Answered step by step

Verified Expert Solution

Question

1 Approved Answer

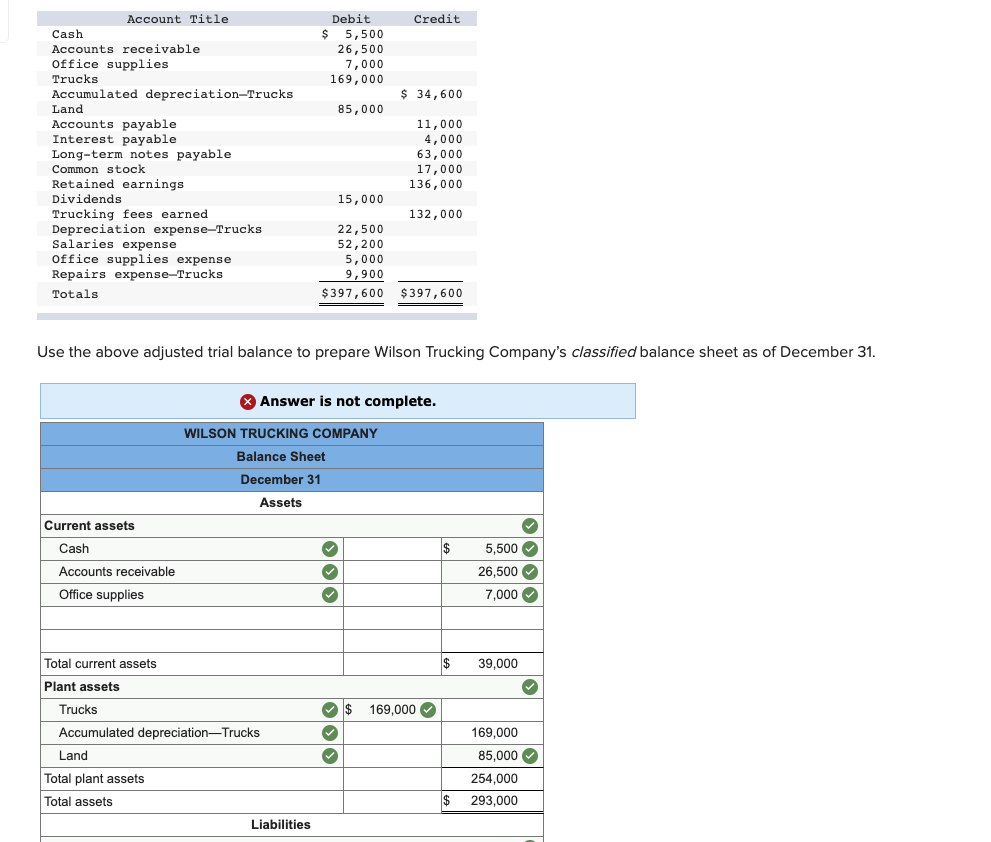

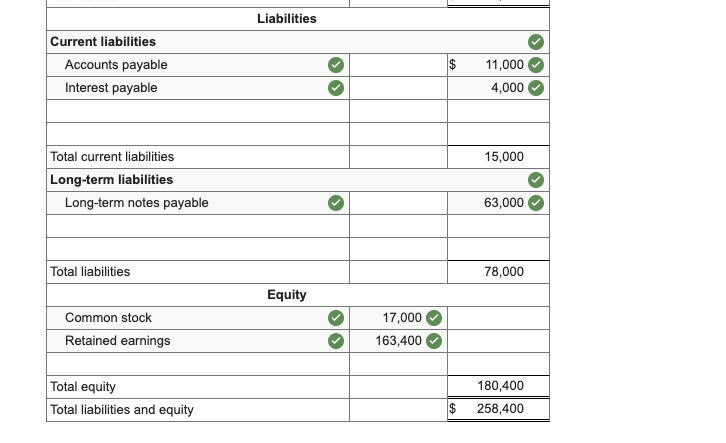

I don't understand why it is saying it is incomplete, If someone can tell me why and explain. Thanks Credit Debit $ 5,500 26,500 7,000

I don't understand why it is saying it is incomplete, If someone can tell me why and explain.

Thanks

Credit Debit $ 5,500 26,500 7,000 169,000 $ 34,600 85,000 Account Title Cash Accounts receivable Office supplies Trucks Accumulated depreciation-Trucks Land Accounts payable Interest payable Long-term notes payable Common stock Retained earnings Dividends Trucking fees earned Depreciation expense-Trucks Salaries expense Office supplies expense Repairs expense-Trucks Totals 11,000 4,000 63,000 17,000 136,000 15,000 132,000 22,500 52,200 5,000 9,900 $397,600 $397,600 Use the above adjusted trial balance to prepare Wilson Trucking Company's classified balance sheet as of December 31. X Answer is not complete. WILSON TRUCKING COMPANY Balance Sheet December 31 Assets $ 5,500 Current assets Cash Accounts receivable Office supplies 26,500 7,000 Total current assets $ 39,000 $ 169,000 00 Plant assets Trucks Accumulated depreciationTrucks Land Total plant assets Total assets Liabilities 169,000 85,000 254,000 293,000 $ Liabilities Current liabilities Accounts payable Interest payable 11,000 4,000 15,000 Total current liabilities Long-term liabilities Long-term notes payable 63,000 Total liabilities 78,000 Equity Common stock Retained earnings 17,000 163,400 Total equity Total liabilities and equity 180,400 258,400 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started