Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I got 57.97 million for part A. 40.7 million B1 109.21 part B 88.39 C The management of Mitchell Labs decided to go private in

I got 57.97 million for part A. 40.7 million B1 109.21 part B 88.39 C

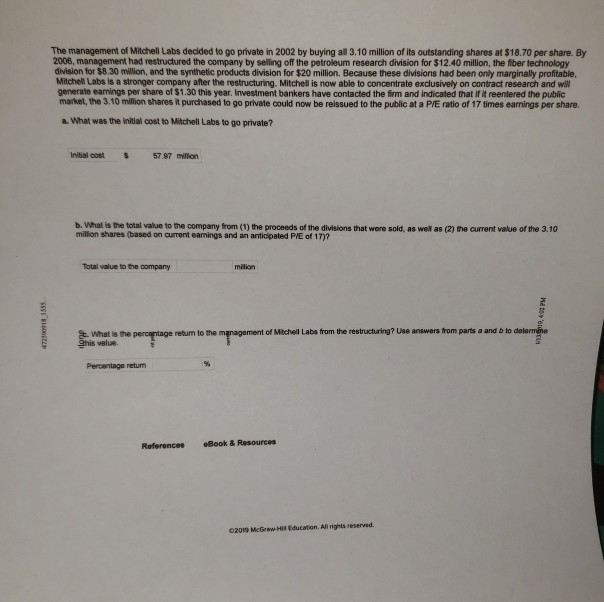

The management of Mitchell Labs decided to go private in 2002 by buying all 3.10 million of its outstanding shares at $18.70 per share. By 2006, management had restructured the company by selling off the petroleum research division for $12.40 million, the fiber technology division for $8.30 million, and the synthetic products division for $20 million. Because these divisions had been only marginally profitable, Mitchell Labs is a stronger company after the restructuring. Mitchell is now able to concentrate exclusively on contract research and ww generate eamings per share of $1.30 this year. Investment bankers have contacted the firm and indicated that if it reentered the public market, the 3.10 milion shares t purchased to go private could now be reissued to the public at a P/E ratio of 17 times earnings per share. a. What was the Iinitial cost to Mitchell Labs to go private? Initial cost 57.97 millon b. What is the total value to the company from (1) the proceeds of the divisions that wore sold, as well as (2) the current value of the 3.10 million shares (based on current eamings and an anticpated PVE of 17)? Total value to the company milion ailuogeresum to me ement of Mitchel Labs from the restructuring? Use answers from parts a and b to determne Et. What is the 9his value Percentage returm References Book & Rssources 02019 McGrew-Hil Education. Ai rights reservedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started