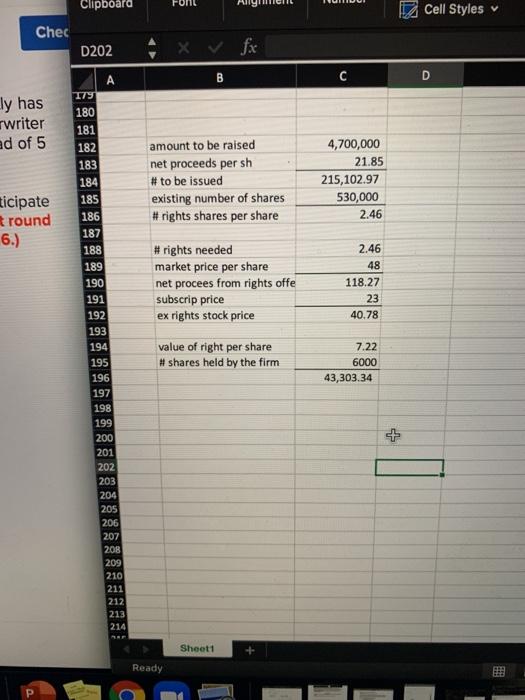

i got 43,303 but it is marking it wrong.

Prahm Corp. wants to raise $4.7 million via a rights offering. The company currently has 530,000 shares of common stock outstanding that sell for $48 per share. Its underwriter has set a subscription price of $23 per share and will charge the company a spread of 5 percent If you currently own 6,000 shares of stock in the company and decide not to participate in the rights offering, how much money can you get by selling your rights? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Your proceeds from sale of rights Font Clipboard Cell Styles Chec D202 B D ly has rwriter ad of 5 A 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 amount to be raised net proceeds per sh # to be issued existing number of shares # rights shares per share 4,700,000 21.85 215,102.97 530,000 2.46 ticipate round 6.) #rights needed market price per share net procees from rights offe subscrip price ex rights stock price 2.46 48 118.27 23 40.78 value of right per share # shares held by the firm 195 7.22 6000 43,303.34 + 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 Sheet1 Ready P Prahm Corp. wants to raise $4.7 million via a rights offering. The company currently has 530,000 shares of common stock outstanding that sell for $48 per share. Its underwriter has set a subscription price of $23 per share and will charge the company a spread of 5 percent If you currently own 6,000 shares of stock in the company and decide not to participate in the rights offering, how much money can you get by selling your rights? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Your proceeds from sale of rights Font Clipboard Cell Styles Chec D202 B D ly has rwriter ad of 5 A 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 amount to be raised net proceeds per sh # to be issued existing number of shares # rights shares per share 4,700,000 21.85 215,102.97 530,000 2.46 ticipate round 6.) #rights needed market price per share net procees from rights offe subscrip price ex rights stock price 2.46 48 118.27 23 40.78 value of right per share # shares held by the firm 195 7.22 6000 43,303.34 + 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 Sheet1 Ready P