I fill out the attached Excel, please answer these 2 questions according to the EXCEl:

1. How much cost will be the Per Unit Cost allocation for product #1 at the end of ABC method of allocation cost per unit?

2. Finish the Excel first. How much cost will be the Per Unit Cost allocation for product #2 at the end of your ABC method of allocation cost per unit?

1. How much cost will be the Per Unit Cost allocation for product #1 at the end of ABC method of allocation cost per unit?

2. How much cost will be the Per Unit Cost allocation for product #2 at the end of your ABC method of allocation cost per unit?

I filled out the Excel, please answer these 2 questions regarding the Excel: Thank you

1. How much cost will be the Per Unit Cost allocation for product #1 at the end of ABC method of allocation cost per unit?

2. How much cost will be the Per Unit Cost allocation for product #2 at the end of your ABC method of allocation cost per unit?

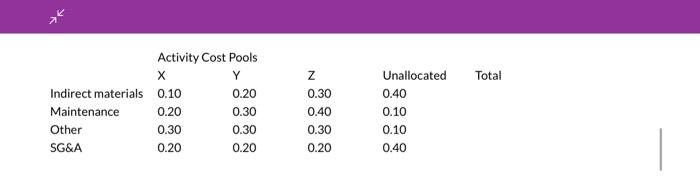

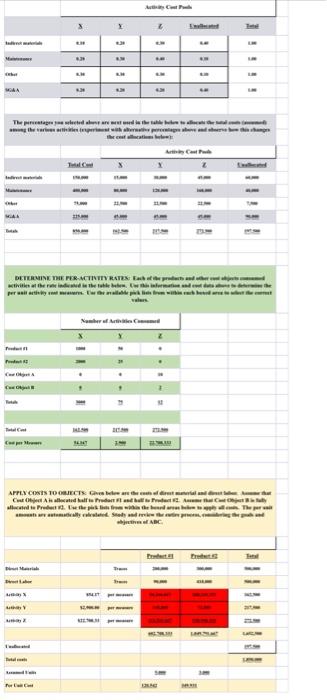

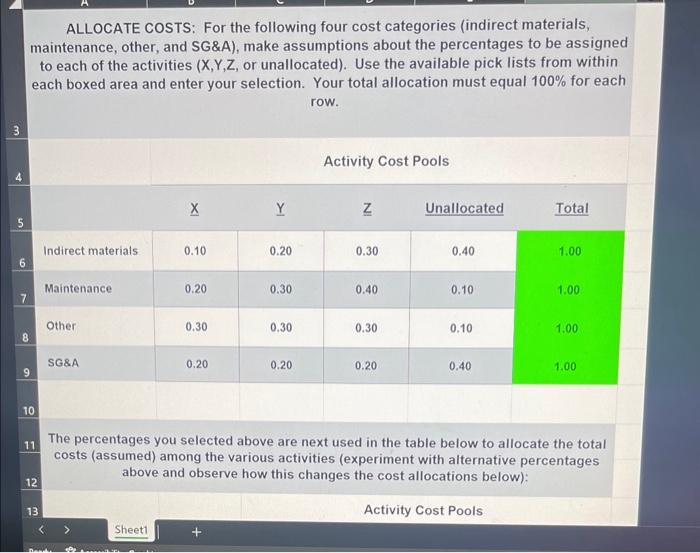

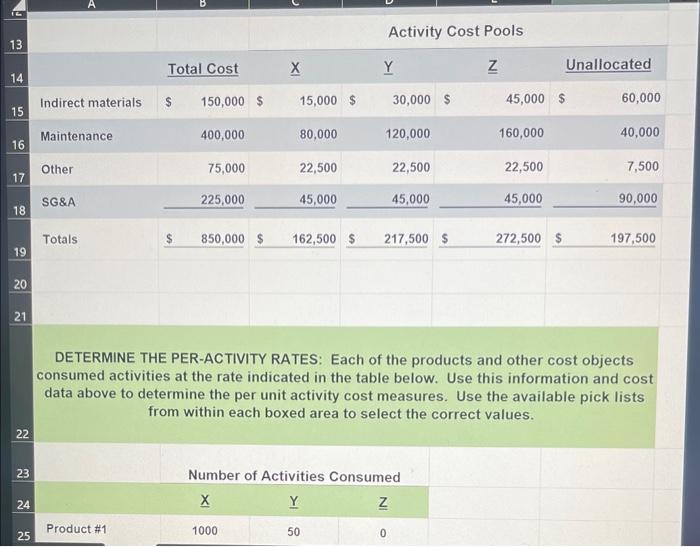

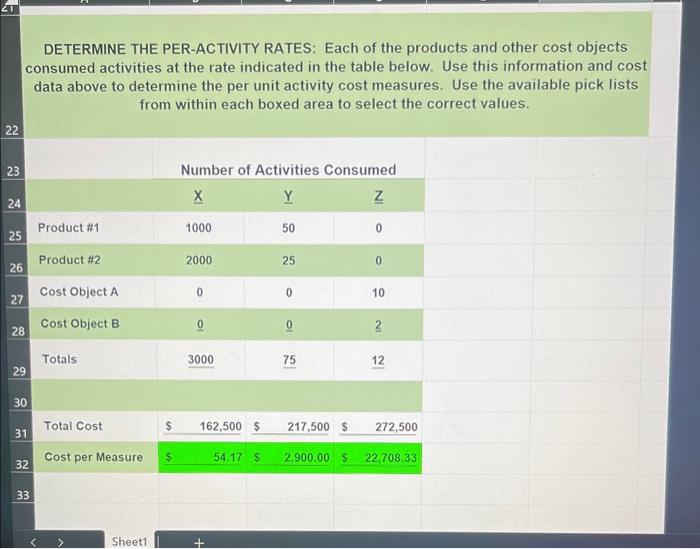

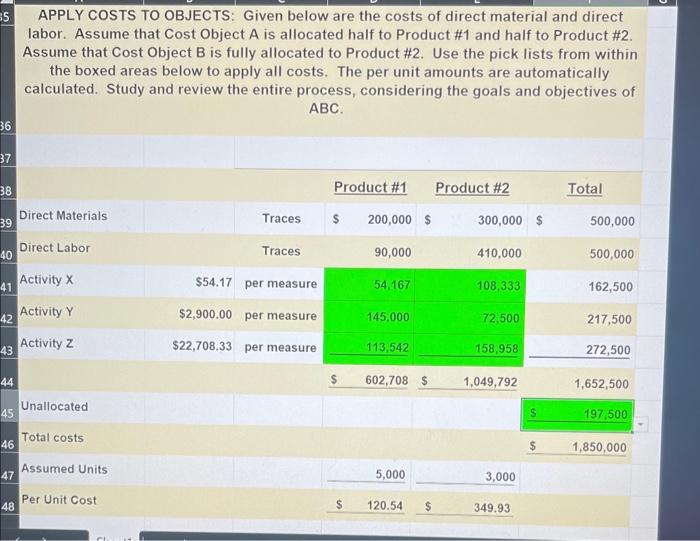

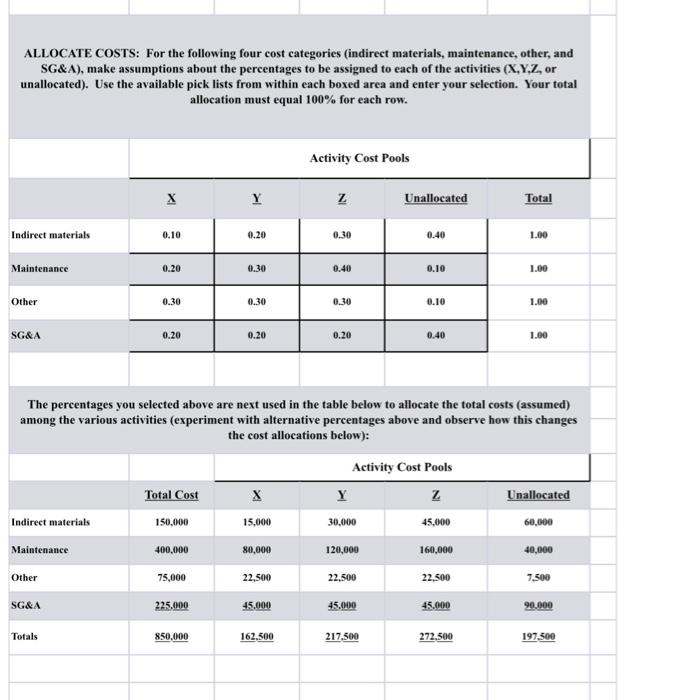

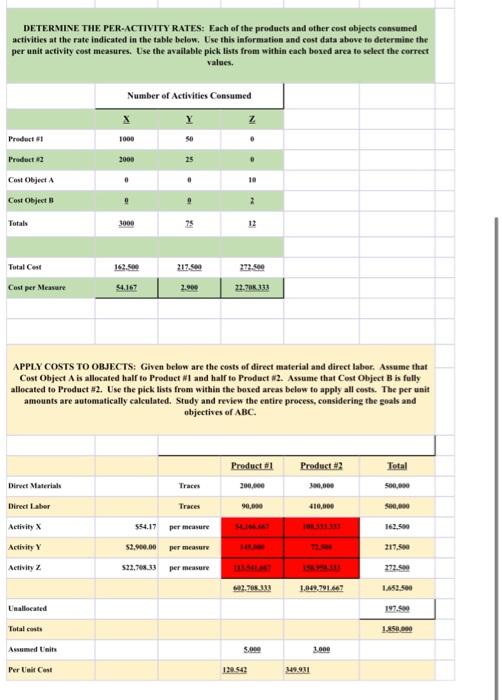

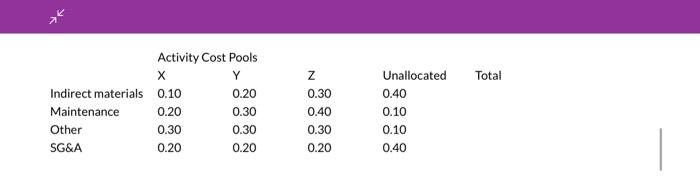

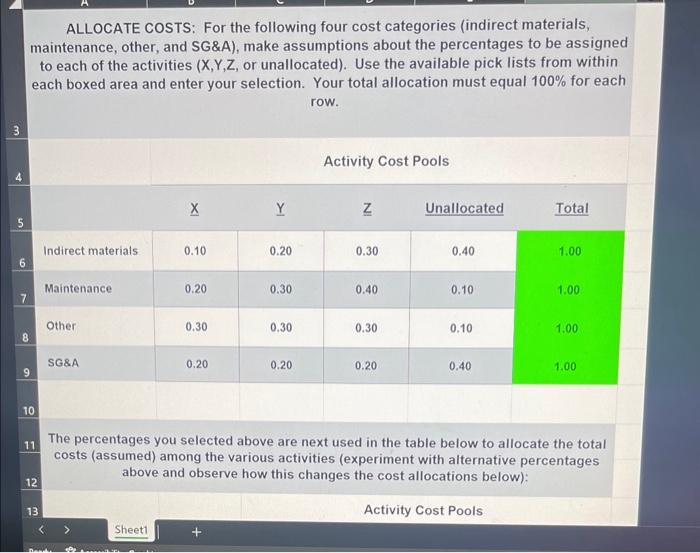

xk \begin{tabular}{llllll} & \multicolumn{2}{l}{ Activity Cost Pools } & & \\ & X & Y & Z & Unallocated & Total \\ Indirect materials & 0.10 & 0.20 & 0.30 & 0.40 \\ Maintenance & 0.20 & 0.30 & 0.40 & 0.10 \\ Other & 0.30 & 0.30 & 0.30 & 0.10 \\ SG\&A & 0.20 & 0.20 & 0.20 & 0.40 \end{tabular} whjetwe ol ABC ALLOCATE COSTS: For the following four cost categories (indirect materials, maintenance, other, and SG\&A), make assumptions about the percentages to be assigned to each of the activities (X,Y,Z, or unallocated). Use the available pick lists from within each boxed area and enter your selection. Your total allocation must equal 100% for each row. Activity Cost Pools The percentages you selected above are next used in the table below to allocate the total costs (assumed) among the various activities (experiment with alternative percentages above and observe how this changes the cost allocations below): DETERMINE THE PER-ACTIVITY RATES: Each of the products and other cost objects consumed activities at the rate indicated in the table below. Use this information and cost data above to determine the per unit activity cost measures. Use the available pick lists from within each boxed area to select the correct values. DETERMINE THE PER-ACTIVITY RATES: Each of the products and other cost objects consumed activities at the rate indicated in the table below. Use this information and cost data above to determine the per unit activity cost measures. Use the available pick lists from within each boxed area to select the correct values. APPLY COSTS TO OBJECTS: Given below are the costs of direct material and direct labor. Assume that Cost Object A is allocated half to Product \#1 and half to Product \#2. Assume that Cost Object B is fully allocated to Product \#2. Use the pick lists from within the boxed areas below to apply all costs. The per unit amounts are automatically calculated. Study and review the entire process, considering the goals and objectives of ABC. ALLOCATE COSTS: For the following four cost categories (indirect materials, maintenance, other, and SG\&A), make assumptions about the percentages to be assigned to each of the activities (X,Y,Z, or unallocated). Use the available pick lists from within each boxed area and enter your selection. Your total allocation must equal 100% for each row. The percentages you selected above are next used in the table below to allocate the total costs (assumed) among the various activities (experiment with alternative percentages above and observe how this changes the cost allocations below): DE.TERMINE THE. PE.R-ACTIVTTY R.ATES: Each of the products and other cost objects consumed activities at the rate indicated in the table below. Ese this iaformation and cest data above to determine the per unit activity cost measures. Use the available pick lists from within cach boxed area te select the correct values. APPLY COSTS TO OBJECTS; Given belen are the costs of difret material and direct laber. Assume that Cost Object A is allocated half to Product 1 and half to Product W2. Assume that Cost Object B is fully allocated to Product \#2. Use the piek lists from within the boxed areas below to apply all cests. The per unit amounts are autontatically calculated. Study and revicw the entire process, considering the aoals and objectives of ABC. xk \begin{tabular}{llllll} & \multicolumn{2}{l}{ Activity Cost Pools } & & \\ & X & Y & Z & Unallocated & Total \\ Indirect materials & 0.10 & 0.20 & 0.30 & 0.40 \\ Maintenance & 0.20 & 0.30 & 0.40 & 0.10 \\ Other & 0.30 & 0.30 & 0.30 & 0.10 \\ SG\&A & 0.20 & 0.20 & 0.20 & 0.40 \end{tabular} whjetwe ol ABC ALLOCATE COSTS: For the following four cost categories (indirect materials, maintenance, other, and SG\&A), make assumptions about the percentages to be assigned to each of the activities (X,Y,Z, or unallocated). Use the available pick lists from within each boxed area and enter your selection. Your total allocation must equal 100% for each row. Activity Cost Pools The percentages you selected above are next used in the table below to allocate the total costs (assumed) among the various activities (experiment with alternative percentages above and observe how this changes the cost allocations below): DETERMINE THE PER-ACTIVITY RATES: Each of the products and other cost objects consumed activities at the rate indicated in the table below. Use this information and cost data above to determine the per unit activity cost measures. Use the available pick lists from within each boxed area to select the correct values. DETERMINE THE PER-ACTIVITY RATES: Each of the products and other cost objects consumed activities at the rate indicated in the table below. Use this information and cost data above to determine the per unit activity cost measures. Use the available pick lists from within each boxed area to select the correct values. APPLY COSTS TO OBJECTS: Given below are the costs of direct material and direct labor. Assume that Cost Object A is allocated half to Product \#1 and half to Product \#2. Assume that Cost Object B is fully allocated to Product \#2. Use the pick lists from within the boxed areas below to apply all costs. The per unit amounts are automatically calculated. Study and review the entire process, considering the goals and objectives of ABC. ALLOCATE COSTS: For the following four cost categories (indirect materials, maintenance, other, and SG\&A), make assumptions about the percentages to be assigned to each of the activities (X,Y,Z, or unallocated). Use the available pick lists from within each boxed area and enter your selection. Your total allocation must equal 100% for each row. The percentages you selected above are next used in the table below to allocate the total costs (assumed) among the various activities (experiment with alternative percentages above and observe how this changes the cost allocations below): DE.TERMINE THE. PE.R-ACTIVTTY R.ATES: Each of the products and other cost objects consumed activities at the rate indicated in the table below. Ese this iaformation and cest data above to determine the per unit activity cost measures. Use the available pick lists from within cach boxed area te select the correct values. APPLY COSTS TO OBJECTS; Given belen are the costs of difret material and direct laber. Assume that Cost Object A is allocated half to Product 1 and half to Product W2. Assume that Cost Object B is fully allocated to Product \#2. Use the piek lists from within the boxed areas below to apply all cests. The per unit amounts are autontatically calculated. Study and revicw the entire process, considering the aoals and objectives of ABC