Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I don't understand this. Please thoroughly explain. Im trying to complete with paper and pencil. Please fully explain how I show calculate not understanding how.P

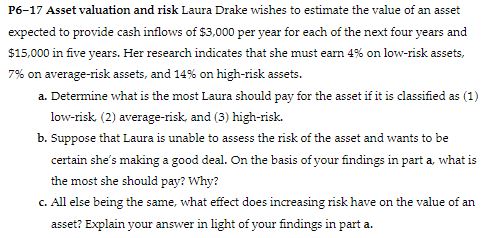

I don't understand this. Please thoroughly explain. Im trying to complete with paper and pencil. Please fully explain how I show calculate not understanding how.P Asset valuation and risk Laura Drake wishes to estimate the value of an asset

expected to provide cash inflows of $ per year for each of the next four years and

$ in five years. Her research indicates that she must earn on lowrisk assets,

on averagerisk assets, and on highrisk assets.

a Determine what is the most Laura should pay for the asset if it is classified as

lowrisk averagerisk, and highrisk.

b Suppose that Laura is unable to assess the risk of the asset and wants to be

certain she's making a good deal. On the basis of your findings in part a what is

the most she should pay? Why?

c All else being the same, what effect does increasing risk have on the value of an

asset? Explain your answer in light of your findings in part a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started