Question

I dont see that in my intermediate accounting text I saved from college, you grumble to a colleague in the accounting division of Dowell Chemical

I dont see that in my intermediate accounting text I saved from college, you grumble to a colleague in the accounting division of Dowell Chemical Corporation. This will take some research. Your comments pertain to the appropriate accounting treatment of a proposed sublease of warehouses Dowell has used for product storage. Dowell leased the warehouses one year ago on December 31. The five-year lease agreement called for Dowell to make quarterly lease payments of $2,398,303, payable each December 31, March 31, June 30, and September 30, with the first payment at the leases beginning. As a finance lease, Dowell had recorded the right-of-use asset and liability at $40 million, the present value of the lease payments at 8%. Dowell records amortization on a straight-line basis at the end of each fiscal year. Today, Danielle Andries, Dowells controller, explained a proposal to sublease the underused warehouses to American Tankers, Inc., for the remaining four years of the lease term. American Tankers would be substituted as lessee under the original lease agreement. As the new lessee, it would become the primary obligor under the agreement, and Dowell would not be secondarily liable for fulfilling the obligations under the lease agreement. Check on how we would need to account for this and get back to me, she had said. Required: 1. After the first full year under the warehouse lease, what is the balance in Dowells lease liability? 2. After the first full year under the warehouse lease, what is the carrying amount (after accumulated amortization) of Dowells leased warehouses? 3. Obtain the relevant authoritative literature on accounting for derecognition of finance leases by lessees using the FASBs Codification Research System. You might gain access from the FASB website (www.fasb.org), from your school library, or some other source. To determine the appropriate accounting treatment for the proposed sublease, what is the specific seven-digit Codification citation (XXX-XX-XX) that Dowell would rely on to determine: a. if the proposal will qualify as a termination of a finance lease, and b. the appropriate accounting treatment for the sublease? 4. What, if any, journal entry would Dowell record in connection with the sublease?

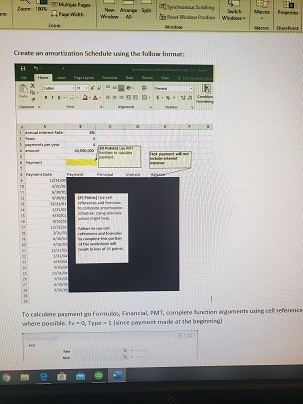

With Create an amortivation Schedule using the follow format payment where possittely formules Financial, PMT, complete function arguments in cell Typ since payment made at the beginning) e With Create an amortivation Schedule using the follow format payment where possittely formules Financial, PMT, complete function arguments in cell Typ since payment made at the beginning) e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started