i dont undested how to calculate the Purchase of building , the Repayments of bank loan and the Dividends paid

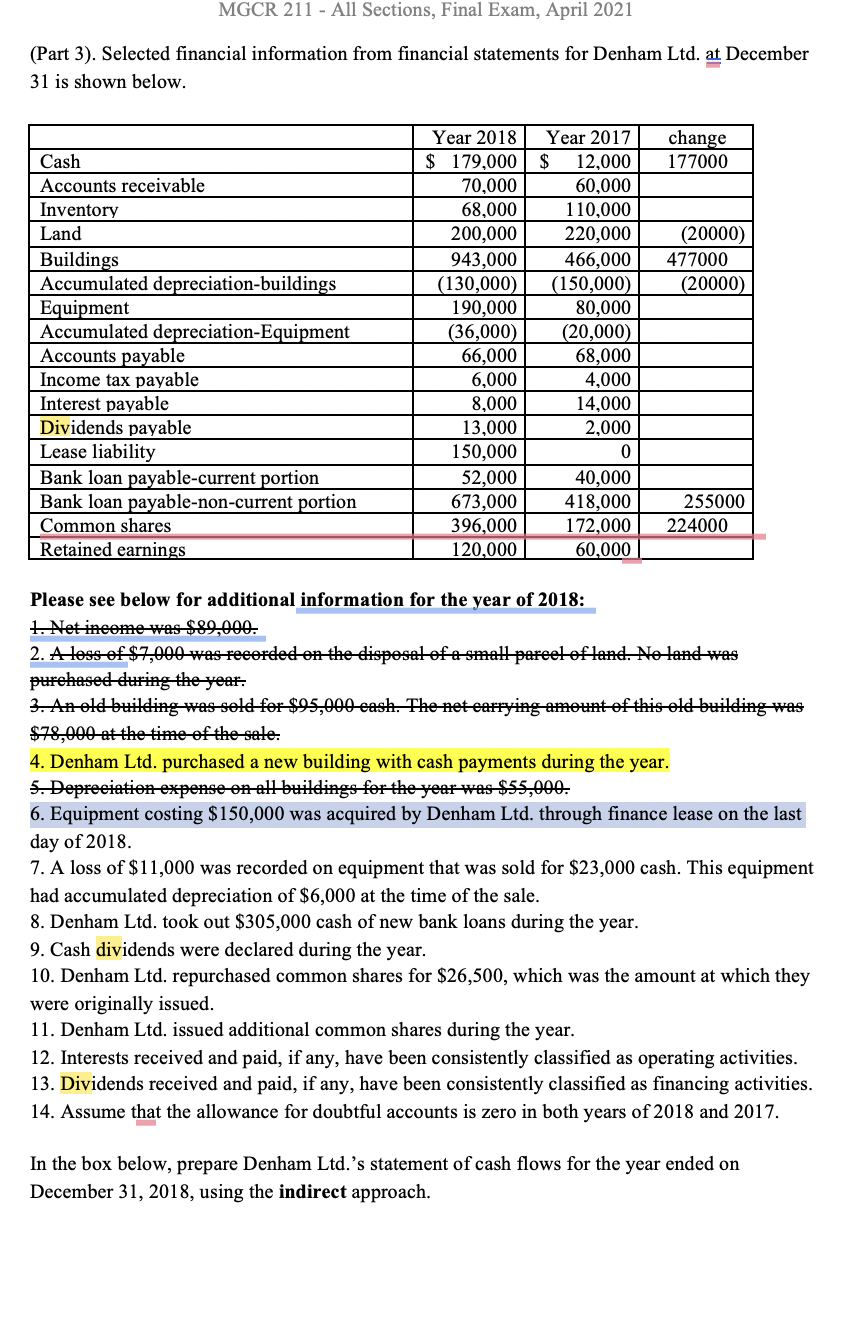

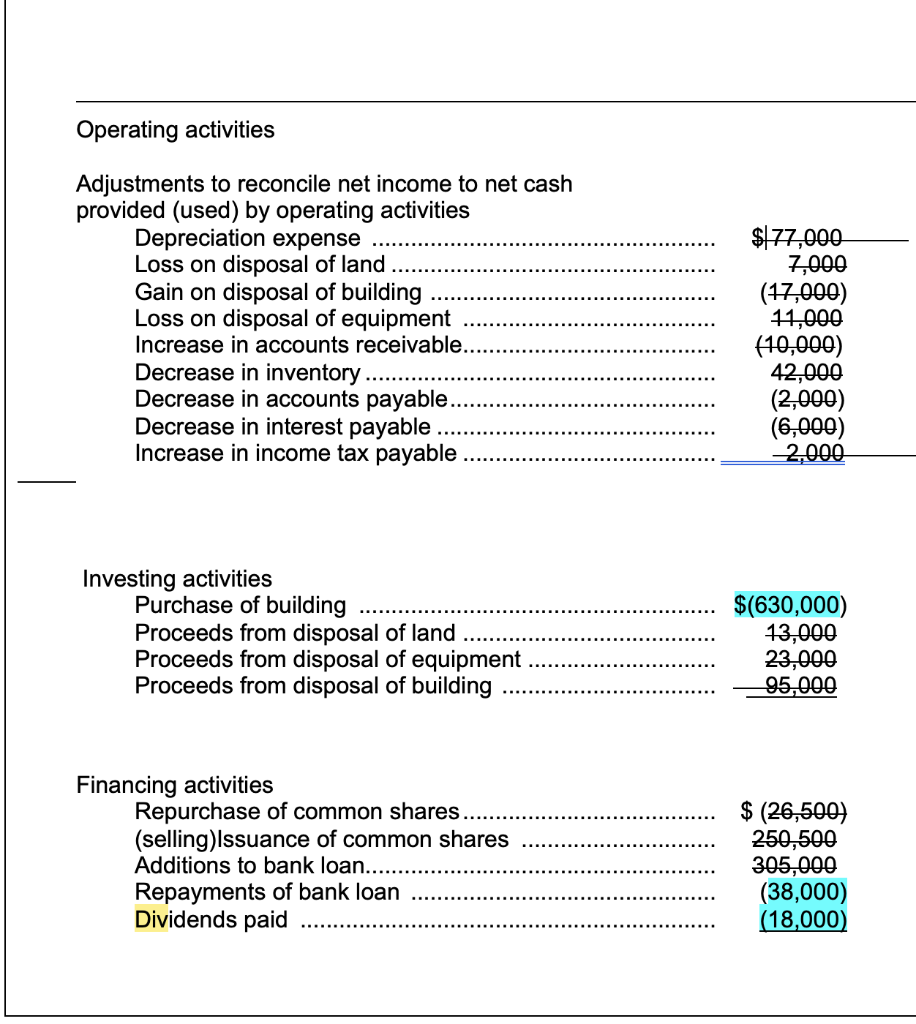

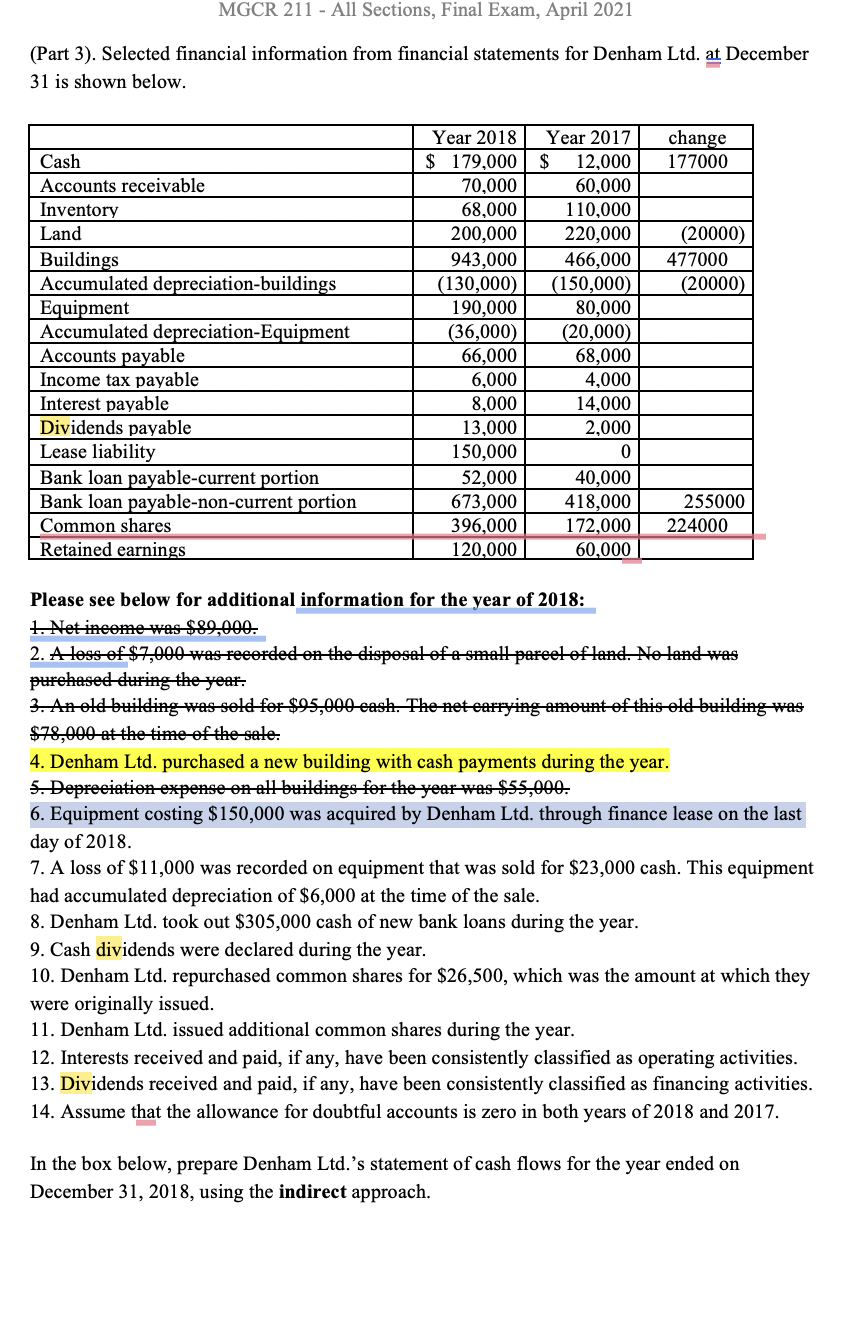

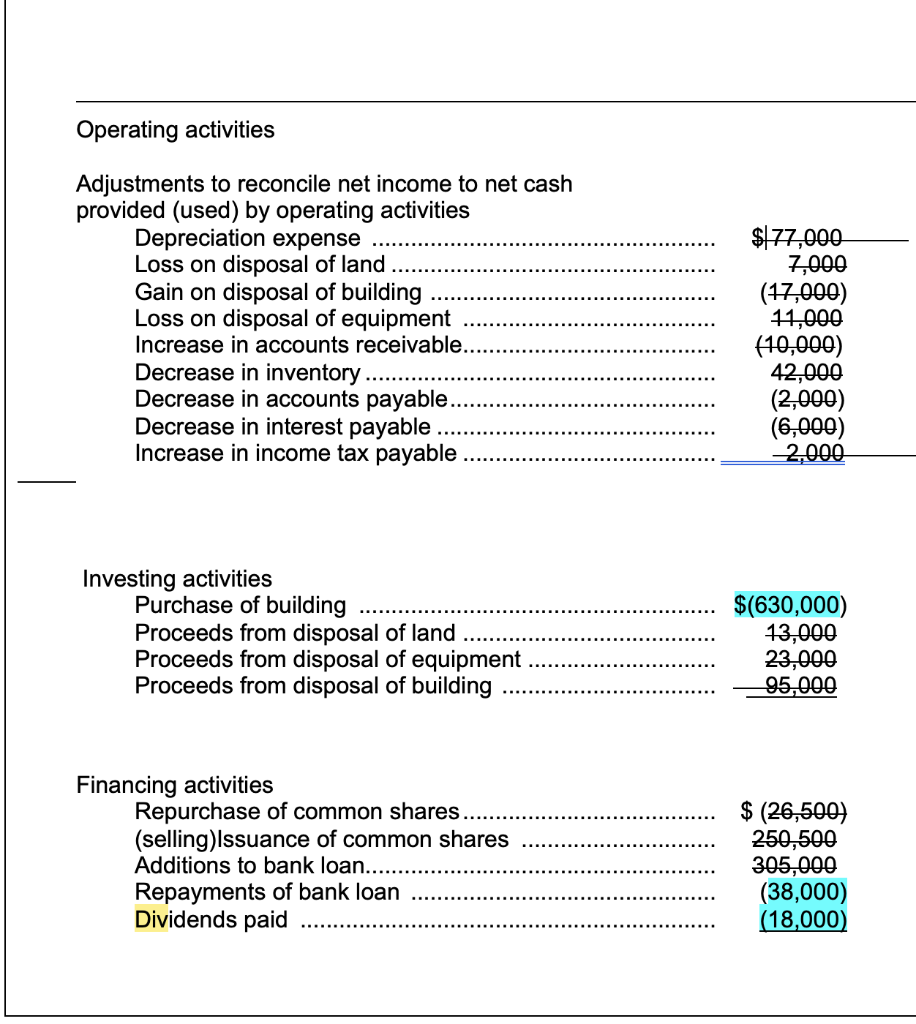

MGCR 211 - All Sections, Final Exam, April 2021 (Part 3). Selected financial information from financial statements for Denham Ltd. at December 31 is shown below. change 177000 (20000) 477000 (20000) Cash Accounts receivable Inventory Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-Equipment Accounts payable Income tax payable Interest payable Dividends payable Lease liability Bank loan payable-current portion Bank loan payable-non-current portion Common shares Retained earnings Year 2018 Year 2017 $ 179,000 $ 12,000 70,000 60,000 68,000 110,000 200,000 220,000 943,000 466,000 (130,000) (150,000) 190,000 80,000 (36,000) (20,000) 66,000 68,000 6,000 4,000 8,000 14,000 13,000 2,000 150,000 0 52,000 40,000 673,000 418,000 396,000 172,000 120,000 60,000 255000 224000 Please see below for additional information for the year of 2018: 1. Net income was $89,000. 2. A loss of $7,900 wes recorded on the disposal of a small parcel of land. No land was purchased during the year. 3. An old building was sold for $95,000 cash. The net carrying amount of this old building was $78,400 at the time of the sale. 4. Denham Ltd. purchased a new building with cash payments during the year. 5. Depreciation expense on all buildings for the year was $55,000. 6. Equipment costing $150,000 was acquired by Denham Ltd. through finance lease on the last day of 2018. 7. A loss of $11,000 was recorded on equipment that was sold for $23,000 cash. This equipment had accumulated depreciation of $6,000 at the time of the sale. 8. Denham Ltd. took out $305,000 cash of new bank loans during the year. 9. Cash dividends were declared during the year. 10. Denham Ltd. repurchased common shares for $26,500, which was the amount at which they were originally issued. 11. Denham Ltd. issued additional common shares during the year. 12. Interests received and paid, if any, have been consistently classified as operating activities. 13. Dividends received and paid, if any, have been consistently classified as financing activities. 14. Assume that the allowance for doubtful accounts is zero in both years of 2018 and 2017. cash flows for the year ended on In the box below, prepare Denham Ltd.'s statement December 31, 2018, using the indirect approach. Operating activities Adjustments to reconcile net income to net cash provided (used) by operating activities Depreciation expense Loss on disposal of land Gain on disposal of building Loss on disposal of equipment Increase in accounts receivable.. Decrease in inventory Decrease in accounts payable Decrease in interest payable Increase in income tax payable $177,000 7,000 (17,000) 11,000 (10,000) 42,000 (2,000) (6,000) -2,000 Investing activities Purchase of building Proceeds from disposal of land Proceeds from disposal of equipment Proceeds from disposal of building $(630,000) 13,000 23,000 95,000 Financing activities Repurchase of common shares (selling)Issuance of common shares Additions to bank loan...... Repayments of bank loan Dividends paid $ (26,500) 250,500 305,000 (38,000) (18,000)