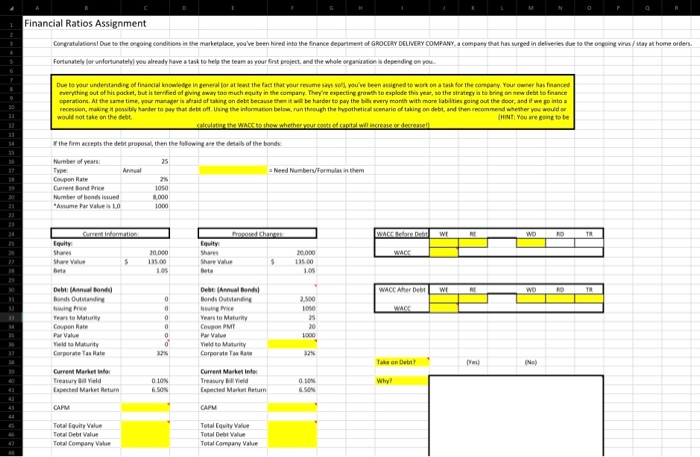

i Financial Ratios Assignment Congratulations! Due to the ongoing conditions in the marketplace, you've been hired into the finance department of GROCERY DELIVERY COMPANY, a company that has surged in deliveries due to the ongoing virus / stay at home orders. Fortunately for unfortunately you already have a task to help the team as your first project, and the whole organisation is depending on you Due to your understanding of financial knowledge in general for at least the fact that your resume says so you've been assigned to work on a task for the company, Youtcwner has financed everything out of his pocket, but is terrified of giving away too much equity in the company. They're expecting growth to esplode this year, so the strategy is to bring on new debt to finance operation. At the same time, your manager is afraid of taking on debt because then it will be harder to pay the bill very month with more liabilities going out the door, and if we go into a recession making it possibly harder to pay that debt of using the information below, run through the hypothetical scenario of taking on debt, and the recommend whether you would or would not take on the debt. CHINT: You are going to be the firm accepts the debt proposal, then the following are the details of the bonds Current and Price Number of bondinud "Avume Par Value 10 A 000 Current Information Shares 30.000 Debt (Annual Bonds) Bonds Outanding Price Tears to Matury Debt Annual Bonds Bonds Outstanding Swingice CPMT Par Valve Vield to Maturity Corporate Tax Rate Yield to Maturity Corporate Tax Rate Ta on Debt? Current Marketing Treasury Vield Current Marketinde Treasury B. Yield 010 Total Equity Valve Total Debt Value Total Equity Valve Total Debt Value Total Company Value i Financial Ratios Assignment Congratulations! Due to the ongoing conditions in the marketplace, you've been hired into the finance department of GROCERY DELIVERY COMPANY, a company that has surged in deliveries due to the ongoing virus / stay at home orders. Fortunately for unfortunately you already have a task to help the team as your first project, and the whole organisation is depending on you Due to your understanding of financial knowledge in general for at least the fact that your resume says so you've been assigned to work on a task for the company, Youtcwner has financed everything out of his pocket, but is terrified of giving away too much equity in the company. They're expecting growth to esplode this year, so the strategy is to bring on new debt to finance operation. At the same time, your manager is afraid of taking on debt because then it will be harder to pay the bill very month with more liabilities going out the door, and if we go into a recession making it possibly harder to pay that debt of using the information below, run through the hypothetical scenario of taking on debt, and the recommend whether you would or would not take on the debt. CHINT: You are going to be the firm accepts the debt proposal, then the following are the details of the bonds Current and Price Number of bondinud "Avume Par Value 10 A 000 Current Information Shares 30.000 Debt (Annual Bonds) Bonds Outanding Price Tears to Matury Debt Annual Bonds Bonds Outstanding Swingice CPMT Par Valve Vield to Maturity Corporate Tax Rate Yield to Maturity Corporate Tax Rate Ta on Debt? Current Marketing Treasury Vield Current Marketinde Treasury B. Yield 010 Total Equity Valve Total Debt Value Total Equity Valve Total Debt Value Total Company Value