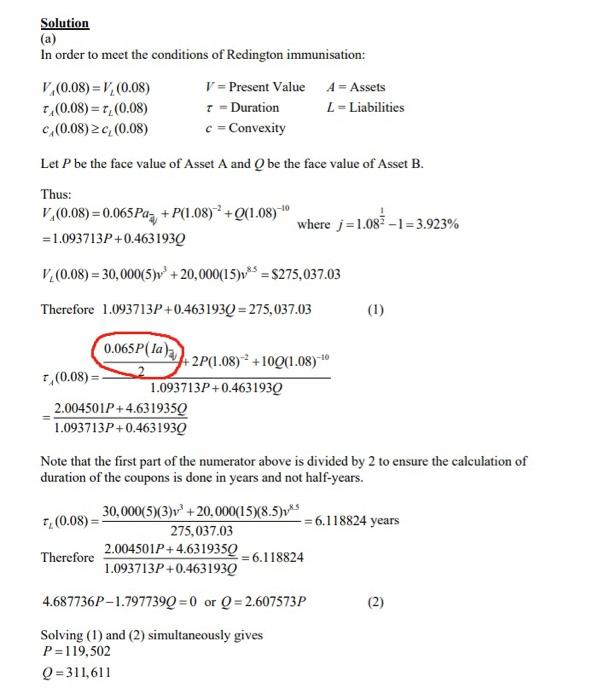

i dont quite understand where the 2 in the red circlr the i draw is coming from. Can you explain it in details?

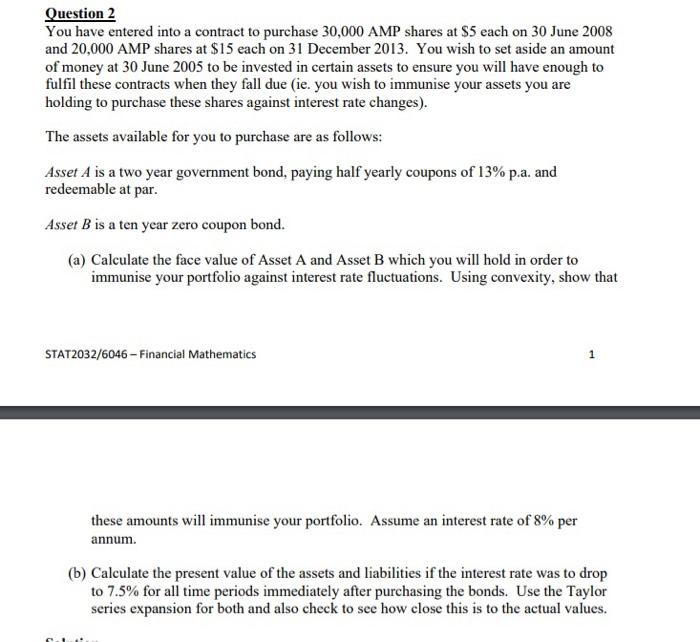

Question 2 You have entered into a contract to purchase 30,000 AMP shares at $5 each on 30 June 2008 and 20,000 AMP shares at $15 each on 31 December 2013. You wish to set aside an amount of money at 30 June 2005 to be invested in certain assets to ensure you will have enough to fulfil these contracts when they fall due (ie. you wish to immunise your assets you are holding to purchase these shares against interest rate changes). The assets available for you to purchase are as follows: Asset A is a two year government bond, paying half yearly coupons of 13% p.a. and redeemable at par Asset B is a ten year zero coupon bond. (a) Calculate the face value of Asset A and Asset B which you will hold in order to immunise your portfolio against interest rate fluctuations. Using convexity, show that STAT2032/6046 - Financial Mathematics 1 these amounts will immunise your portfolio. Assume an interest rate of 8% per annum (b) Calculate the present value of the assets and liabilities if the interest rate was to drop to 7.5% for all time periods immediately after purchasing the bonds. Use the Taylor series expansion for both and also check to see how close this is to the actual values. Solution (a) In order to meet the conditions of Redington immunisation: V.0.08) =V (0.08) V = Present Value A = Assets 1,(0.08)=,(0.08) 1 - Duration L = Liabilities C,(0.08) 2c, (0.08) c = Convexity Let P be the face value of Asset A and Q be the face value of Asset B. Thus: V.0.08)=0.065Pa+ P(1.08)? +9(1.08) where j = 1.083 - 1 = 3.923% =1.093713P+0.4631939 V.(0.08) = 30,000(5) +20,000(15)= $275,037.03 Therefore 1.093713P+0.4631939 = 275,037.03 (1) 0.065P(la)) #2P(1.08) +100(1.08) 7,(0.08) 1.093713P+0.463193Q 2.004501P+4.631935Q 1.093713P+0.4631939 Note that the first part of the numerator above is divided by 2 to ensure the calculation of duration of the coupons is done in years and not half-years. T: (0.08) 30,000(5)(3)v +20,000(15)8.5)ves = 6.118824 years 275,037.03 Therefore 2.004501P+4.631935 6.118824 1.093713P +0.4631939 4.687736P-1.797739Q=0 or Q=2.607573P (2) Solving (1) and (2) simultaneously gives P=119,502 Q = 311,611 Question 2 You have entered into a contract to purchase 30,000 AMP shares at $5 each on 30 June 2008 and 20,000 AMP shares at $15 each on 31 December 2013. You wish to set aside an amount of money at 30 June 2005 to be invested in certain assets to ensure you will have enough to fulfil these contracts when they fall due (ie. you wish to immunise your assets you are holding to purchase these shares against interest rate changes). The assets available for you to purchase are as follows: Asset A is a two year government bond, paying half yearly coupons of 13% p.a. and redeemable at par Asset B is a ten year zero coupon bond. (a) Calculate the face value of Asset A and Asset B which you will hold in order to immunise your portfolio against interest rate fluctuations. Using convexity, show that STAT2032/6046 - Financial Mathematics 1 these amounts will immunise your portfolio. Assume an interest rate of 8% per annum (b) Calculate the present value of the assets and liabilities if the interest rate was to drop to 7.5% for all time periods immediately after purchasing the bonds. Use the Taylor series expansion for both and also check to see how close this is to the actual values. Solution (a) In order to meet the conditions of Redington immunisation: V.0.08) =V (0.08) V = Present Value A = Assets 1,(0.08)=,(0.08) 1 - Duration L = Liabilities C,(0.08) 2c, (0.08) c = Convexity Let P be the face value of Asset A and Q be the face value of Asset B. Thus: V.0.08)=0.065Pa+ P(1.08)? +9(1.08) where j = 1.083 - 1 = 3.923% =1.093713P+0.4631939 V.(0.08) = 30,000(5) +20,000(15)= $275,037.03 Therefore 1.093713P+0.4631939 = 275,037.03 (1) 0.065P(la)) #2P(1.08) +100(1.08) 7,(0.08) 1.093713P+0.463193Q 2.004501P+4.631935Q 1.093713P+0.4631939 Note that the first part of the numerator above is divided by 2 to ensure the calculation of duration of the coupons is done in years and not half-years. T: (0.08) 30,000(5)(3)v +20,000(15)8.5)ves = 6.118824 years 275,037.03 Therefore 2.004501P+4.631935 6.118824 1.093713P +0.4631939 4.687736P-1.797739Q=0 or Q=2.607573P (2) Solving (1) and (2) simultaneously gives P=119,502 Q = 311,611