I give you an assignment about calculating beta values of stocks and cost of equity. I explained how to estimate historical betas and cost of equity for companies in the last online class, please watch the video carefully.

You can see your assigned common stocks as attached.

What you have to do ?

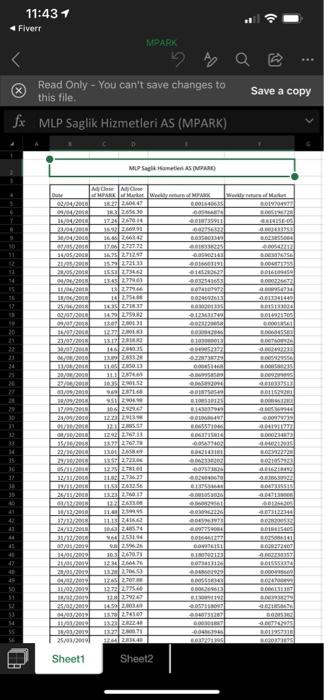

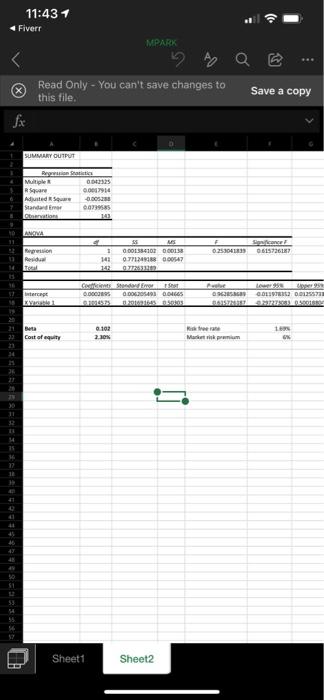

1) Calculate beta values (weekly, for 3 years) in excel as I explained in the last online class. And adjust these raw (regression) betas to adjusted betas

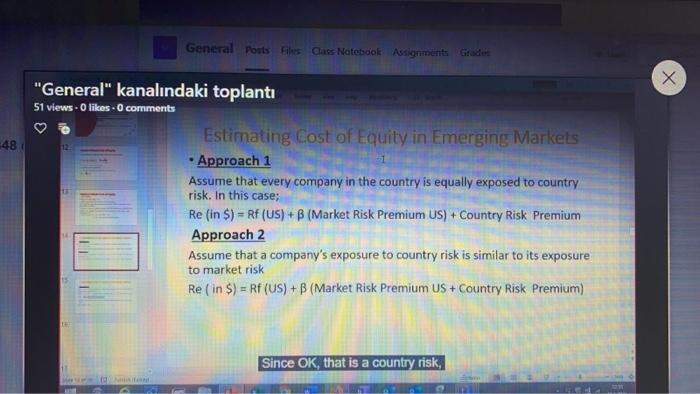

2) Using these adjusted betas, calculate the cost of equity for your company. First, you will calculate cost of equity in local currency (TL) and then you will calculate cost of equity in dollars using Approack 1 and Approach 2 (Estimating Cost of Equity in Emerging Markets)

Then you will convert this $ cost of equity to local currency (TL) .If you want, you can make comment maximum writing 2-3 sentences.

3) You will upload one excel document to the assignment folder.

11:43 1 Fiverr OS MPARK a Read Only - You can't save changes to Save a copy this file. fx MLP Saglik Hizmetleri AS (MPARK) MUSAS MARE GREESE DS MORNITO MOM MARK Market Welly MARK 03/01/2010 DOMI REF:30 LATE 15/04 2010 3720 ESTO 20 JE 30/04/2010 16.4 BOSCH 2.797.72 CASTS 34 -0.143 21 ADA 23/05 16522 91/91-2018 0286 BR 18/06/2010 230 100 TRIT 14729983 11 1270 GB CHASE WEZESSE 23 WS 2000 MEVE 02:05 SRB TE TEREZ DOTS SEO COROLO TO NERE 200 2010 L 20/2010 RO 110.12 1102 10 22 BBS 010332533 2011 WO TOP 2012 2010 SS BASTO 20/12/2010 R! POSTED Porno 000 SURE 13 22/10/2001 ST 120 15222767 200 28.01 112720 BERG 1121 BONG BOTS BRO 2010 TO VZH BRONZE SESSEVOD CHE TEST 1260 ATT PER 05/ 12/11/2010 2018 26/11/2010 RE! 30/03/2010 ATE 28/03/2010 22/2010 10/01 14/2 210. 23/03/2010 DAVATE al GRESO 11 24596 25 22 10:3 2.6701 1234276 00 DOMZEE ESES 16 FA2.2017 BASIS 31/03/2018 BIO 25/09/2010 0222 BRID 18/01/2018 25/01/2009 12 14 1200 20240 2.07 07 BONORE -00469 3. BD B. Sheet1 Sheet2 11:431 Fiverr MPARK Read Only - You can't save changes to this file. Save a copy SUMMARY OUTPUT Muit R Square Adjusted Standard 0.00791 85 ANAVA Repression Red 0251041229 061572667 1 143 142 0.00534102 000138 0712488 0.00547 7725322 0.000 0.006205403 006S DS CSGO DESTER 125571 CLASSIERS DRESS 1 Beta Cost of it 0.102 2.30 Marketpremium Sheet1 Sheet2 General Posts Files Class Notebook Assignments Grade X "General" kanalndaki toplant 51 views. O likes - 0 comments 48 Estimating Cost of Equity in Emerging Markets Approach 1 Assume that every company in the country is equally exposed to country risk. In this case; Re (in $) = RF (US) + B (Market Risk Premium US) + Country Risk Premium Approach 2 Assume that a company's exposure to country risk is similar to its exposure to market risk Re (in $) = Rf (US) + B (Market Risk Premium US + Country Risk Premium) Since OK, that is a country risk, 11:43 1 Fiverr OS MPARK a Read Only - You can't save changes to Save a copy this file. fx MLP Saglik Hizmetleri AS (MPARK) MUSAS MARE GREESE DS MORNITO MOM MARK Market Welly MARK 03/01/2010 DOMI REF:30 LATE 15/04 2010 3720 ESTO 20 JE 30/04/2010 16.4 BOSCH 2.797.72 CASTS 34 -0.143 21 ADA 23/05 16522 91/91-2018 0286 BR 18/06/2010 230 100 TRIT 14729983 11 1270 GB CHASE WEZESSE 23 WS 2000 MEVE 02:05 SRB TE TEREZ DOTS SEO COROLO TO NERE 200 2010 L 20/2010 RO 110.12 1102 10 22 BBS 010332533 2011 WO TOP 2012 2010 SS BASTO 20/12/2010 R! POSTED Porno 000 SURE 13 22/10/2001 ST 120 15222767 200 28.01 112720 BERG 1121 BONG BOTS BRO 2010 TO VZH BRONZE SESSEVOD CHE TEST 1260 ATT PER 05/ 12/11/2010 2018 26/11/2010 RE! 30/03/2010 ATE 28/03/2010 22/2010 10/01 14/2 210. 23/03/2010 DAVATE al GRESO 11 24596 25 22 10:3 2.6701 1234276 00 DOMZEE ESES 16 FA2.2017 BASIS 31/03/2018 BIO 25/09/2010 0222 BRID 18/01/2018 25/01/2009 12 14 1200 20240 2.07 07 BONORE -00469 3. BD B. Sheet1 Sheet2 11:431 Fiverr MPARK Read Only - You can't save changes to this file. Save a copy SUMMARY OUTPUT Muit R Square Adjusted Standard 0.00791 85 ANAVA Repression Red 0251041229 061572667 1 143 142 0.00534102 000138 0712488 0.00547 7725322 0.000 0.006205403 006S DS CSGO DESTER 125571 CLASSIERS DRESS 1 Beta Cost of it 0.102 2.30 Marketpremium Sheet1 Sheet2 General Posts Files Class Notebook Assignments Grade X "General" kanalndaki toplant 51 views. O likes - 0 comments 48 Estimating Cost of Equity in Emerging Markets Approach 1 Assume that every company in the country is equally exposed to country risk. In this case; Re (in $) = RF (US) + B (Market Risk Premium US) + Country Risk Premium Approach 2 Assume that a company's exposure to country risk is similar to its exposure to market risk Re (in $) = Rf (US) + B (Market Risk Premium US + Country Risk Premium) Since OK, that is a country risk