization expense Interest expense Equity in income of Sierra Separate company net income Consolidated net income (2,141,.230) 1,204,000 337,700 8,650 53,450 (1.504 480)(636,750) 757,000 447,000 11,900 5,650 328,000 2,200 3,000 7,200 2,050 0 129,720 44,200 (129,720) (505,000) (165,000) (537,430) (25,180) 25,180 $(512,250) 1,470,000) (505,000) 13,000260,000 (1,715,000) $ 1,698,210 NI to noncontrolling interest NI to Padre Company Retained earnings 1/1 Net income (above) Dividends declared (1470000) 100 513,000 (505000) (165,000) 65,000 260,000 52,000 (1,715,000) (613,000) $ 1,032,760 665.450 Retained earnings 12/31 Current assets Investment in Sierra Land Buildings and equipment (net) Copyright 52000885,240 833,240 340,000 949,000 324,1002.20010,100 69,100 217,000 626,100 1,265,200 170,000 $ 3,759,510 107,350 65,650 3,000 3,155,000 1,166,000 Total assets Depreciation expense Amortization expense Interest expense Equity in income of Sierra Separate company net income Consolidated net income 11,900 5,650 7,200 328,000 2,200 3,000 2,050 337,700 8,650 53,450 44,200 (129,720) 0 129,720 (605,000) (165.000) $ (537,430) 25,180 $ (512,250) s (1,470,000) Nl to noncontrolling interest (25,180) NI to Padre Company Retained earnings 1/1 Net income (above) Dividends declared $(513,000) 513,000 1.470000) (505,000)(165,000) 65,000 (505,000) C 52,000 13,000260,000 (1,715,000) 260,000 Retained earnings 12/31 (1,715,000) (613,000) s 1,032,760 665,450 Current assets Investment in Sierra Land Buildings and equipment (net) Copyright 1,698,210 52000885,240 833,240 340,000 949,000 0 626,100 1,265,200 170,000 $ 3,759,510 (459,000) (609,650) 69,100 217,000 2.20010,100 65.650 3,000 324.100 107,350 3,155,000 1,166,000 (228,000) (231,000) Total assets Accounts payable Notes payable NCI in Sierra 1/1 NCI in Sierra 12/31 Common stock Additional paid-in capital Retained earnings 12/31 (above) Total liabilities and stockholders' equity (462,000)(162000) 6402,050 206,430 S (12,180) (225.860) 3 (300,000)(100,000) 100,000 (450,000) (300,000) 450,000) (1,715,000) S (3,759,510) 60,000) 60,000 (1,715,000) (613,000) (3,155,000) (1,166,000) 1,161,020 1,161.020