Question: I don't understand what I'm doing wrong. Please help. AutoSave OFF E data-11_22_2021-8_30 P Home Insert Draw Page Layout Formulas Data Review View Tell me

I don't understand what I'm doing wrong. Please help.

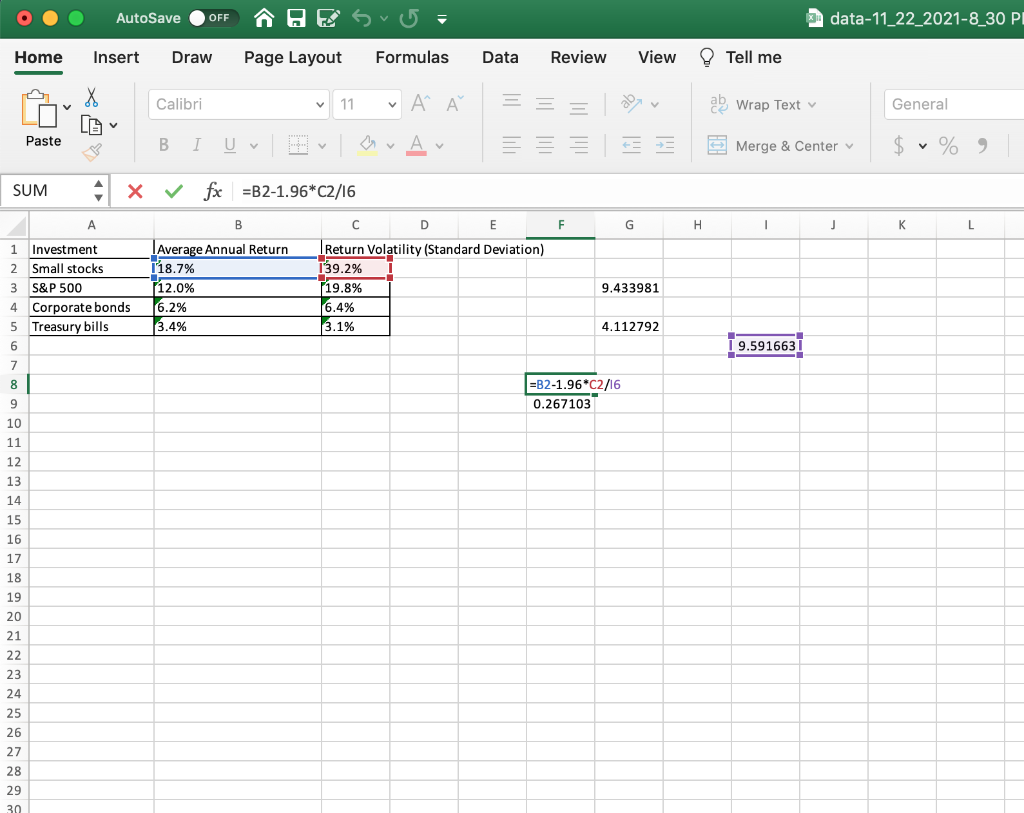

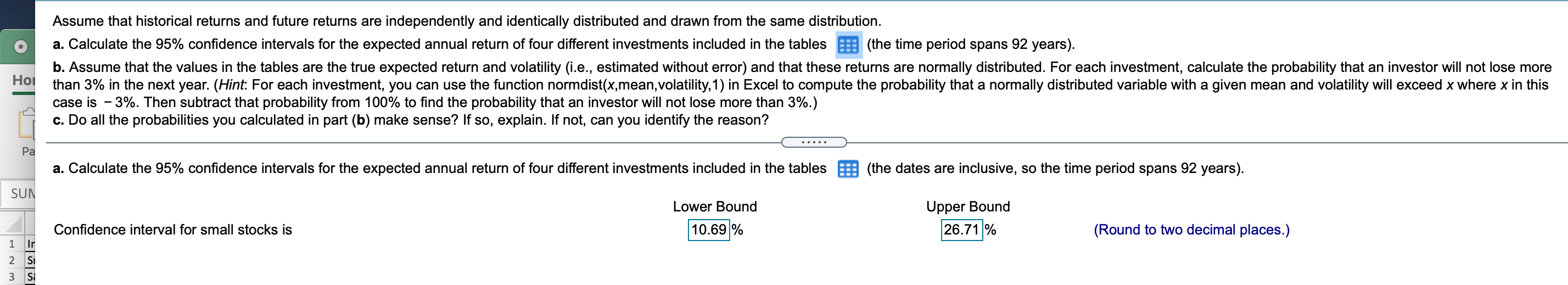

AutoSave OFF E data-11_22_2021-8_30 P Home Insert Draw Page Layout Formulas Data Review View Tell me Calibri 11 ' 2017 ab Wrap Text General LA Paste B I Uv = = Merge & Center $ v % SUM 4 x fx =B2-1.96*C2/16 F G H 1 K L 1 2 B Average Annual Return 118.7% 12.0% 6.2% 3.4% Investment Small stocks S&P 500 Corporate bonds Treasury bills C D Return Volatility (Standard Deviation) 39.2% 19.8% 6.4% 3.1% 3 9.433981 4 5 4.112792 6 T 9.5916631 7 8 9 =B2-1.96*02/16 0.267103 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Assume that historical returns and future returns are independently and identically distributed and drawn from the same distribution. a. Calculate the 95% confidence intervals for the expected annual return of four different investments included in the tables (the time period spans 92 years). b. Assume that the values in the tables are the true expected return and volatility (i.e., estimated without error) and that these returns are normally distributed. For each investment, calculate the probability that an investor will not lose more than 3% in the next year. (Hint: For each investment, you can use the function normdist(x,mean, volatility,1) in Excel to compute the probability that a normally distributed variable with a given mean and volatility will exceed x where x in this case is 3%. Then subtract that probability from 100% to find the probability that an investor will not lose more than 3%.) c. Do all the probabilities you calculated in part (b) make sense? If so, explain. If not, can you identify the reason? Hoi Pa a. Calculate the 95% confidence intervals for the expected annual return of four different investments included in the tables (the dates are inclusive, so the time period spans 92 years). SUN Lower Bound Upper Bound 26.71% Confidence interval for small stocks is 10.69% (Round to two decimal places.) 1 Ir 2 3 SI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts