Answered step by step

Verified Expert Solution

Question

1 Approved Answer

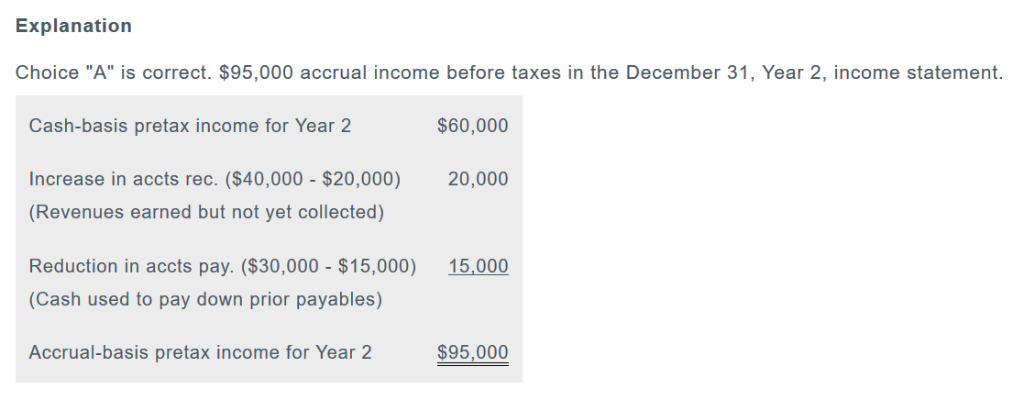

I don't understand why the 15,000 is added instead of subtracted to get the correct answer of 95,000 Class Corp. maintains its accounting records on

I don't understand why the 15,000 is added instead of subtracted to get the correct answer of 95,000

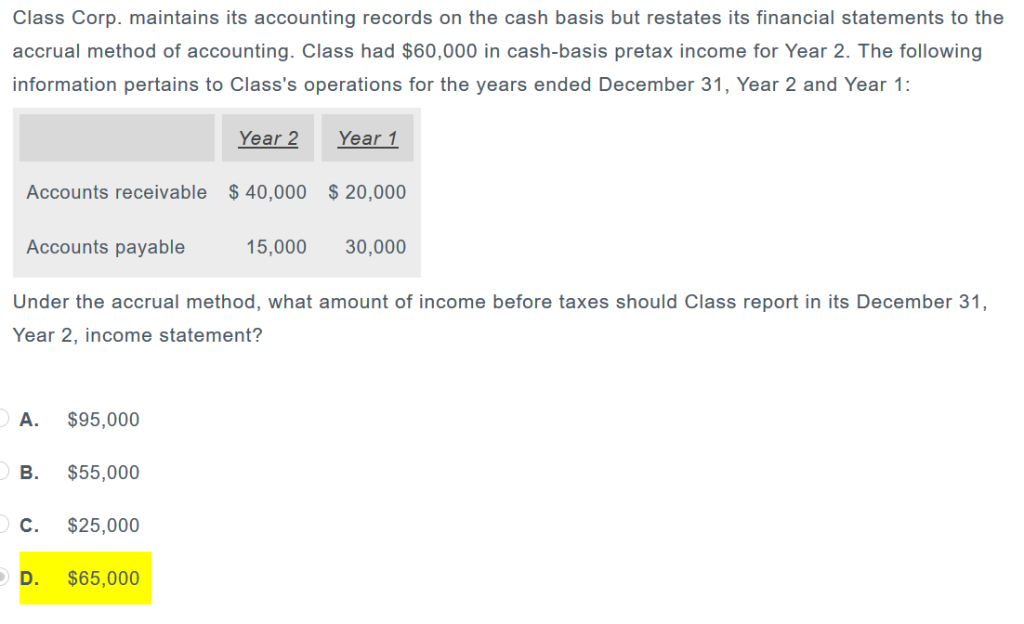

Class Corp. maintains its accounting records on the cash basis but restates its financial statements to the accrual method of accounting. Class had $60,000 in cash-basis pretax income for Year 2. The following information pertains to Class's operations for the years ended December 31, Year 2 and Year 1: Year 2 Year 1 $ 40,000 $ 20,000 Accounts receivable Accounts payable 5,000 30,000 Under the accrual method, what amount of income before taxes should Class report in its December 31, Year 2, income statement? A. $95,000 B. $55,000 C. $25,000 D. $65,000 Explanation Choice "A" is correct. $95,000 accrual income before taxes in the December 31, Year 2, income statement. Cash-basis pretax income for Year 2 Increase in accts rec. ($40,000 - $20,000 20,000 Revenues earned but not yet collected) Reduction in accts pay. ($30,000 $15,000) 15,000 (Cash used to pay down prior payables) Accrual-basis pretax income for Year 2 $60,000 $95,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started