Answered step by step

Verified Expert Solution

Question

1 Approved Answer

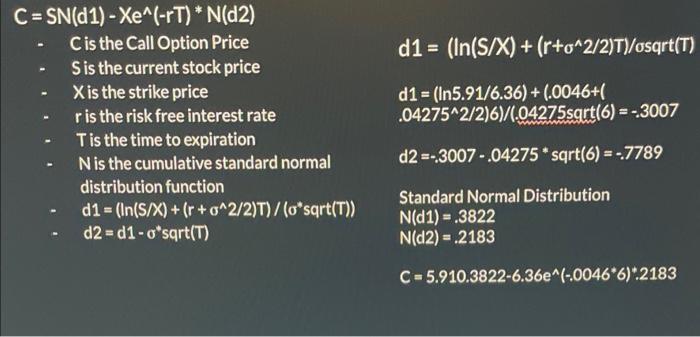

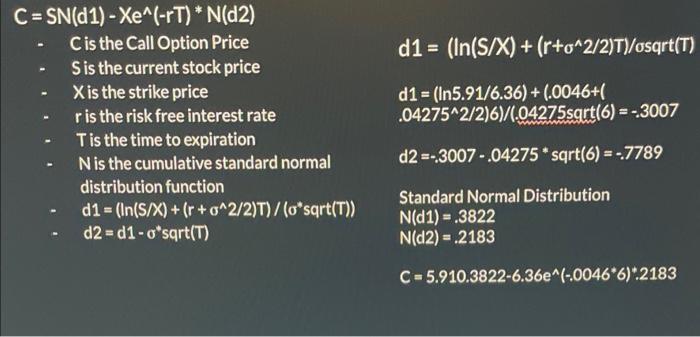

I don't understand the 5.910.3822 it doesn't seem right... please help me answer =.0839 S = 5.91 X = 6.36 r = .46% T =

I don't understand the 5.910.3822 it doesn't seem right... please help me answer =.0839

S = 5.91

C=SN(d1)Xe(rT)N(d2) - Cis the Call Option Price d1=(ln(S/X)+(r+2/2)T)/sqrt(T) - Sis the current stock price - Xis the strike price d1=(ln5.91/6.36)+(.0046+1 - r is the risk free interest rate .042752/2)6)/(.04275 sgrtt (6)=.3007 - Tis the time to expiration - N is the cumulative standard normal distributionfunctiond1=(ln(S/X)+(r+2/2)T)/(sqrt(T))d2=d1sqr(T)StandardNormalDistributionN(d1)=.3822N(d2)=.2183C=5.910.38226.36e(.00466):.2183 X = 6.36

r = .46%

T = 6

Sigma = 4.275

N = Cumulative Standard Normal Distribution Function

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started