Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I got a 50%. I posted my feedback from my teacher but don't understand what they mean and how to fix it. I will give

I got a 50%. I posted my feedback from my teacher but don't understand what they mean and how to fix it. I will give good ratings to anyone who can help. Thank you!!

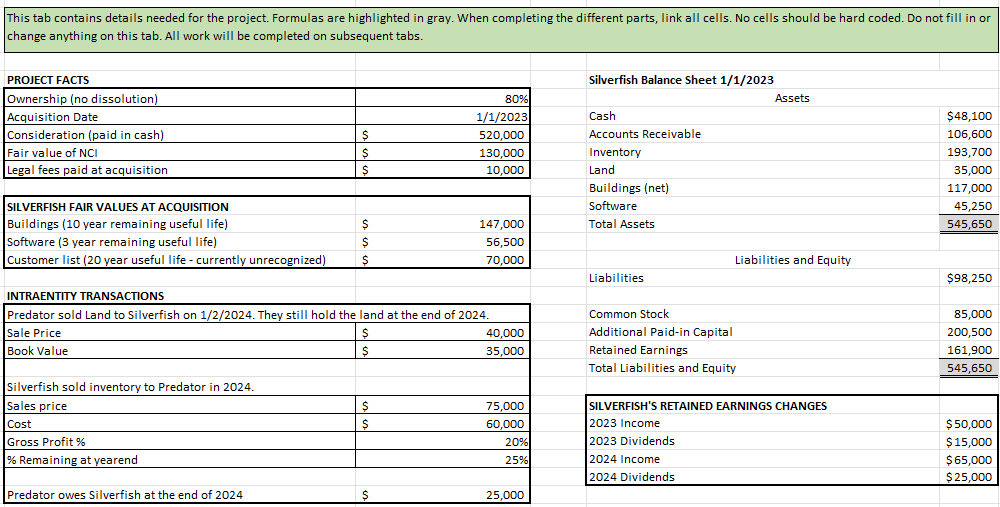

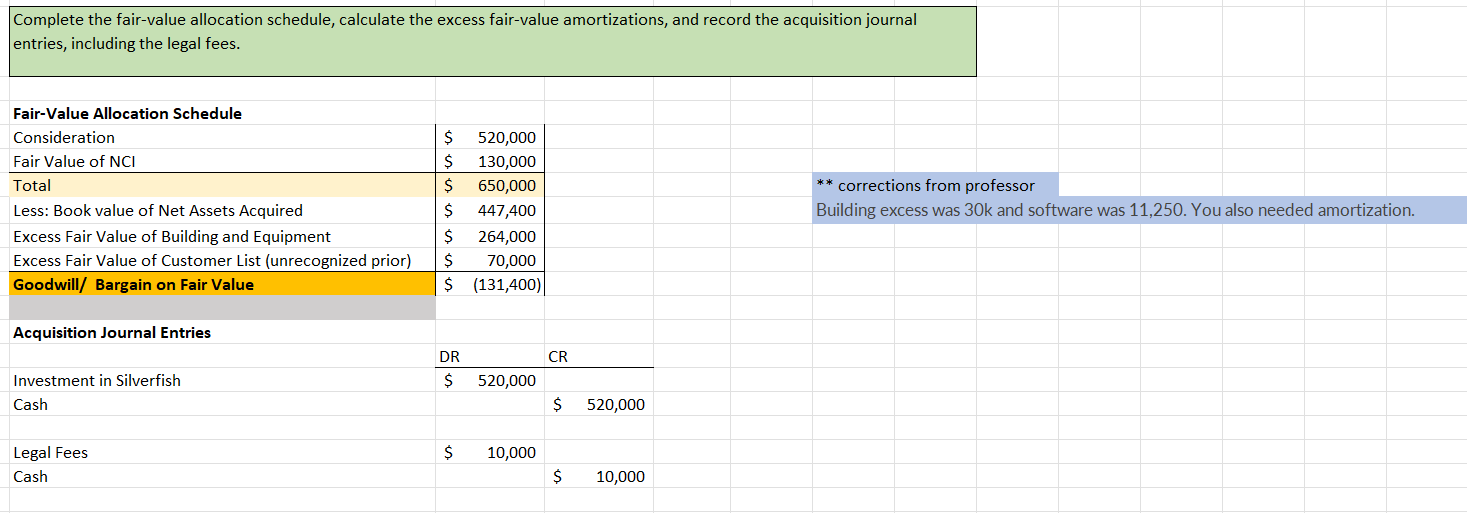

his tab contains details needed for the project. Formulas are highlighted in gray. When completing the different parts, link all cells. No cells should be hard coded. Do not fill in or hange anything on this tab. All work will be completed on subsequent tabs. Complete the fair-value allocation schedule, calculate the excess fair-value amortizations, and record the acquisition journal entries, including the legal fees. Fair-Value Allocation Schedule \begin{tabular}{l|rr|} Consideration & $ & 520,000 \\ Fair Value of NCl & $ & 130,000 \\ \hline Total & $ & 650,000 \\ Less: Book value of Net Assets Acquired & $ & 447,400 \\ Excess Fair Value of Building and Equipment & $ & 264,000 \\ Excess Fair Value of Customer List (unrecognized prior) & $ & 70,000 \\ \hline Goodwill/ Bargain on Fair Value & $ & (131,400) \end{tabular} ** corrections from professor Building excess was 30k and software was 11,250. You also needed amortization. Acquisition Journal Entries Investment in Silverfish Cash Legal Fees $10,000 Cash $10,000 his tab contains details needed for the project. Formulas are highlighted in gray. When completing the different parts, link all cells. No cells should be hard coded. Do not fill in or hange anything on this tab. All work will be completed on subsequent tabs. Complete the fair-value allocation schedule, calculate the excess fair-value amortizations, and record the acquisition journal entries, including the legal fees. Fair-Value Allocation Schedule \begin{tabular}{l|rr|} Consideration & $ & 520,000 \\ Fair Value of NCl & $ & 130,000 \\ \hline Total & $ & 650,000 \\ Less: Book value of Net Assets Acquired & $ & 447,400 \\ Excess Fair Value of Building and Equipment & $ & 264,000 \\ Excess Fair Value of Customer List (unrecognized prior) & $ & 70,000 \\ \hline Goodwill/ Bargain on Fair Value & $ & (131,400) \end{tabular} ** corrections from professor Building excess was 30k and software was 11,250. You also needed amortization. Acquisition Journal Entries Investment in Silverfish Cash Legal Fees $10,000 Cash $10,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started