Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I don't understand how $45,000 is the answer can please explain regardless of the above explanation because I don't understand it. Step by step simple

I don't understand how $45,000 is the answer can please explain regardless of the above explanation because I don't understand it. Step by step simple explanation please.

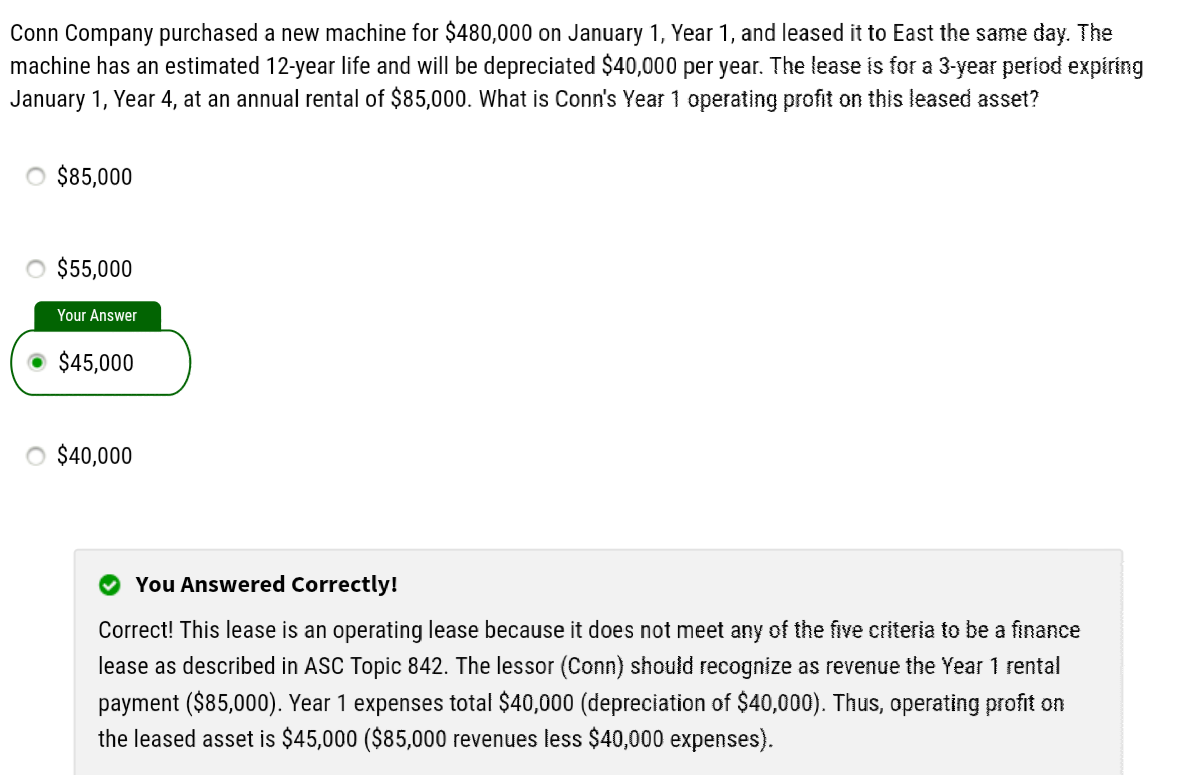

Conn Company purchased a new machine for $480,000 on January 1, Year 1, and leased it to East the same day. The machine has an estimated 12-year life and will be depreciated $40,000 per year. The lease is for a 3-year period expiring January 1, Year 4, at an annual rental of $85,000. What is Conn's Year 1 operating profit on this leased asset? $85,000 $55,000 Your Answer $45,000 O $40,000 You Answered Correctly! Correct! This lease is an operating lease because it does not meet any of the five criteria to be a finance lease as described in ASC Topic 842. The lessor (Conn) should recognize as revenue the Year 1 rental payment ($85,000). Year 1 expenses total $40,000 (depreciation of $40,000). Thus, operating profit on the leased asset is $45,000 ($85,000 revenues less $40,000 expenses)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started