I don't understand column (c) of this problem because of the Lump-Sum Payment. Everything else I got fine.

Edited: First time user

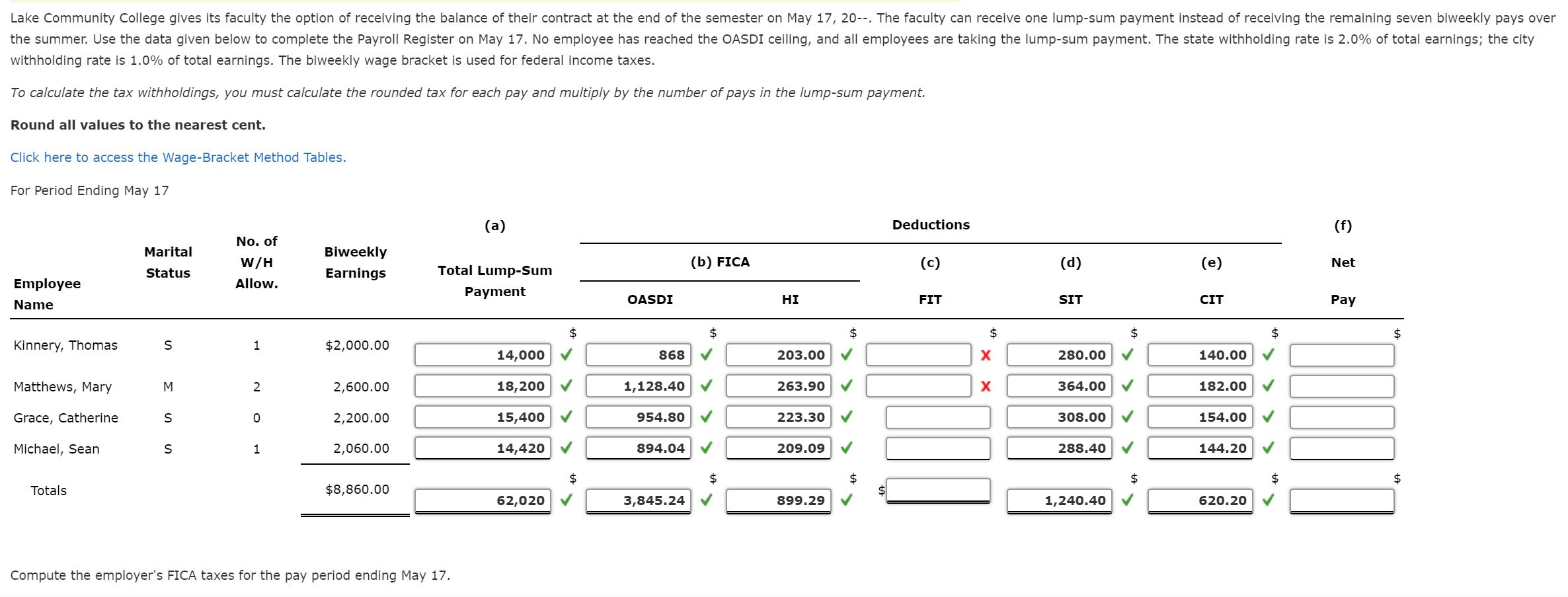

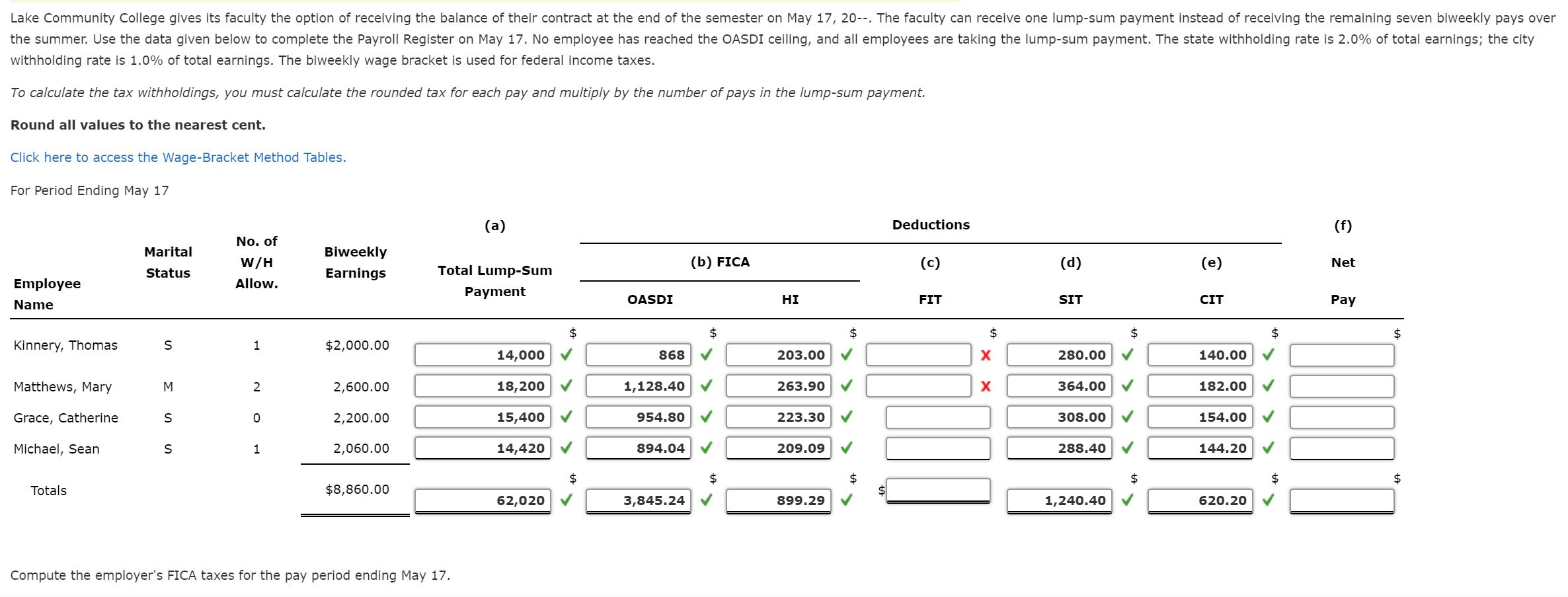

Lake Community College gives its faculty the option of receiving the balance of their contract at the end of the semester on May 17, 20--. The faculty can receive one lump-sum payment instead of receiving the remaining seven biweekly pays over the summer. Use the data given below to complete the Payroll Register on May 17. No employee has reached the OASDI ceiling, and all employees are taking the lump-sum payment. The state withholding rate is 2.0% of total earnings; the city withholding rate is 1.0% of total earnings. The biweekly wage bracket is used for federal income taxes. To calculate the tax withholdings, you must calculate the rounded tax for each pay and multiply by the number of pays in the lump-sum payment. Round all values to the nearest cent. Click here to access the Wage-Bracket Method Tables. For Period Ending May 17 (a) Deductions (f) Marital Status No. of W/H Allow. Biweekly Earnings (b) FICA (C) ( (d) 0 Net ) (e) Employee Name Total Lump-Sum Payment OASDI HI FIT SIT CIT Pay ta $ Kinnery, Thomas $2,000.00 14,000 868 203.00 280.00 140.00 Matthews, Mary 18,200 1,128.40 263.90 364.00 182.00 Grace, Catherine 2,600.00 2,200.00 2,060.00 15,400 954.80 223.30 308.00 154.00 Michael, Sean 14,420 894.04 209.09 288.40 144.20 $ $ $ Totals $8,860.00 62,020 62,020 V 3,845.24 3,845.24 899.29 899.29 $ 1,240.40 V 1,240.40 620.20 620.20 Compute the employer's FICA taxes for the pay period ending May 17. Lake Community College gives its faculty the option of receiving the balance of their contract at the end of the semester on May 17, 20--. The faculty can receive one lump-sum payment instead of receiving the remaining seven biweekly pays over the summer. Use the data given below to complete the Payroll Register on May 17. No employee has reached the OASDI ceiling, and all employees are taking the lump-sum payment. The state withholding rate is 2.0% of total earnings; the city withholding rate is 1.0% of total earnings. The biweekly wage bracket is used for federal income taxes. To calculate the tax withholdings, you must calculate the rounded tax for each pay and multiply by the number of pays in the lump-sum payment. Round all values to the nearest cent. Click here to access the Wage-Bracket Method Tables. For Period Ending May 17 (a) Deductions (f) Marital Status No. of W/H Allow. Biweekly Earnings (b) FICA (C) ( (d) 0 Net ) (e) Employee Name Total Lump-Sum Payment OASDI HI FIT SIT CIT Pay ta $ Kinnery, Thomas $2,000.00 14,000 868 203.00 280.00 140.00 Matthews, Mary 18,200 1,128.40 263.90 364.00 182.00 Grace, Catherine 2,600.00 2,200.00 2,060.00 15,400 954.80 223.30 308.00 154.00 Michael, Sean 14,420 894.04 209.09 288.40 144.20 $ $ $ Totals $8,860.00 62,020 62,020 V 3,845.24 3,845.24 899.29 899.29 $ 1,240.40 V 1,240.40 620.20 620.20 Compute the employer's FICA taxes for the pay period ending May 17