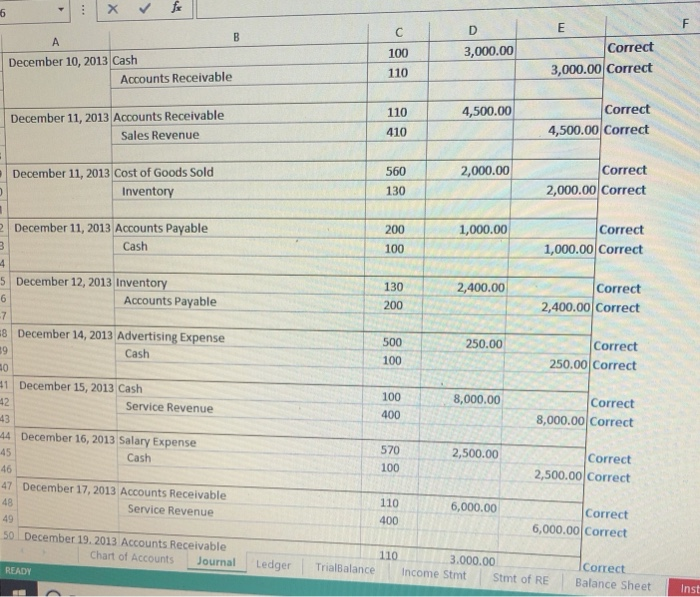

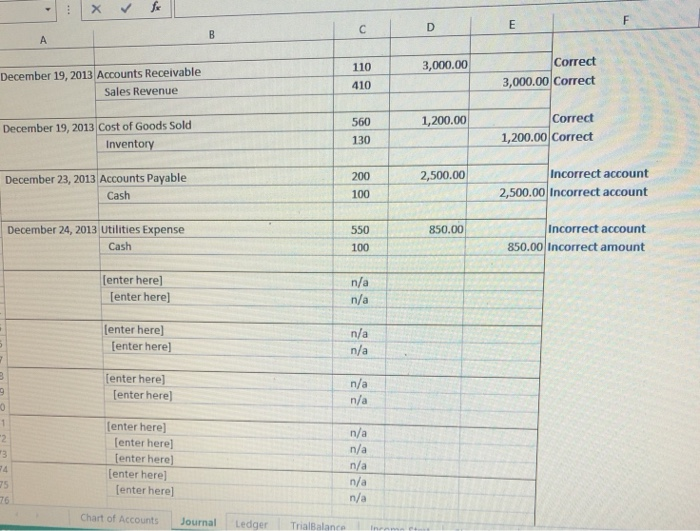

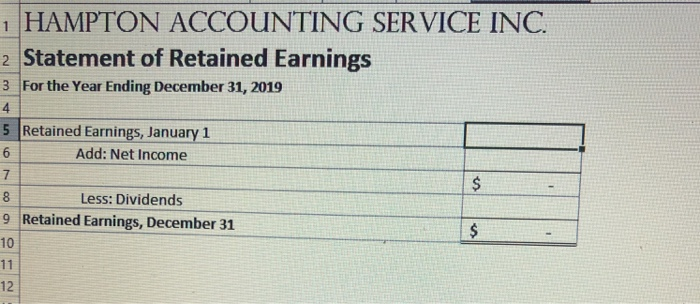

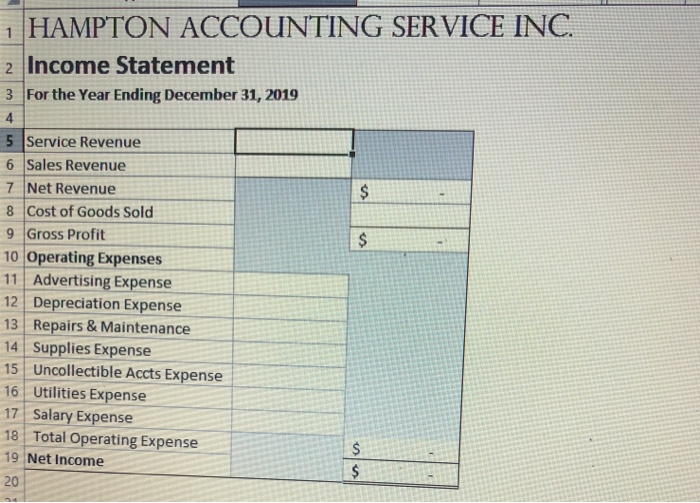

I got most of tje journey entries done! Just need help on the blank ones & the ones that say incorrect. Also need help on the statement of retained earnings & Income statement. Thanks!

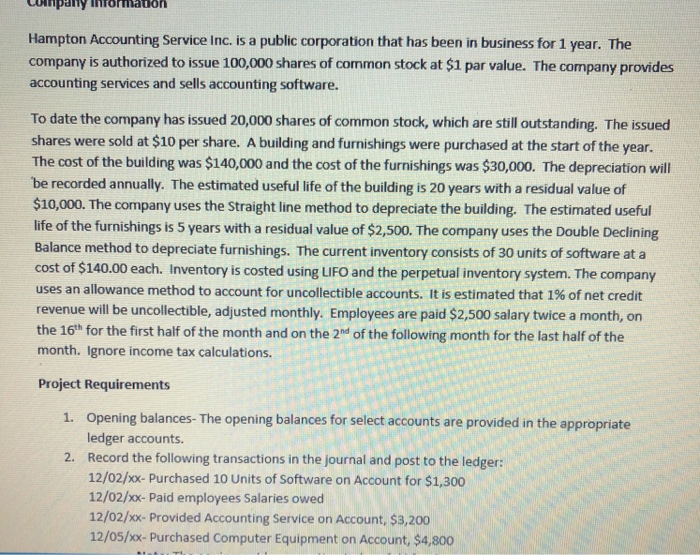

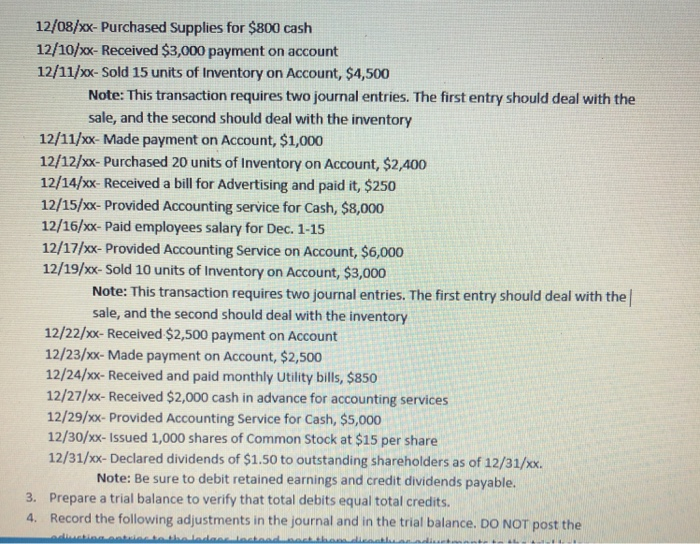

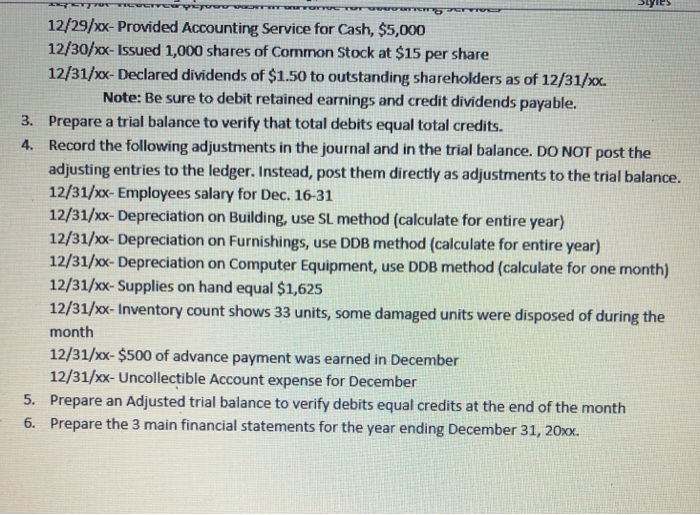

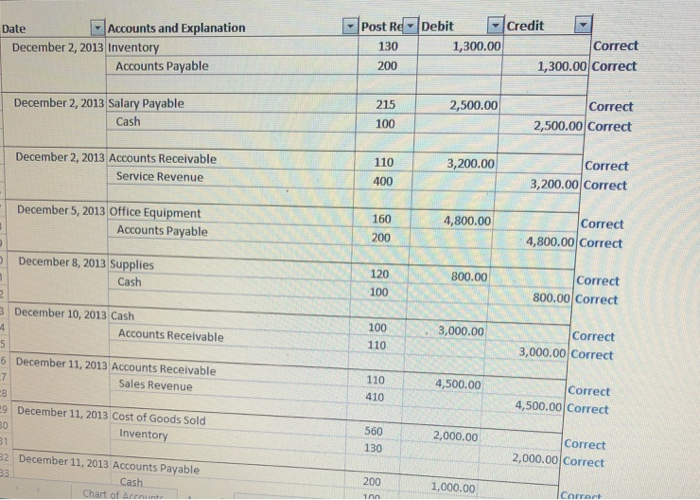

12/08/xx- Purchased Supplies for $800 cash 12/10/x- Received $3,000 payment on account 12/11/xx- Sold 15 units of Inventory on Account, $4,500 Note: This transaction requires two journal entries. The first entry should deal with the sale, and the second should deal with the inventory 12/11/x- Made payment on Account, $1,000 12/12/xx- Purchased 20 units of Inventory on Account, $2,400 12/14/xx- Received a bill for Advertising and paid it, $250 12/15/xx- Provided Accounting service for Cash, $8,000 12/16/xx-Paid employees salary for Dec. 1-15 12/17/xx-Provided Accounting Service on Account, $6,000 12/19/xx- Sold 10 units of Inventory on Account, $3,000 Note: This transaction requires two journal entries. The first entry should deal with the sale, and the second should deal with the inventory 12/22/x- Received $2,500 payment on Account 12/23/xx- Made payment on Account, $2,500 12/24/x- Received and paid monthly Utility bills, $850 12/27/xx- Received $2,000 cash in advance for accounting services 12/29/xx- Provided Accounting Service for Cash, $5,000 12/30/xx-Issued 1,000 shares of Common Stock at $15 per share 12/31/xx- Declared dividends of $1.50 to outstanding shareholders as of 12/31/xx. Note: Be sure to debit retained earnings and credit dividends payable. 3. Prepare a trial balance to verify that total debits equal total credits. Record the following adjustments in the journal and in the trial balance. DO NOT post the 4. 110 3,000.00 410 Correct 3,000.00 Correct December 19, 2013 Accounts Receivable Sales Revenue Correct 1,200.00 Correct 560 1,200.00 December 19, 2013 Cost of Goods Sold 130 Inventory December 23, 2013 Accounts Payable 2,500.00 Incorrect account Cash 100 2,500.00 Incorrect account December 24, 2013 Utilities Expense Incorrect account 550 100 850.00 Cash 850.00 Incorrect amount lenter herel enter here] n/a enter here] fenter here) n/a fenter herel n/a Tenter here) n/a enter here) enter herel enter here) (enter here n/a n/a enter here Chart of Accounts Journal Ledger TrialBalance innn HAMPTON ACCOUNTING SERVICE INC 2 Statement of Retained Earnings 3 For the Year Ending December 31, 2019 4 5 Retained Earnings, January 1 Add: Net Income 7 Less: Dividends 9 Retained Earnings, December 31 10 12 HAMPTON ACCOUNTING SERVICE INC 2 Income Statement 3 For the Year Ending December 31, 2019 4 5 Service Revenue 6 Sales Revenue 7 Net Revenue 8 Cost of Goods Sold 9 Gross Profit 10 Operating Expenses 11 Advertising Expense 12 Depreciation Expense 13 Repairs & Maintenance 14 Supplies Expense 15 Uncollectible Accts Expense 16 Utilities Expense 17 Salary Expense 18 Total Operating Expense 19 Net Income 20 12/08/xx- Purchased Supplies for $800 cash 12/10/x- Received $3,000 payment on account 12/11/xx- Sold 15 units of Inventory on Account, $4,500 Note: This transaction requires two journal entries. The first entry should deal with the sale, and the second should deal with the inventory 12/11/x- Made payment on Account, $1,000 12/12/xx- Purchased 20 units of Inventory on Account, $2,400 12/14/xx- Received a bill for Advertising and paid it, $250 12/15/xx- Provided Accounting service for Cash, $8,000 12/16/xx-Paid employees salary for Dec. 1-15 12/17/xx-Provided Accounting Service on Account, $6,000 12/19/xx- Sold 10 units of Inventory on Account, $3,000 Note: This transaction requires two journal entries. The first entry should deal with the sale, and the second should deal with the inventory 12/22/x- Received $2,500 payment on Account 12/23/xx- Made payment on Account, $2,500 12/24/x- Received and paid monthly Utility bills, $850 12/27/xx- Received $2,000 cash in advance for accounting services 12/29/xx- Provided Accounting Service for Cash, $5,000 12/30/xx-Issued 1,000 shares of Common Stock at $15 per share 12/31/xx- Declared dividends of $1.50 to outstanding shareholders as of 12/31/xx. Note: Be sure to debit retained earnings and credit dividends payable. 3. Prepare a trial balance to verify that total debits equal total credits. Record the following adjustments in the journal and in the trial balance. DO NOT post the 4. 110 3,000.00 410 Correct 3,000.00 Correct December 19, 2013 Accounts Receivable Sales Revenue Correct 1,200.00 Correct 560 1,200.00 December 19, 2013 Cost of Goods Sold 130 Inventory December 23, 2013 Accounts Payable 2,500.00 Incorrect account Cash 100 2,500.00 Incorrect account December 24, 2013 Utilities Expense Incorrect account 550 100 850.00 Cash 850.00 Incorrect amount lenter herel enter here] n/a enter here] fenter here) n/a fenter herel n/a Tenter here) n/a enter here) enter herel enter here) (enter here n/a n/a enter here Chart of Accounts Journal Ledger TrialBalance innn HAMPTON ACCOUNTING SERVICE INC 2 Statement of Retained Earnings 3 For the Year Ending December 31, 2019 4 5 Retained Earnings, January 1 Add: Net Income 7 Less: Dividends 9 Retained Earnings, December 31 10 12 HAMPTON ACCOUNTING SERVICE INC 2 Income Statement 3 For the Year Ending December 31, 2019 4 5 Service Revenue 6 Sales Revenue 7 Net Revenue 8 Cost of Goods Sold 9 Gross Profit 10 Operating Expenses 11 Advertising Expense 12 Depreciation Expense 13 Repairs & Maintenance 14 Supplies Expense 15 Uncollectible Accts Expense 16 Utilities Expense 17 Salary Expense 18 Total Operating Expense 19 Net Income 20