Answered step by step

Verified Expert Solution

Question

1 Approved Answer

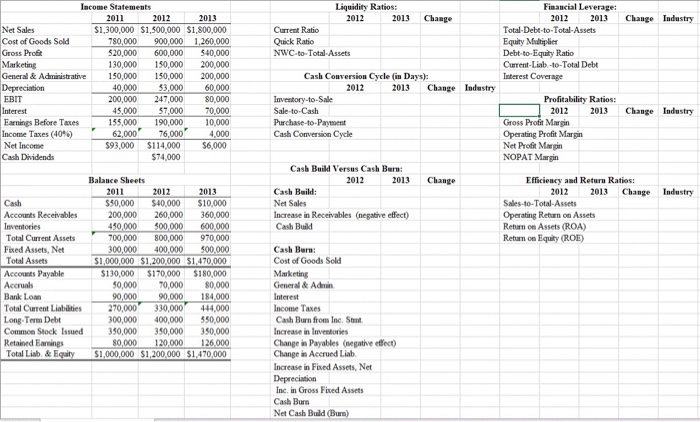

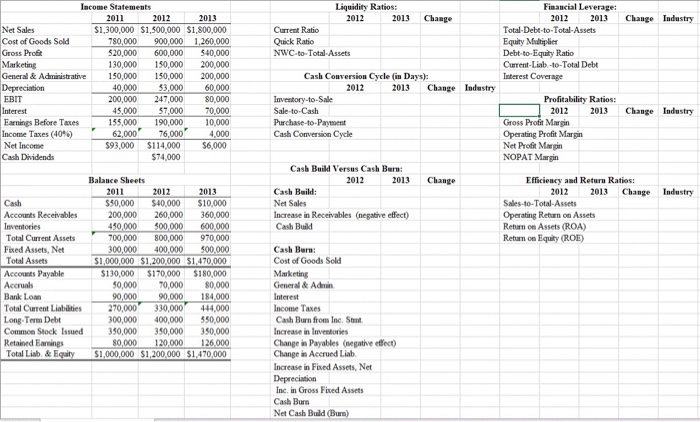

I figured mostly, but confused with cash burn and not sure my cash build and efficiency and return ratios are correctly or no. Income Statements

I figured mostly, but confused with cash burn and not sure my cash build and efficiency and return ratios are correctly or no.

Income Statements Liquidity Ratios: Fimancial Leverage: 2012 2013 Change 2012 2013 Chauge Industry $1,300,000 $1,500,000 $1,800,000 Total-Debt-to-Total-Assets NWC-to-Total Assets Debt-to-Equity Ratio Current-Liab-to-Total Debt Cash Conversion Cycle (in Days) 2012 2013 Change Industry Profitability Ratios: 2012 2013 Change Industry Profit Margin NOPAT Margin Cash Build Versus Cash Burn: Balance Sheets 2012 013 Change Efficiency and Return Ratios 2012 2013 Change Industry Increase in Receivables (negative effect) Operating Return on Assets Return on Assets (ROA) Return on Equity (ROE) Cost of Goods Sold $1,000,000 $1,200,000 $1,470,000 130,000 $170,000 $180,000 Cash Burn from Inc, Sn Change in Payables (negative effect) Change in Acerued Liab Increase in Fixed Assets, Net $1,000,000 $1,200,000 $1,470,000 Inc. in Gross Fixed Assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started