Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I got all of these wrong. Please post solution on how to solve them. And please hurry they are due tonight and I am so

I got all of these wrong. Please post solution on how to solve them. And please hurry they are due tonight and I am so confused. Thank you soooo much

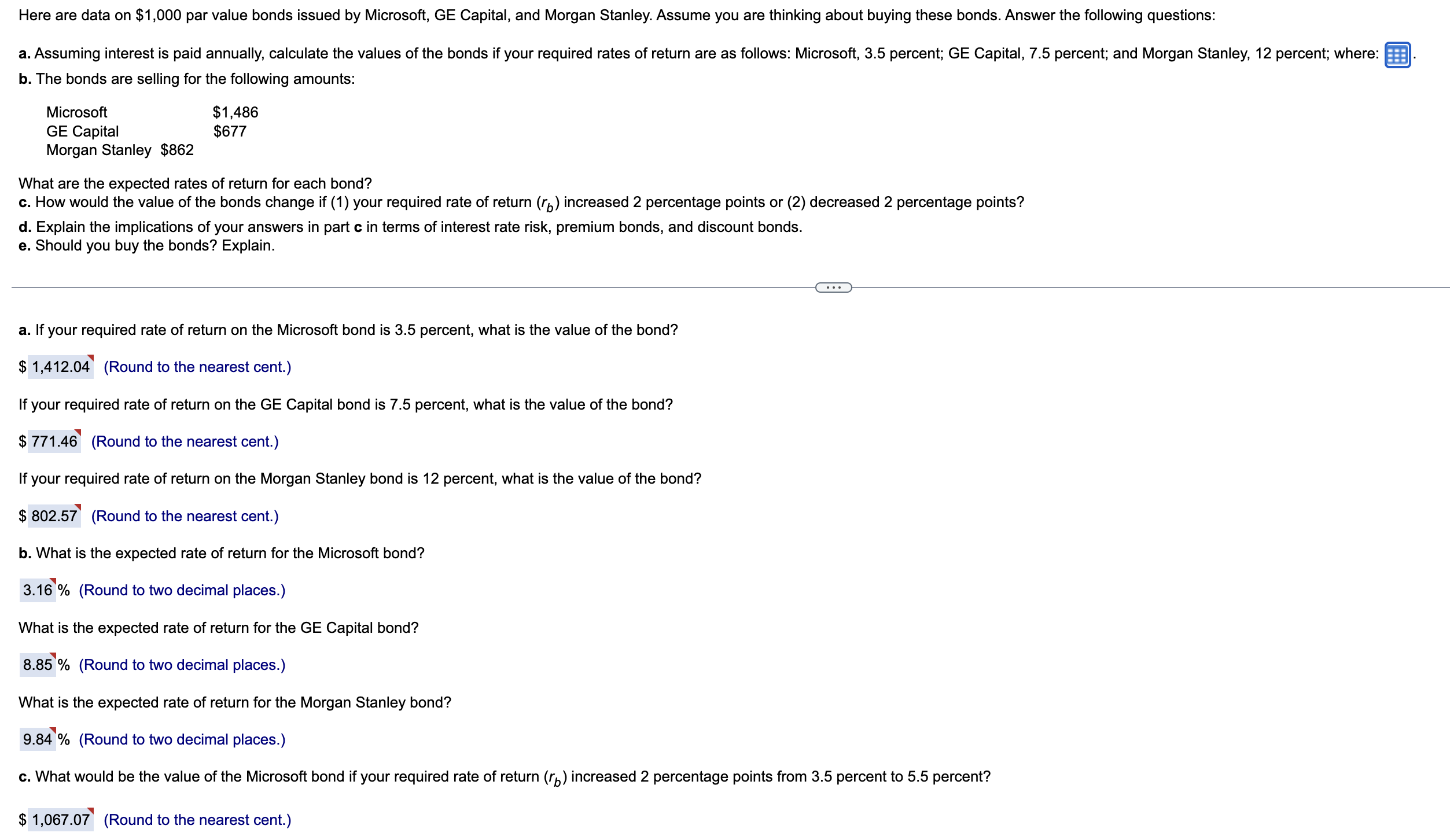

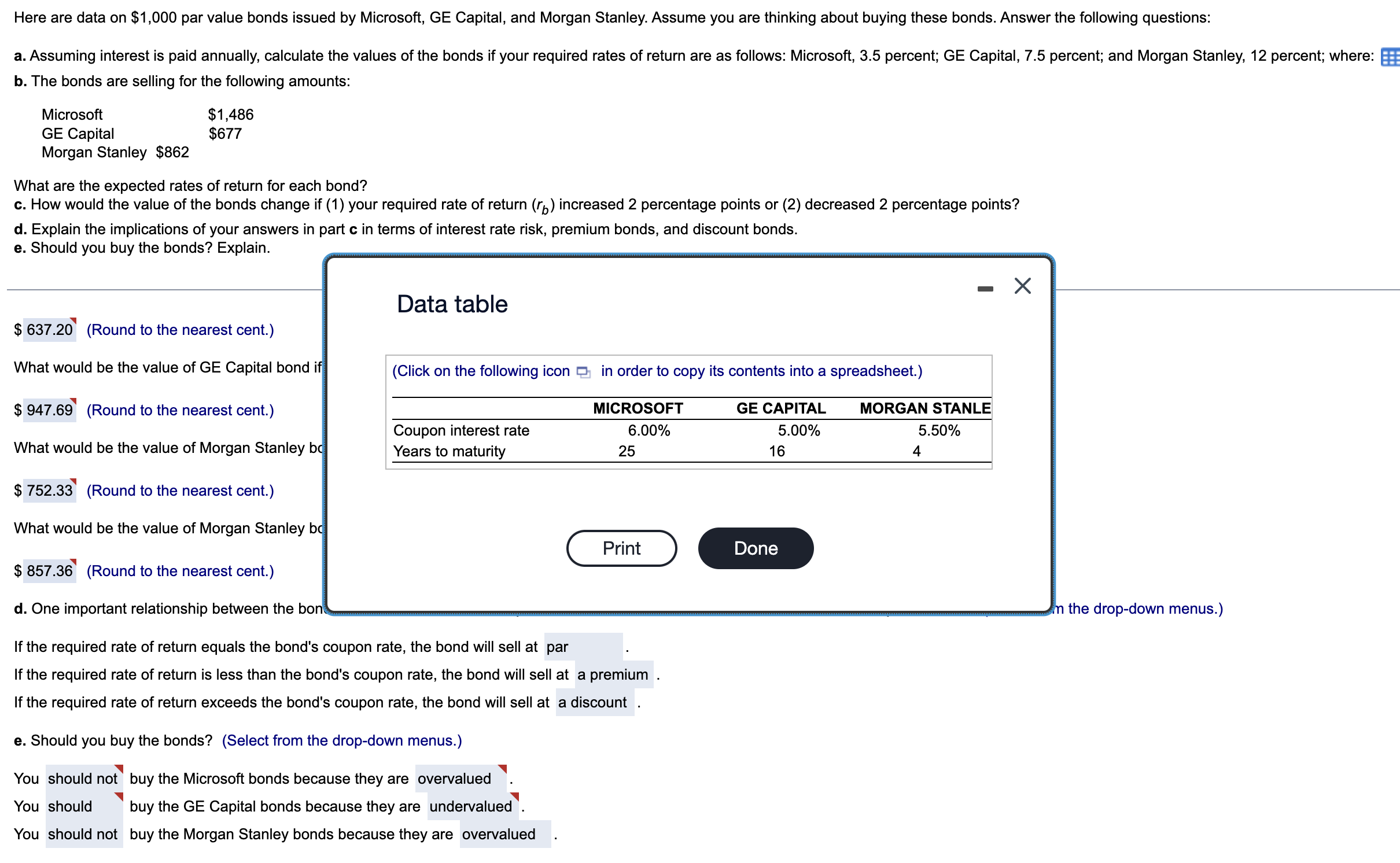

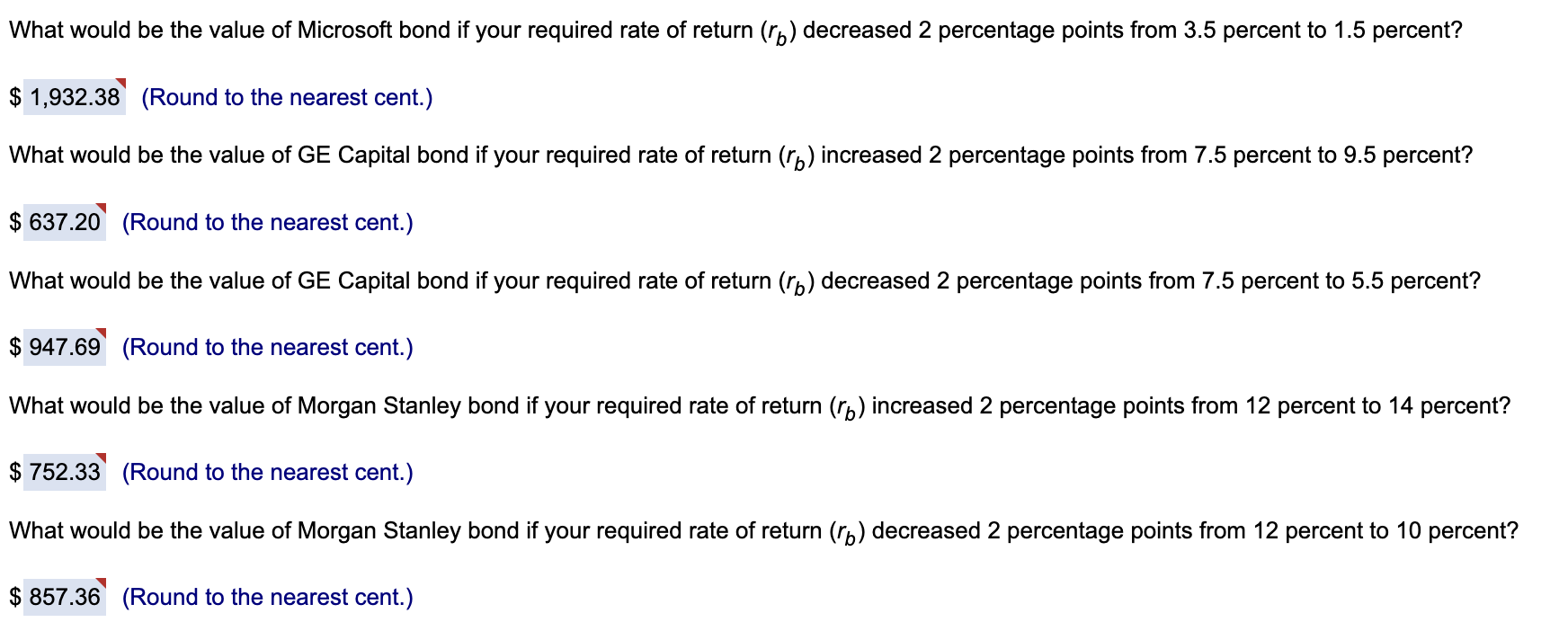

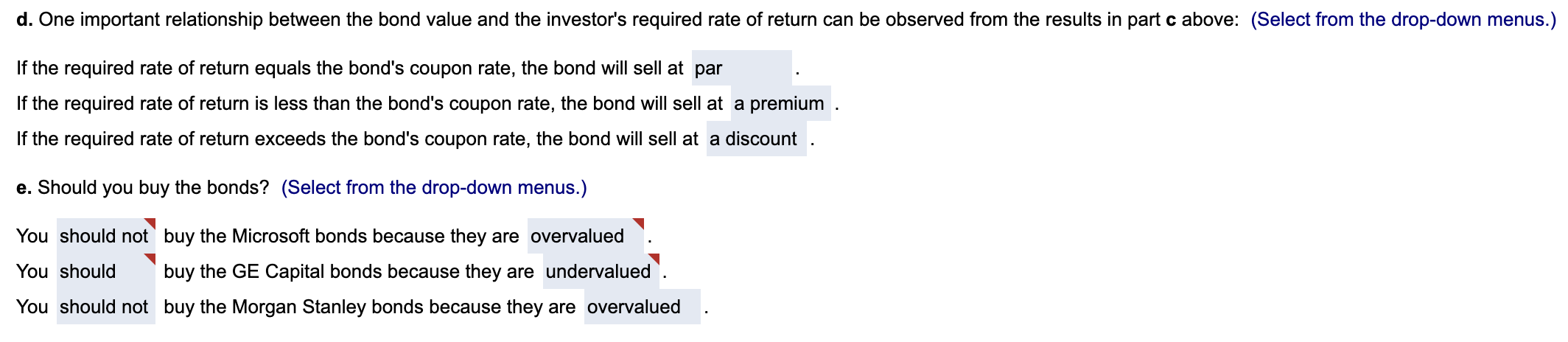

Here are data on $1,000 par value bonds issued by Microsoft, GE Capital, and Morgan Stanley. Assume you are thinking about buying these bonds. Answer the following questions: b. The bonds are selling for the following amounts: MicrosoftGECapitalMorganStanley$862$1,486$677 What are the expected rates of return for each bond? c. How would the value of the bonds change if (1) your required rate of return (rb) increased 2 percentage points or (2) decreased 2 percentage points? d. Explain the implications of your answers in part c in terms of interest rate risk, premium bonds, and discount bonds. b. The bonds are selling for the following amounts: What are the expected rates of return for each bond? c. How would the value of the bonds change if (1) your required rate of return (rb) increased 2 percentage points or (2) decreased 2 percentage points? d. Explain the implications of your answers in part c in terms of interest rate risk, premium bonds, and discount bonds. e. Should you buy the bonds? Explain. Data table $637.20 (Round to the nearest cent.) What would be the value of GE Capital bond if (Round to the nearest cent.) What would be the value of Morgan Stanley bc (Round to the nearest cent.) What would be the value of Morgan Stanley bc (Round to the nearest cent.) (Click on the following icon in order to copy its contents into a spreadsheet.) d. One important relationship between the bon the drop-down menus.) If the required rate of return equals the bond's coupon rate, the bond will sell at If the required rate of return is less than the bond's coupon rate, the bond will sell at a premium . If the required rate of return exceeds the bond's coupon rate, the bond will sell at e. Should you buy the bonds? (Select from the drop-down menus.) You should not buy the Microsoft bonds because they are You should buy the GE Capital bonds because they are undervalued . You should not buy the Morgan Stanley bonds because they are What would be the value of Microsoft bond if your required rate of return (rb) decreased 2 percentage points from 3.5 percent to 1.5 percent? (Round to the nearest cent.) What would be the value of GE Capital bond if your required rate of return (rb) increased 2 percentage points from 7.5 percent to 9.5 percent? (Round to the nearest cent.) What would be the value of GE Capital bond if your required rate of return (rb) decreased 2 percentage points from 7.5 percent to 5.5 percent? (Round to the nearest cent.) What would be the value of Morgan Stanley bond if your required rate of return (rb) increased 2 percentage points from 12 percent to 14 percent? (Round to the nearest cent.) What would be the value of Morgan Stanley bond if your required rate of return (rb) decreased 2 percentage points from 12 percent to 10 percent? (Round to the nearest cent.) d. One important relationship between the bond value and the investor's required rate of return can be observed from the results in part c above: (Select from the drop-down menus.) If the required rate of return equals the bond's coupon rate, the bond will sell at If the required rate of return is less than the bond's coupon rate, the bond will sell at a premium . If the required rate of return exceeds the bond's coupon rate, the bond will sell at a discount . e. Should you buy the bonds? (Select from the drop-down menus.) You should not buy the Microsoft bonds because they are You should buy the GE Capital bonds because they are undervalued . You should not buy the Morgan Stanley bonds because they are

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started