Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I don't know where to find them on target financial summary so can anyone please explain . Thank you th the income nuch cash did

I don't know where to find them on target financial summary so can anyone please explain . Thank you

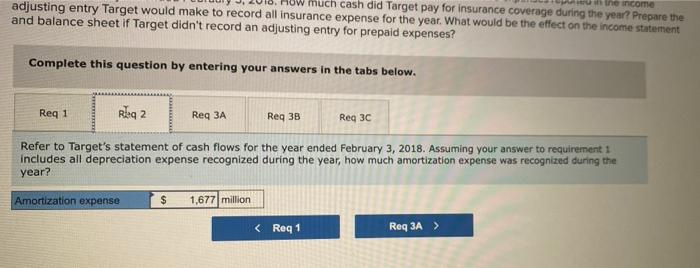

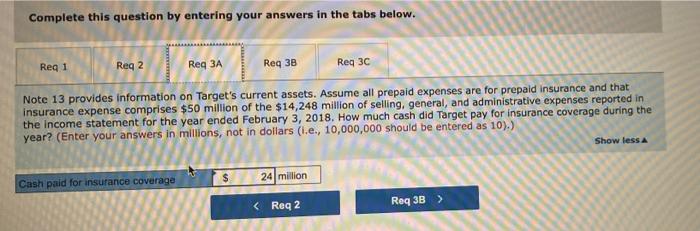

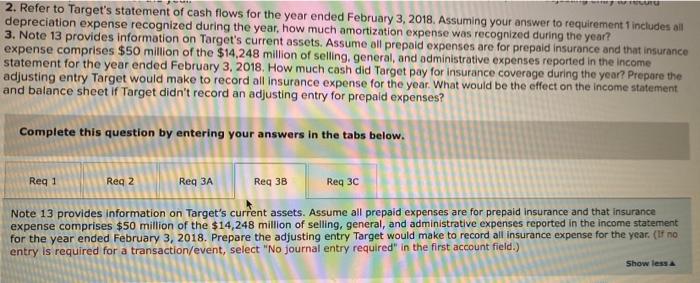

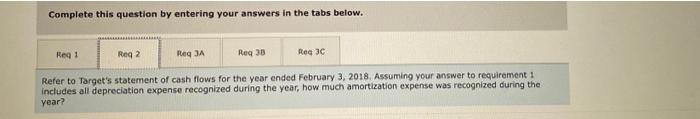

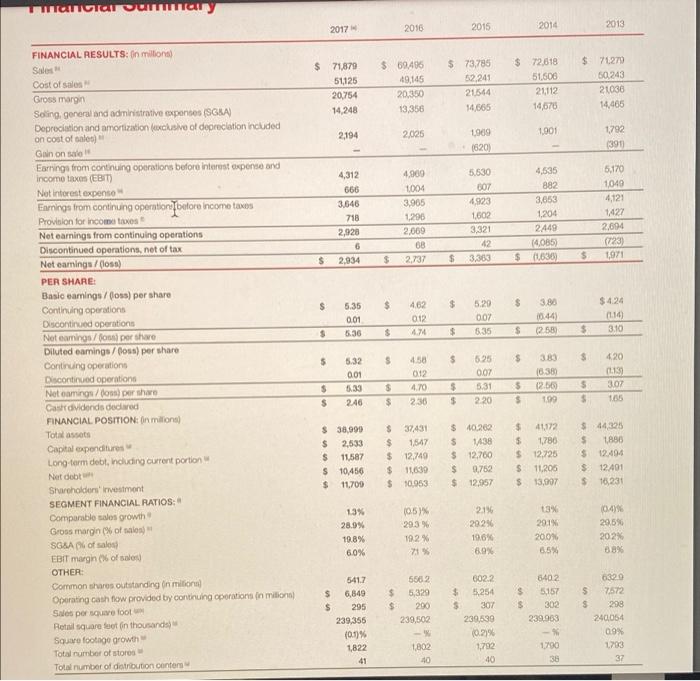

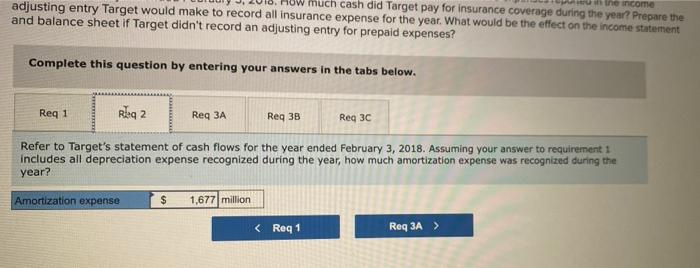

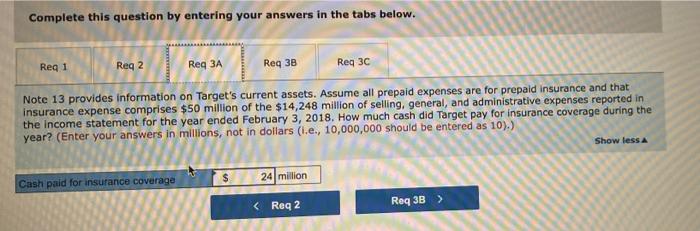

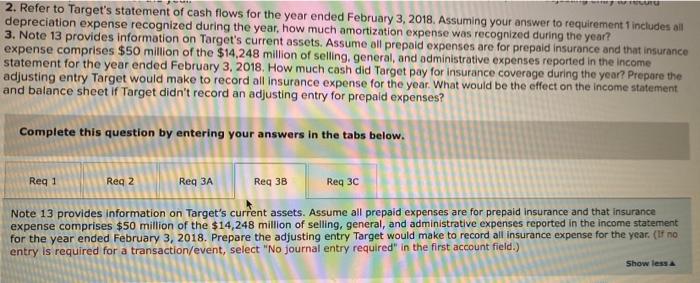

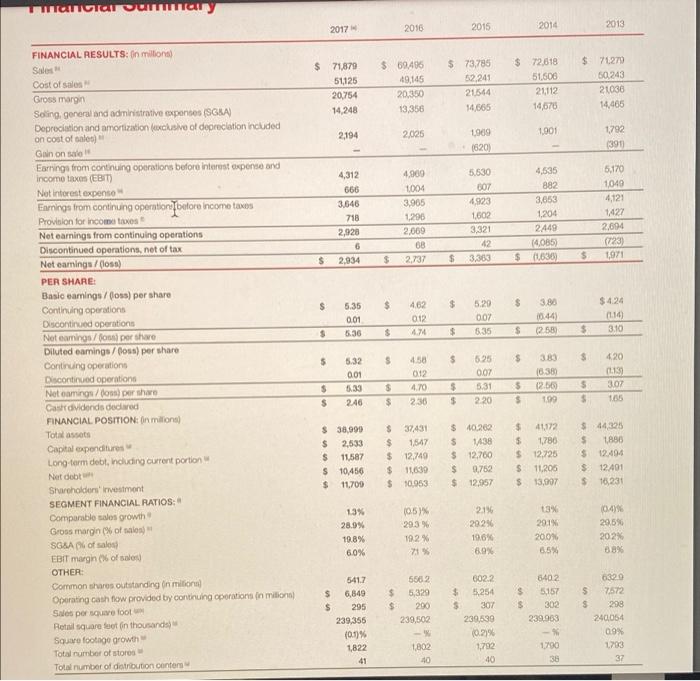

th the income nuch cash did Target pay for insurance coverage during the year? Prepare the adjusting entry Target would make to record all insurance expense for the year. What would be the effect on the income statement and balance sheet if Target didn't record an adjusting entry for prepaid expenses? Complete this question by entering your answers in the tabs below. Req 1 Rha 2 Reg 3A Reg 3B Reg 3C Refer to Target's statement of cash flows for the year ended February 3, 2018. Assuming your answer to requirement 1 includes all depreciation expense recognized during the year, how much amortization expense was recognized during the year? Amortization expense $ 1,677 million Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Req 3A Req 3B Reg 30 Note 13 provides information on Target's current assets. Assume all prepaid expenses are for prepaid insurance and that insurance expense comprises $50 million of the $14,248 million of selling, general, and administrative expenses reported in the income statement for the year ended February 3, 2018. How much cash did Target pay for insurance coverage during the year? (Enter your answers in millions, not in dollars (.e., 10,000,000 should be entered as 10).) Show less $ 24 million Cash paid for insurance coverage TUTU 2. Refer to Target's statement of cash flows for the year ended February 3, 2018. Assuming your answer to requirement includes all depreciation expense recognized during the year, how much amortization expense was recognized during the year? 3. Note 13 provides information on Target's current assets. Assume all prepold expenses are for prepaid insurance and that insurance expense comprises $50 million of the $14,248 million of selling, general, and administrative expenses reported in the income statement for the year ended February 3, 2018. How much cash did Target pay for insurance coverage during the year? Prepare the adjusting entry Target would make to record all Insurance expense for the year. What would be the effect on the income statement and balance sheet if Target didn't record an adjusting entry for prepaid expenses? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg Reg 3B Reg 30 Note 13 provides information on Target's current assets. Assume all prepaid expenses are for prepaid insurance and that insurance expense comprises $50 million of the $14,248 million of selling, general, and administrative expenses reported in the income statement for the year ended February 3, 2018. Prepare the adjusting entry Target would make to record all Insurance expense for the year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show less Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 Reg JA Reg 30 Reg C Refer to Target's statement of cash flows for the year ended February 3, 2018. Assuming your answer to requirement1 includes all depreciation expense recognized during the year, how much amortization expense was recognized during the year? OMTAI DUTY 2017 2016 2015 2014 2013 $ 71,879 5025 20,754 14,248 $69496 49,145 20.350 13,356 $ 73,785 52.241 21.544 14665 $ 72,618 51.606 21112 14,678 $ 71270 50.243 21038 14.065 2,194 2.025 1989 1,001 1792 390 620 4,312 666 3.646 718 2,928 6 2,934 4.900 1004 3,905 1296 2,009 68 2.737 5.630 807 4.923 1,602 3,321 42 3.363 4,535 882 3,653 1204 2449 (4015) $ 0.636) 5,170 1049 4,121 1427 2,694 (123) 1971 $ S $ $ $ $ 462 $ $ 5.35 0.01 5.30 012 5.20 007 5:35 3.80 10:44) (258) $ 424 (11) 3.10 $ $ 4.74 $ $ $ FINANCIAL RESULTS: On millions Sale Cost of sales Gross margin Soling, general and administrative expenses (SGA) Depreciation and amortization focusive of depreciation included on cost of a Gin on sale Earrings from continuing operations before interest expense and income taxon (EBIT) Not interest expenso Earnings from continuing operation before income taxes Provision for income taxes Net earnings from continuing operations Discontinued operations, not of tax Net eamingu/(los) PER SHARE: Basic varings/oss) per share Continuing operations Discontinued operations Net caminow/comportare Diluted eamings/osa) per share Continuing operation Discontinued operations Not oomingu/tom) per she Cas dividonds de red FINANCIAL POSITION:n milions Tot assets Capital expenditures Long term debt, including current portion Net det Shareholders Investment SEGMENT FINANCIAL RATIOS: Comparable sales growth Gross margin % of to SGSA of sales EBIT margin of sale OTHER Common shares outstanding in million) Operating cash flow provided by continuing operations in milion Ses per square foot Retail square foot in thousands Square footage growth Total number of stores Total number of distribution Contem $ S $ $ $ $ 6.25 007 5.32 0.01 5.33 246 4.50 012 4.70 2.30 383 16,389 (2.56 199 420 (113) 3.02 105 5:31 $ $ $ $ $ $ $ $ 5 $ 220 $ 38,999 $ 2,533 $ 11,587 s 10456 $ 11700 $ 37.431 $ 1547 $ 12,749 $ 11,639 $ 10.053 $ 10.200 $ 1438 $ 12,700 $ 0,752 $ 12,957 $ $ 1786 $ 12,725 $ 11205 $ 13,007 544325 $ 1880 $ 12494 $ 12401 $ 16,231 13% 26.9% 19.8% 60% 105) 29.3 % 19.2% 2.1% 2024 19.0% 6.9% 13 291 200% 6.5% 104 20.5% 202% 08 6402 5.157 $ $ 5562 5,320 200 239.502 - $ $ $ S $ $ 5417 $ 6,840 $ 295 239.355 (0:1) 1822 41 302 602.2 5.254 307 239,530 10% 1,792 40 239.983 --- 1.790 36 6320 7572 298 240054 0.9% 1783 37 1802 40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started