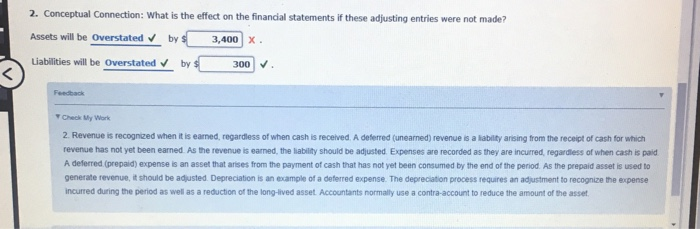

I got wrong on 2. conceptual connection. My final answer for Asset is $3400. It shows as wrong.

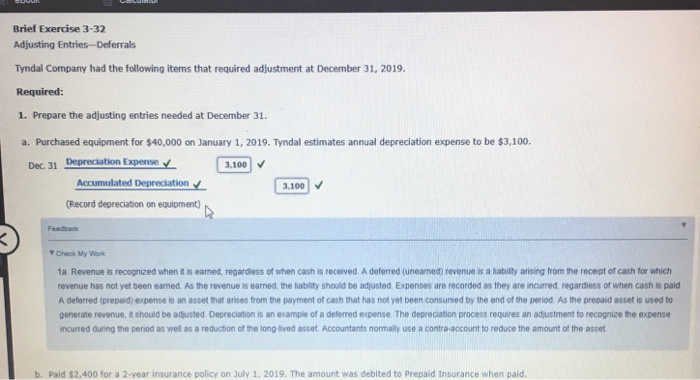

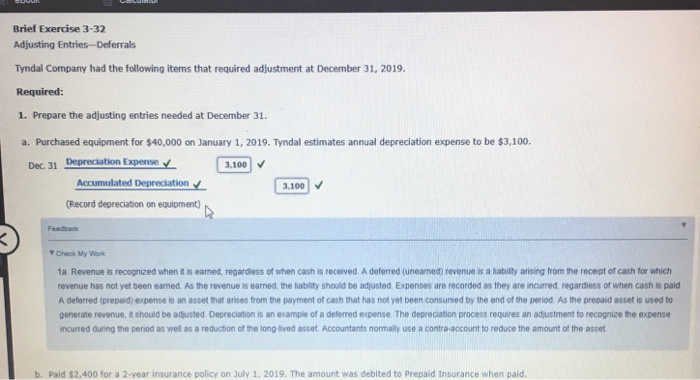

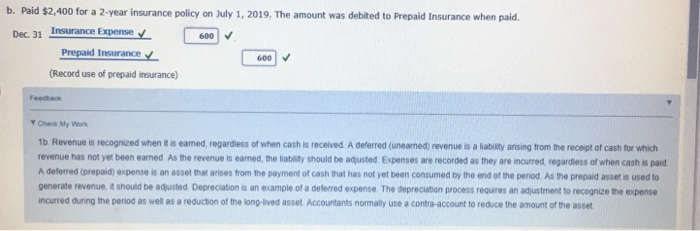

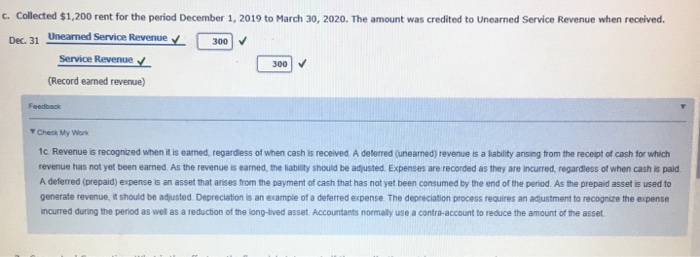

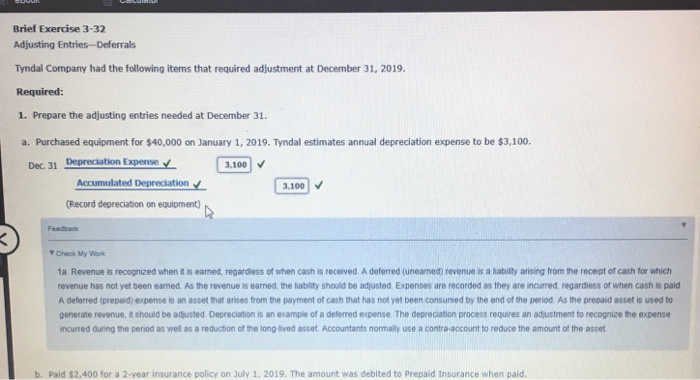

Brief Exercise 3-32 Tyndal Company had the following items that required adjustment at December 31, 2019. Required: 1. Prepare the adjusting entries needed at December 31 a. Purchased equipment for $40,000 on January 1, 2019. Tyndal estimates annual depreciation expense to be $3,100 Dec. 31 Depreciation Expense 3,100 Accumulated Depreciation (Record depreciation on equipment) 3,100 Check My Work 1a Revenue is recognized when it is eamed, regardless of when cash is received A deferred (unearned) revenue is a hability arising from the receipt of cash for which revenue has not yet been eamed. As the revenue is earned, the liability should be adjusted Expenses are recorded as they are incurred, regardless of when cash is paid A deferred (prepaid) expense is an asset that arees firom the payment of cash that has not yet been consumed by the end or re per od As the prepaid asset is used to generate revenue, it should be adjusted Depreciation is an example of a deflerred expense. The depreciation process requires an adjustment to recognize the expense incurred during the period as well as a reduction of the long-lived asset Accountants normally use a contra-account to reduce the amount of the asset b. Paid $2,400 for a 2-year insurance policy on July 1, 2019. The amount was debited to Prepald Insurance when paid. b. Paid $2,400 for a 2-year insurance policy on July 1, 2019, The amount was debited to Prepaid Insurance when paid. Dec. 31 Insurance 600 Prepaid Insurance 600 (Record use of prepaid insurance) Feedback Check My Work 1b Revenue is recognized when t is eamed, regardless of when cash is recelved. A deferred (unearned) revenue is a liability anising trom the receipt of cash for which revenue has not yet been earned As the revenue is earned, the liability should be adusted Expenses are recorded as they are incurred, regardiess of when cash is paid A deterred (prepaid) expense is an asset that arises from the payment of cash that has not yet been consumed by the end of the period As the prepaid asset is used to generate revenue, t should be adjusted Depreciation is an example of a deferred expense. The depreciation process requires an adjustment to recognize the expense incurred duning the period as well as a reduction of the long-lived asset Accountants normally use a contra-account to reduce the amount of the asset c. Collected $1,200 rent for the period December 1, 2019 to March 30, 2020. The amount was credited to Unearned Service Revenue when received Unearned Service Revenue Dec. 31 300 Service Revenue Record earned revenue) 300 Feedback Y Check My Work 1c. Revenue is recognized when t is eamed, regardless of when cash is received A deferred (unearned) revenue is a lability arising from the receipt of cash for which revenue has not yet been earned. As the revenue is earned, the liability should be adjusted. Expenses are recorded as they are incurred, regardless of when cash is paid A deferred (prepaid) expense is an asset that arises from the payment of cash that has not yet been consumed by the end of the period. As the prepaid asset is used to generate revenue, it should be adjusted Depreciation is an example of a deferred expense. The depreciation process requires an adjustment to recognize the expense ncurred during the peniod as wel as a reduction of the long-lived asset Accountants normally use a contra-account to reduce the amount of the asset 2. Conceptual Connection: What is the effect on the financial statements if these adjusting entries were not made? Assets will be Overstatedby Liabilities will be Overstatedby 3,400 x 300 Feedback Check Wy Work 2. Revenue is recognized when it is earned, regardless of when cash is received A deferred (unearned) revenue is a lability arising from the receipt of cash for which revenue has not yet been earned. As the revenue is earned, the liability should be adjusted Expenses are recorded as they are incurred, regardless of when cash is paid Adeferred prepaid) expense an asset that anses from the payment of cash that has not yet been consumed by the end of the pend Asthe prepaid asset is used to generate revenue, it should be adjusted Depreciation is an example of a deferred expense. The depreciation process requires an adjustment to recognize the expense incurred during the period as well as a reduction of the long-lived asset. Accountants normally use a contra-account to reduce the amount of the asset