I got 2 of the 5 parts correct, having trouble figuring out the rest and missing pieces, any help would be great

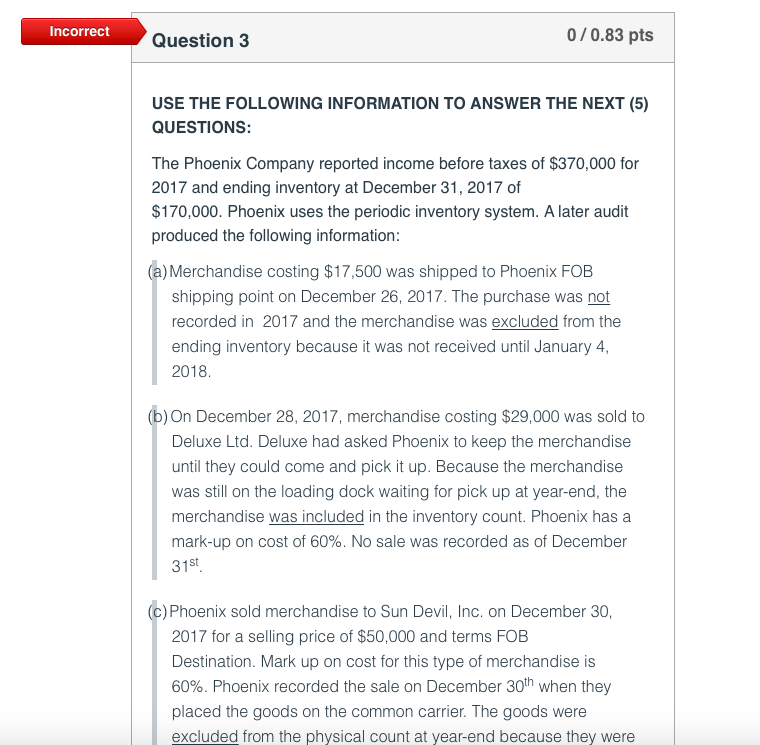

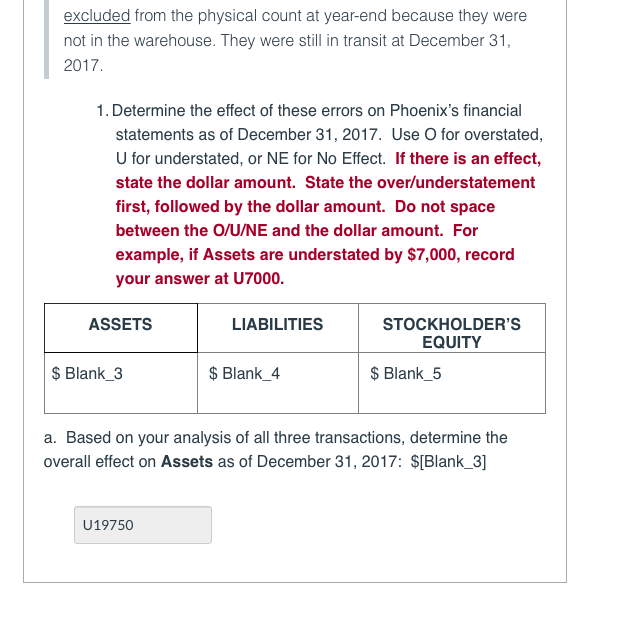

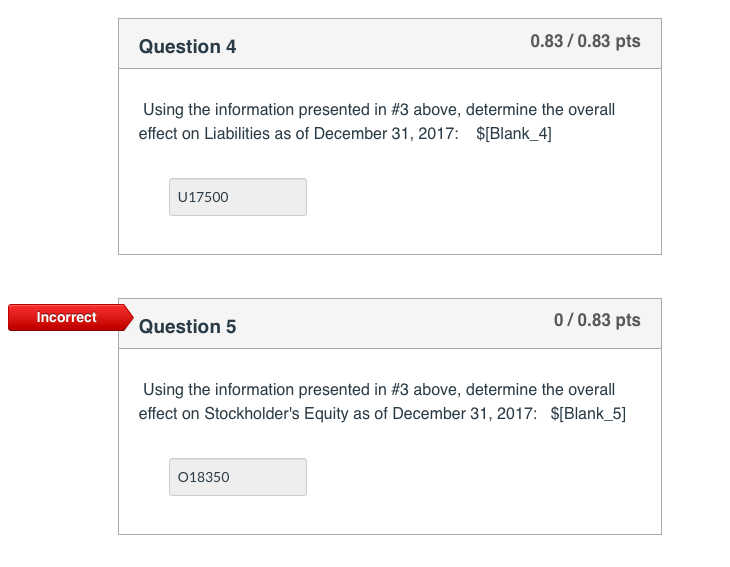

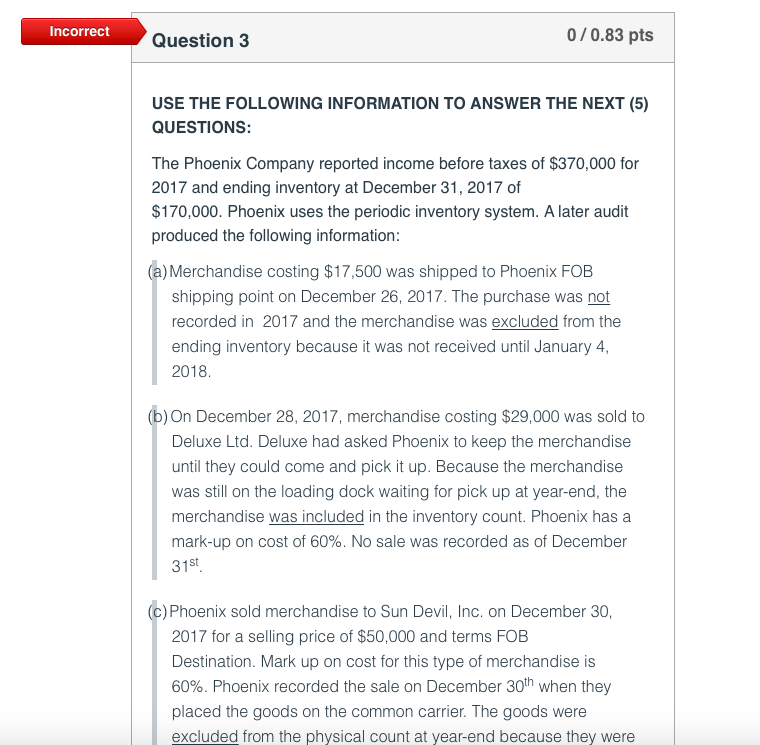

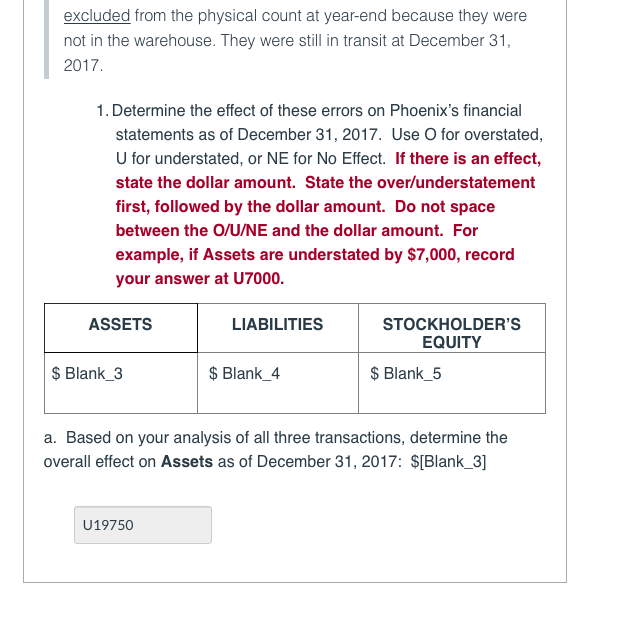

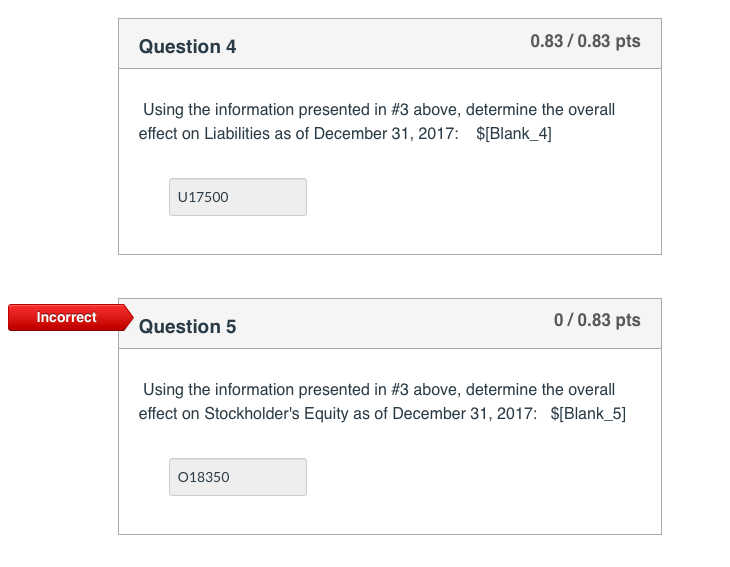

Incorrect 0/0.83 pts Question 3 USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (5) QUESTIONS: The Phoenix Company reported income before taxes of $370,000 for 2017 and ending inventory at December 31, 2017 of $170,000. Phoenix uses the periodic inventory system. A later audit produced the following information: (a)Merchandise costing $17,500 was shipped to Phoenix FOB S shipping point on December 26, 2017. The purchase was not recorded in 2017 and the merchandise was excluded from the ending inventory because it was not received until January 4 2018. (b) On December 28, 2017, merchandise costing $29,000 was sold to Deluxe Ltd. Deluxe had asked Phoenix to keep the merchandise until they could come and pick it up. Because the merchandise was still on the loading dock waiting for pick up at year-end, the merchandise was included in the inventory count. Phoenix has a mark-up on cost of 60%. No sale was recorded as of December 31st (c)Phoenix sold merchandise to Sun Devil, Inc. on December 30, 2017 for a selling price of $50,000 and terms FOB Destination. Mark up on cost for this type of merchandise is 60%. Phoenix recorded the sale on December 30th when they placed the goods on the common carrier. The goods were excluded from the physical count at year-end because they were excluded from the physical count at year-end because they were not in the warehouse. They were still in transit at December 31, 2017. 1. Determine the effect of these errors on Phoenix's financial statements as of December 31, 2017. Use O for overstated U for understated, or NE for No Effect. If there is an effect, state the dollar amount. State the over/understatement first, followed by the dollar amount. Do not space between the O/U/NE and the dollar amount. For example, if Assets are understated by $7,000, record your answer at U7000 ASSETS LIABILITIES STOCKHOLDER'S EQUITY Blank_4 $ Blank_5 Blank_3 a. Based on your analysis of all three transactions, determine the overall effect on Assets as of December 31, 2017: $IBlank_3] U19750 0.83/0.83 pts Question 4 Using the information presented in #3 above, determine the overall effect on Liabilities as of December 31, 2017: $[Blank_4] U17500 Incorrect 0/0.83 pts Question 5 Using the information presented in #3 above, determine the overall effect on Stockholder's Equity as of December 31, 2017: $[Blank_5] 018350 0.81/0.81 pts Question 6 Using the information presented in #3 above, Determine the correct ending inventory Phoenix Company should report on their year end balance sheet dated December 31, 2017. (Phoenix was originally reporting ending inventory at $170,000.) $IBlank_6] 189750 Incorrect 0/0.81 pts Question 7 Using the information presented in #3 above, determine the correct income before taxes as of December 31, 2017 (*Phoenix was $IBlank_7] originally reporting Income Before Taxes of $370,000): 369900