Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I don't understand the calculation to get the bad debt expense in the calculation. What are the steps and why are they adding/substracting certain numbers

I don't understand the calculation to get the bad debt expense in the calculation. What are the steps and why are they adding/substracting certain numbers to get the difference between the account receivable and the AFDA ? Steps needed. Thanks

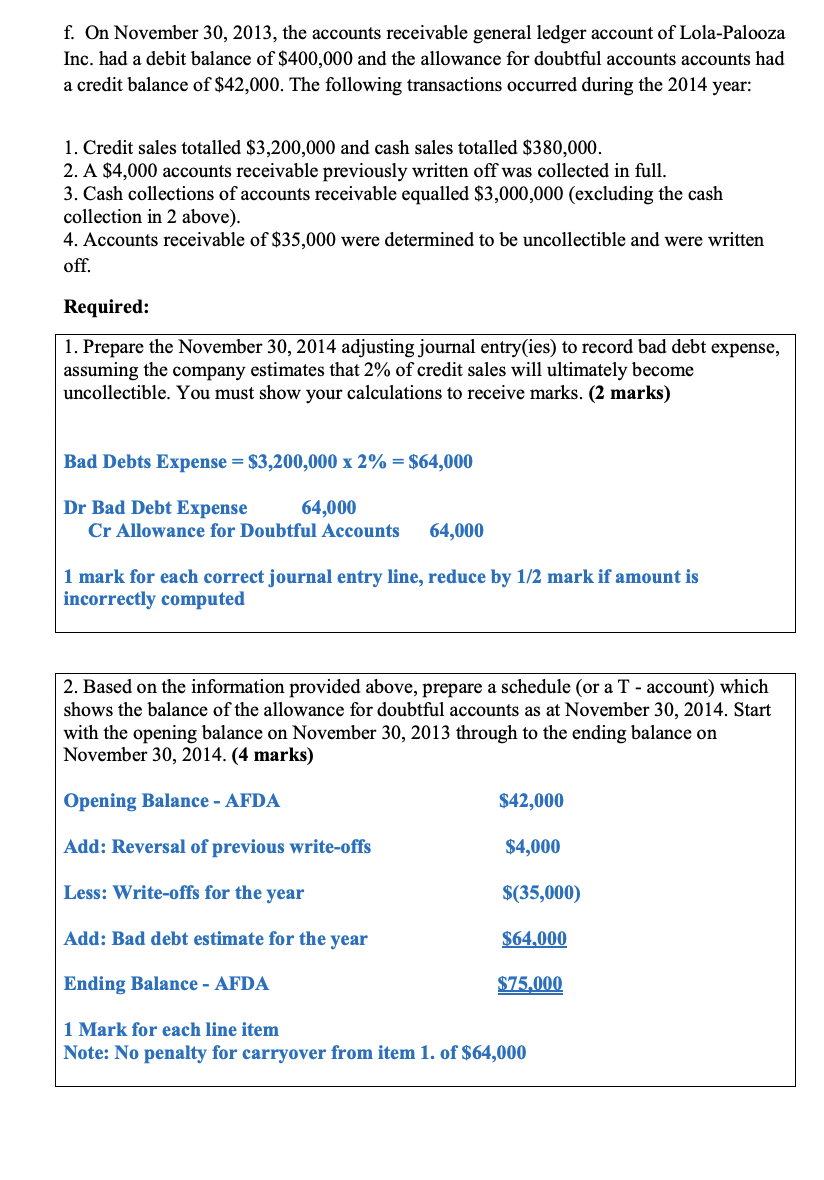

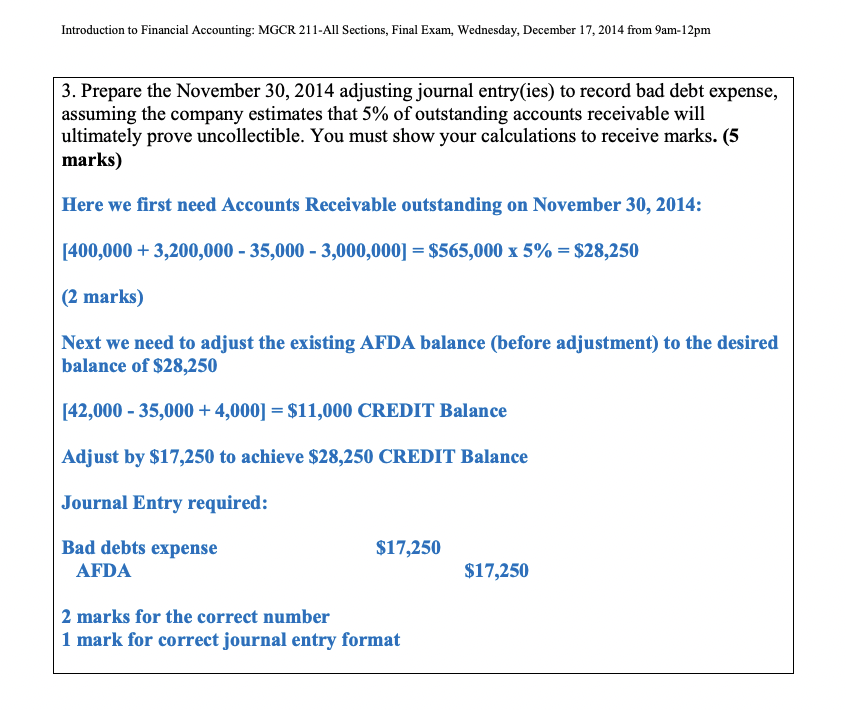

f. On November 30, 2013, the accounts receivable general ledger account of Lola-Palooza Inc. had a debit balance of $400,000 and the allowance for doubtful accounts accounts had a credit balance of $42,000. The following transactions occurred during the 2014 year: 1. Credit sales totalled $3,200,000 and cash sales totalled $380,000. 2. A $4,000 accounts receivable previously written off was collected in full. 3. Cash collections of accounts receivable equalled $3,000,000 (excluding the cash collection in 2 above). 4. Accounts receivable of $35,000 were determined to be uncollectible and were written off. Required: 1. Prepare the November 30, 2014 adjusting journal entry(ies) to record bad debt expense, assuming the company estimates that 2% of credit sales will ultimately become uncollectible. You must show your calculations to receive marks. (2 marks) Bad Debts Expense =$3,200,0002%=$64,000 Dr Bad Debt Expense 64,000 Cr Allowance for Doubtful Accounts 64,000 1 mark for each correct journal entry line, reduce by 1/2 mark if amount is incorrectly computed 2. Based on the information provided above, prepare a schedule (or a T - account) which shows the balance of the allowance for doubtful accounts as at November 30, 2014. Start with the opening balance on November 30,2013 through to the ending balance on November 30,2014 . (4 marks) Introduction to Financial Accounting: MGCR 211-All Sections, Final Exam, Wednesday, December 17, 2014 from 9am-12pm 3. Prepare the November 30, 2014 adjusting journal entry(ies) to record bad debt expense, assuming the company estimates that 5% of outstanding accounts receivable will ultimately prove uncollectible. You must show your calculations to receive marks. (5 marks) Here we first need Accounts Receivable outstanding on November 30, 2014: [400,000+3,200,00035,0003,000,000]=$565,0005%=$28,250 (2 marks) Next we need to adjust the existing AFDA balance (before adjustment) to the desired balance of $28,250 [42,00035,000+4,000]=$11,000 CREDIT Balance Adjust by $17,250 to achieve $28,250 CREDIT Balance Journal Entry required: Bad debts expense $17,250 AFDA $17,250 2 marks for the correct number 1 mark for correct journal entry format

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started