i dont need the first picture anymore. Just do the picture that starts with "briefly explain"

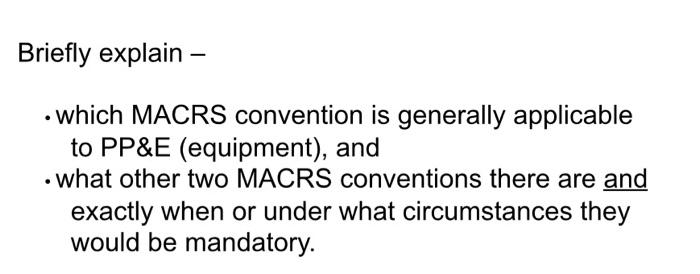

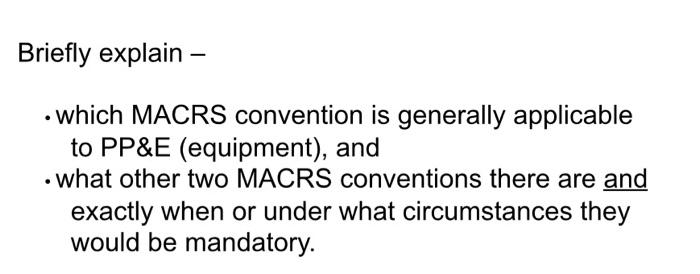

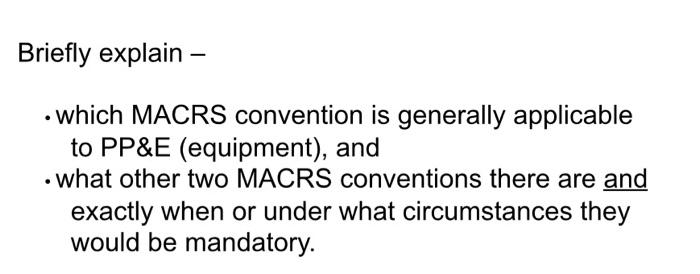

(2) Timmy paid $800,000 cash for all of the assets of Bob's Chicken Fried Steak Shack, Inc. (Bob's). Timmy did not buy the stock of Bob's; rather he bought all of Bob's assets from Bob's. Here is a list of the physical assets that Timmy got for his $800,000, showing the stand-alone FMV of each category:* Land & Building, $350,000 Furniture & Equipment, $160,000 Inventory, $15,000 Bob's latest property tax appraisal from Dallas County showed the land value at $150,000, the building at $100,000, the furniture and equipment at $75,000. 1. What is Timmy's depreciable basis in the building? 2. What is Timmy's depreciable basis in the furniture and equipment? What amount will Timmy eventually record as COGS with respect to the purchased inventory? How much, if any, goodwill did Timmy purchase? Address each item separately. (Each part must be correctly answered to earn a point for this item (3).) *** These FMVs are as agreed and stated in the negotiated Purchase Agreement (3) Rich Uncle died on March 1, 2020, and left you his mansion. Additional facts: The mansion was worth $4 million on March 1, 2020 The mansion was worth $4.2 million six months later (September 1, 2020). The mansion was worth $4.25 million on October 15, 2020, the date on which you finally received the deed from Uncle's executor. Uncle's executor did not elect the alternative valuation date. Your tax basis in the mansion is $_ Explain why. Briefly explain which MACRS convention is generally applicable to PP&E (equipment), and what other two MACRS conventions there are and exactly when or under what circumstances they would be mandatory. (2) Timmy paid $800,000 cash for all of the assets of Bob's Chicken Fried Steak Shack, Inc. (Bob's). Timmy did not buy the stock of Bob's; rather he bought all of Bob's assets from Bob's. Here is a list of the physical assets that Timmy got for his $800,000, showing the stand-alone FMV of each category:* Land & Building, $350,000 Furniture & Equipment, $160,000 Inventory, $15,000 Bob's latest property tax appraisal from Dallas County showed the land value at $150,000, the building at $100,000, the furniture and equipment at $75,000. 1. What is Timmy's depreciable basis in the building? 2. What is Timmy's depreciable basis in the furniture and equipment? What amount will Timmy eventually record as COGS with respect to the purchased inventory? How much, if any, goodwill did Timmy purchase? Address each item separately. (Each part must be correctly answered to earn a point for this item (3).) *** These FMVs are as agreed and stated in the negotiated Purchase Agreement (3) Rich Uncle died on March 1, 2020, and left you his mansion. Additional facts: The mansion was worth $4 million on March 1, 2020 The mansion was worth $4.2 million six months later (September 1, 2020). The mansion was worth $4.25 million on October 15, 2020, the date on which you finally received the deed from Uncle's executor. Uncle's executor did not elect the alternative valuation date. Your tax basis in the mansion is $_ Explain why. Briefly explain which MACRS convention is generally applicable to PP&E (equipment), and what other two MACRS conventions there are and exactly when or under what circumstances they would be mandatory