Answered step by step

Verified Expert Solution

Question

1 Approved Answer

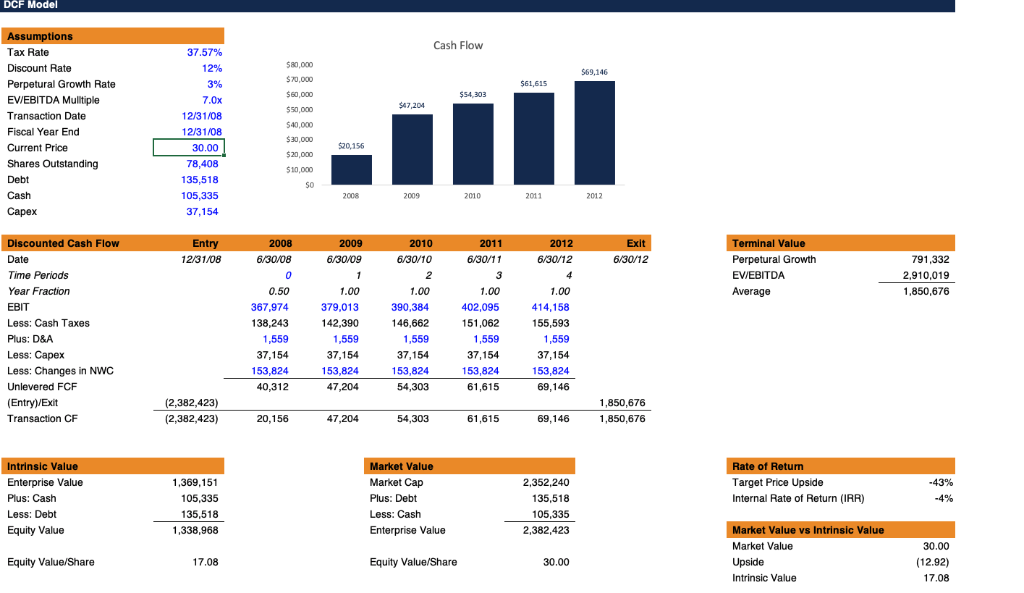

I got this DCF model template online and filled it in with a public company's information. Some things are just assumed values, but if you

I got this DCF model template online and filled it in with a public company's information. Some things are just assumed values, but if you had to explain what was going on here, what would you say about this? Literally any kind of analysis on this would help me. For example, if you were thinking about acquiring this company, would you or would you not? Why?

DCF Model Cash Flow $69,146 Perpetural Growth Rate EVIEBITDA Multiple $61,615 $54,303 47,204 520,156 Shares Outstanding 009 2011 2012 Terminal Value Perpetural Growth EVIEBITDA Average 791,332 2,910,019 1,850,676 6/30/12 6/30/12 axes Less: Changes in NWC (2,382,423) (2,382,423) 1,850,676 1,850,676 Market Value Market Cap Plus: Debt Less: Cash Enterprise Value ue Enterprise Value 1,369,151 105,335 135,518 1,338,968 2,352,240 135,518 105,335 2,382,423 Target Price Upside Internal Rate of Return (IRR) Market Value vs Intrinsic Value Market Value Equity Value/Share Equity Value/Share 30.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started