Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I got the answer for 5-6, just uploaded all relevant information for QUESTION 7 and 8, please! (Information is relevant to questions 5-8) You are

I got the answer for 5-6, just uploaded all relevant information for QUESTION 7 and 8, please!

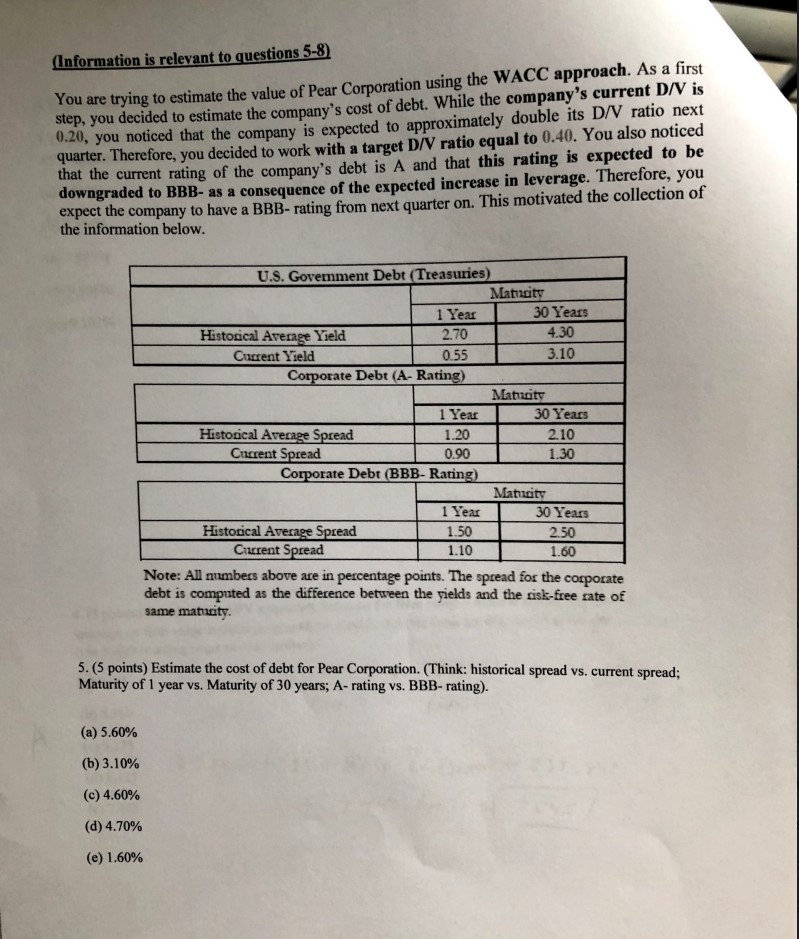

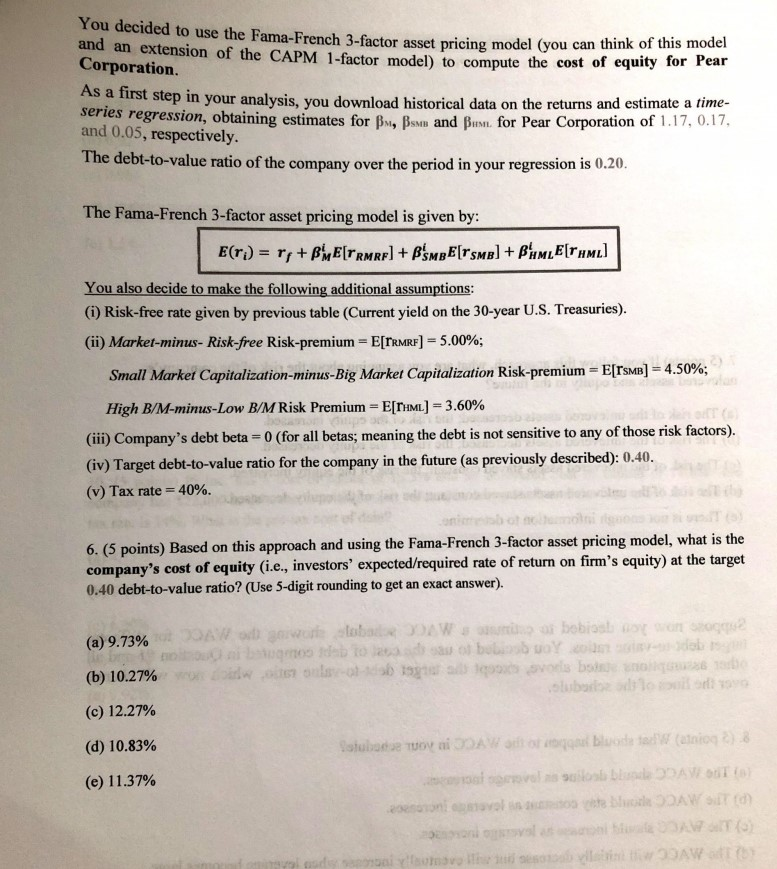

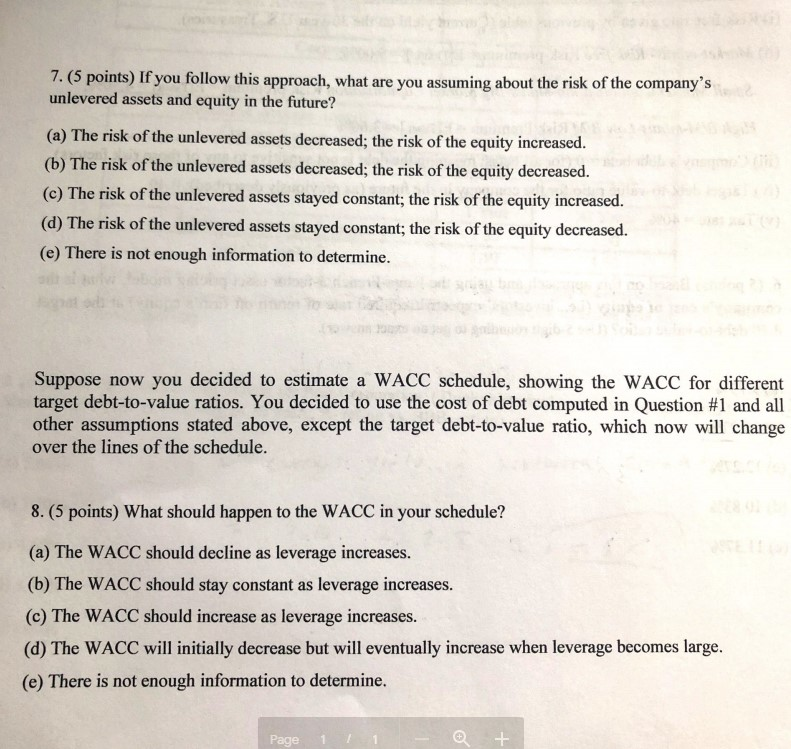

(Information is relevant to questions 5-8) You are trying to estimate the value of Pear Corporation using the WACC approach. As a first step, you decided to estimate the company's cost of debt. While the company's current D/V is 0.20, you noticed that the company is expected to approximately double its DN ratio next quarter. Therefore, you decided to work with a target D/V ratio equal to 0.40. You also noticed that the current rating of the company's debt is A and that this rating is expected to be downgraded to BBB- as a consequence of the expected increase in leverage. Therefore, you expect the company to have a BBB-rating from next quarter on. This motivated the collection of the information below. U.S. Government Debt Treasuries) Maturity 1 Year 30 Years Historical Average Yield 2.70 4.30 Current Yield 0.55 3.10 Corporate Debt (A- Rating) Maticity 1 Year 1 30 Years Historical Average Spread 1.20 2 .10 Current Spread 0. 901 .30 Corporate Debt (BBB- Rating) Maturity 1 Year 30 Years Historical Average Spread 1.50 2.50 Current Spread 1.10 1.60 Note: All numbers above are in percentage points. The spread for the corporate debt is computed as the difference between the yields and the risk-free cate of same matuity. 5. (5 points) Estimate the cost of debt for Pear Corporation. (Think: historical spread vs. current spread; Maturity of 1 year vs. Maturity of 30 years; A-rating vs. BBB-rating). (a) 5.60% (b) 3.10% (c) 4.60% (d) 4.70% (e) 1.60% You decided to use the Fama-French 3-factor asset pricing model (you can and an extension of the CAPM 1-factor model) to com tor asset pricing model (you can think of this model son of the CAPM 1-factor model) to compute the cost of equity for Pear Corporation. As a first step in you As a first step in your analysis, you download historical data on the returns and estimate a lime- series regression, obtaining estimates for BM, Bsm and Bin for Pear Corporation of 1.17.0.17, and 0.05, respectively. The debt-to-value ratio of the company over the period in your regression is 0.20. The Fama-French 3-factor asset pricing model is given by: E(r) = r, + BME[Trurf] + BMBE[TSMB] + B'UMLETHML] You also decide to make the following additional assumptions: (i) Risk-free rate given by previous table (Current yield on the 30-year U.S. Treasuries). (ii) Market-minus-Risk-free Risk-premium = E[TRMRF) = 5.00%; Small Market Capitalization-minus-Big Market Capitalization Risk-premium E[rsms] =4.50%; High B/M-minus-Low B/M Risk Premium = E[THM) - 3.60% (iii) Company's debt beta = 0 (for all betas, meaning the debt is not sensitive to any of those risk factors). (iv) Target debt-to-value ratio for the company in the future (as previously described): 0.40. (v) Tax rate = 40%. 6. (5 points) Based on this approach and using the Fama-French 3-factor asset pricing model, what is the company's cost of equity (i.e., investors' expected/required rate of return on firm's equity) at the target 0.40 debt-to-value ratio? (Use 5-digit rounding to get an exact answer). o (a) 9.73% DAW ogia DAW wastoban modablo 2 67 - bobiol bob Yo 5 svoris b b (b) 10.27% 199 o (c) 12.27% (d) 10.83% Oslobate tuo DAW at blodete (non) 8 (e) 11.37% l ovels ob blade tavolin o s e on DAW SIT on omavahe l DAW 7. (5 points) If you follow this approach, what are you assuming about the risk of the company's unlevered assets and equity in the future? (a) The risk of the unlevered assets decreased; the risk of the equity increased. (b) The risk of the unlevered assets decreased; the risk of the equity decreased. (c) The risk of the unlevered assets stayed constant; the risk of the equity increased. (d) The risk of the unlevered assets stayed constant; the risk of the equity decreased. (e) There is not enough information to determine. Suppose now you decided to estimate a WACC schedule, showing the WACC for different target debt-to-value ratios. You decided to use the cost of debt computed in Question #1 and all other assumptions stated above, except the target debt-to-value ratio, which now will change over the lines of the schedule. 8. (5 points) What should happen to the WACC in your schedule? (a) The WACC should decline as leverage increases. (b) The WACC should stay constant as leverage increases. (c) The WACC should increase as leverage increases. (d) The WACC will initially decrease but will eventually increase when leverage becomes large. (e) There is not enough information to determine. Page 1 (Information is relevant to questions 5-8) You are trying to estimate the value of Pear Corporation using the WACC approach. As a first step, you decided to estimate the company's cost of debt. While the company's current D/V is 0.20, you noticed that the company is expected to approximately double its DN ratio next quarter. Therefore, you decided to work with a target D/V ratio equal to 0.40. You also noticed that the current rating of the company's debt is A and that this rating is expected to be downgraded to BBB- as a consequence of the expected increase in leverage. Therefore, you expect the company to have a BBB-rating from next quarter on. This motivated the collection of the information below. U.S. Government Debt Treasuries) Maturity 1 Year 30 Years Historical Average Yield 2.70 4.30 Current Yield 0.55 3.10 Corporate Debt (A- Rating) Maticity 1 Year 1 30 Years Historical Average Spread 1.20 2 .10 Current Spread 0. 901 .30 Corporate Debt (BBB- Rating) Maturity 1 Year 30 Years Historical Average Spread 1.50 2.50 Current Spread 1.10 1.60 Note: All numbers above are in percentage points. The spread for the corporate debt is computed as the difference between the yields and the risk-free cate of same matuity. 5. (5 points) Estimate the cost of debt for Pear Corporation. (Think: historical spread vs. current spread; Maturity of 1 year vs. Maturity of 30 years; A-rating vs. BBB-rating). (a) 5.60% (b) 3.10% (c) 4.60% (d) 4.70% (e) 1.60% You decided to use the Fama-French 3-factor asset pricing model (you can and an extension of the CAPM 1-factor model) to com tor asset pricing model (you can think of this model son of the CAPM 1-factor model) to compute the cost of equity for Pear Corporation. As a first step in you As a first step in your analysis, you download historical data on the returns and estimate a lime- series regression, obtaining estimates for BM, Bsm and Bin for Pear Corporation of 1.17.0.17, and 0.05, respectively. The debt-to-value ratio of the company over the period in your regression is 0.20. The Fama-French 3-factor asset pricing model is given by: E(r) = r, + BME[Trurf] + BMBE[TSMB] + B'UMLETHML] You also decide to make the following additional assumptions: (i) Risk-free rate given by previous table (Current yield on the 30-year U.S. Treasuries). (ii) Market-minus-Risk-free Risk-premium = E[TRMRF) = 5.00%; Small Market Capitalization-minus-Big Market Capitalization Risk-premium E[rsms] =4.50%; High B/M-minus-Low B/M Risk Premium = E[THM) - 3.60% (iii) Company's debt beta = 0 (for all betas, meaning the debt is not sensitive to any of those risk factors). (iv) Target debt-to-value ratio for the company in the future (as previously described): 0.40. (v) Tax rate = 40%. 6. (5 points) Based on this approach and using the Fama-French 3-factor asset pricing model, what is the company's cost of equity (i.e., investors' expected/required rate of return on firm's equity) at the target 0.40 debt-to-value ratio? (Use 5-digit rounding to get an exact answer). o (a) 9.73% DAW ogia DAW wastoban modablo 2 67 - bobiol bob Yo 5 svoris b b (b) 10.27% 199 o (c) 12.27% (d) 10.83% Oslobate tuo DAW at blodete (non) 8 (e) 11.37% l ovels ob blade tavolin o s e on DAW SIT on omavahe l DAW 7. (5 points) If you follow this approach, what are you assuming about the risk of the company's unlevered assets and equity in the future? (a) The risk of the unlevered assets decreased; the risk of the equity increased. (b) The risk of the unlevered assets decreased; the risk of the equity decreased. (c) The risk of the unlevered assets stayed constant; the risk of the equity increased. (d) The risk of the unlevered assets stayed constant; the risk of the equity decreased. (e) There is not enough information to determine. Suppose now you decided to estimate a WACC schedule, showing the WACC for different target debt-to-value ratios. You decided to use the cost of debt computed in Question #1 and all other assumptions stated above, except the target debt-to-value ratio, which now will change over the lines of the schedule. 8. (5 points) What should happen to the WACC in your schedule? (a) The WACC should decline as leverage increases. (b) The WACC should stay constant as leverage increases. (c) The WACC should increase as leverage increases. (d) The WACC will initially decrease but will eventually increase when leverage becomes large. (e) There is not enough information to determine. Page 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started