I don't need answer all the questions. answer the questions that you know.

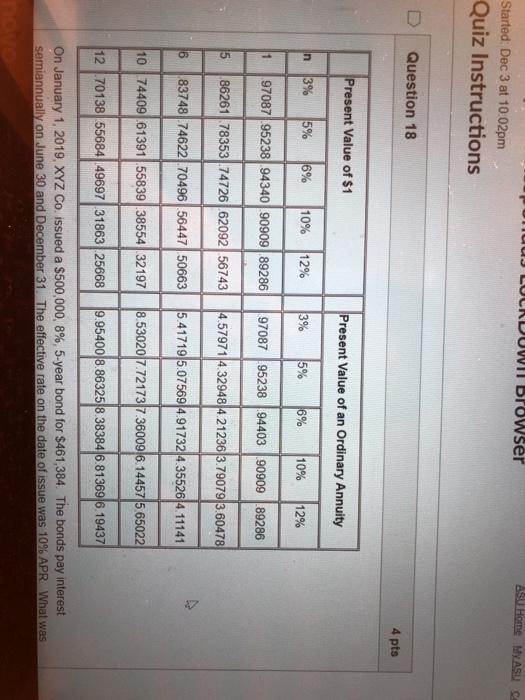

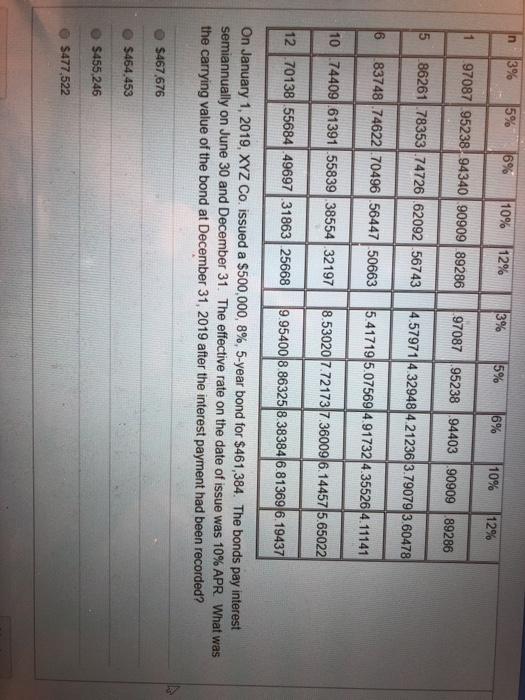

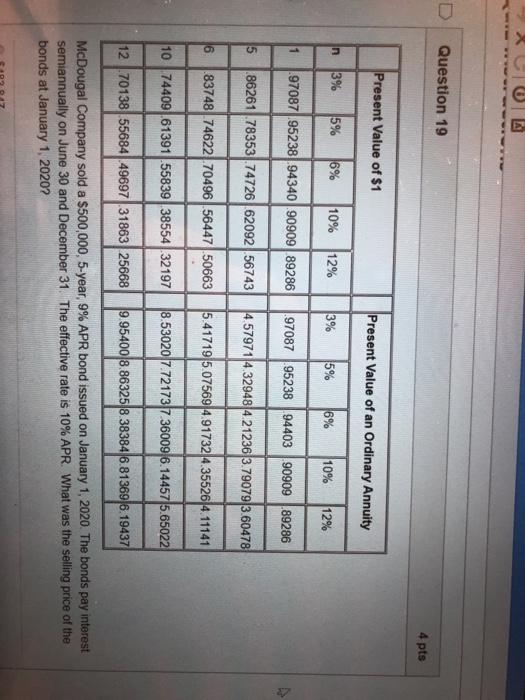

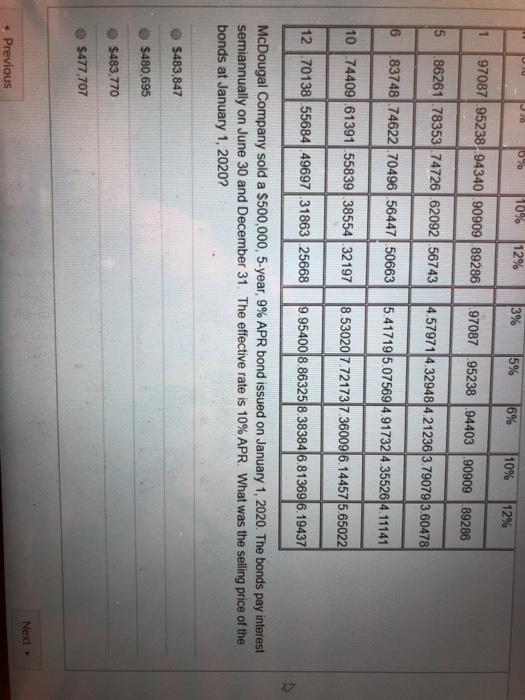

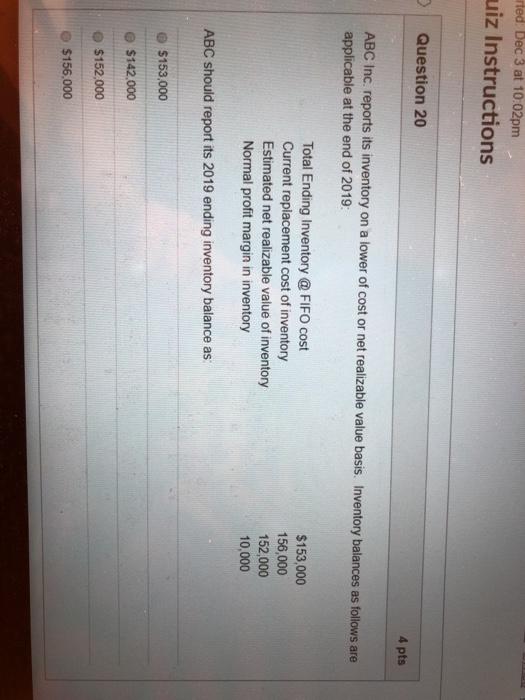

I LUCRDUWII browser Au Home My ASU Started: Dec 3 at 10.02pm Quiz Instructions Question 18 4 pts Present Value of $1 Present Value of an Ordinary Annuity n 3% 5% 16% 10% 12% 3% 5% 6% 10% 12% 1 97087 95238 9434090909 89286 97087 95238 94403 90909 89286 15 8626178353 747266209256743 4.57971432948 4 21236|3.79079 3.60478 6 8374874622 704965644750663 5.41719 5.075694.917324.35526 4.11141 10 7440961391.558393855432197 8.53020 7.721737.360096.14457 5.65022 12 70138 55684 49697 3186325668 9.95400 8.863258.38384 6.813696.19437 On January 1, 2019, XYZ Co. issued a $500,000, 8%, 5-year bond for $461,384. The bonds pay interest semiannually on June 30 and December 31. The effective rate on the date of issue was 10% APR What was n 3% 5% 16% 10% 12% 13% 15% 16% 10% 12% 1 97087 95238 9434090909 89286 97087 95238 94403 90909 89286 8626178353 74726 62092 56743 4.57971 4.32948 4 21236|3.79079 3.60478 6 83748.74622 70496 5644750663 5.41719 5.07569 4.91732 4.35526 4.11141 10 7440961391.558393855432197 18.5302017.7217317 36009 6.14457 5.65022 12 70138 55684.496973186325668 9.95400 8.863258.3838416.81369]6.19437 On January 1, 2019, XYZ Co. issued a $500,000, 8%, 5-year bond for $461,384. The bonds pay interest semiannually on June 30 and December 31. The effective rate on the date of issue was 10% APR. What was the carrying value of the bond at December 31, 2019 after the interest payment had been recorded? $467,676 $464.453 $455 246 $477,522 XOA Question 19 4 pts Present Value of $1 Present Value of an Ordinary Annuity n 3% 5% 16% 10% 12% 3% 5% 6% 10% 12% 1 1.97087 952389434090909 89286 97087 95238 94403 90909 89286 5 86261.78353.74726 6209256743 4.57971 4.32948 4 21236 3.79079 3.60478 6 8374874622,704965644750663 5.41719 5.075694.91732 4.35526 4.11141 10 7440961391.558393855432197 8.53020 7.7217317 36009 6.14457 5.65022 12 70138 556844969731863 25668 9 954008.863258.38384 6.81369|6.19437 McDougal Company sold a $500,000, 5-year 9% APR bond issued on January 1, 2020. The bonds pay interest semiannually on June 30 and December 31. The effective rate is 10% APR. What was the selling price of the bonds at January 1, 2020? 070 110% 12% 3% 15% 16% 10% 12% 97087 95238 9434090909 89286 97087 95238 94403 90909 89286 5 86261,78353 747266209256743 4.57971 4.32948 4 21236|3.79079|3.60478 6 .8374874622 70496 5644750663 5.41719 5.07569 4.91732 4.35526 4.11141 10 7440961391 558393855432197 8.53020 7 72173|7 360096.14457 5.65022 12 70138 55684.4969731863 25668 9.95400 8.86325 8.383846.81369 6.19437 McDougal Company sold a $500,000, 5-year, 9% APR bond issued on January 1, 2020. The bonds pay interest semiannually on June 30 and December 31. The effective rate is 10% APR. What was the selling price of the bonds at January 1, 2020? $483,847 $480.695 $483.770 $477,707 Next Previous rted Dec 3 at 10.02pm uiz Instructions Question 20 4 pts ABC Inc. reports its inventory on a lower of cost or net realizable value basis. Inventory balances as follows are applicable at the end of 2019: Total Ending Inventory @ FIFO cost Current replacement cost of inventory Estimated net realizable value of inventory Normal profit margin in inventory $153,000 156,000 152,000 10,000 ABC should report its 2019 ending inventory balance as $153,000 $142.000 $152,000 $156,000