Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I guessed and got this correct, could anyonne describe the steps to get this answer? A vintner is deciding when to release a vintage of

I guessed and got this correct, could anyonne describe the steps to get this answer?

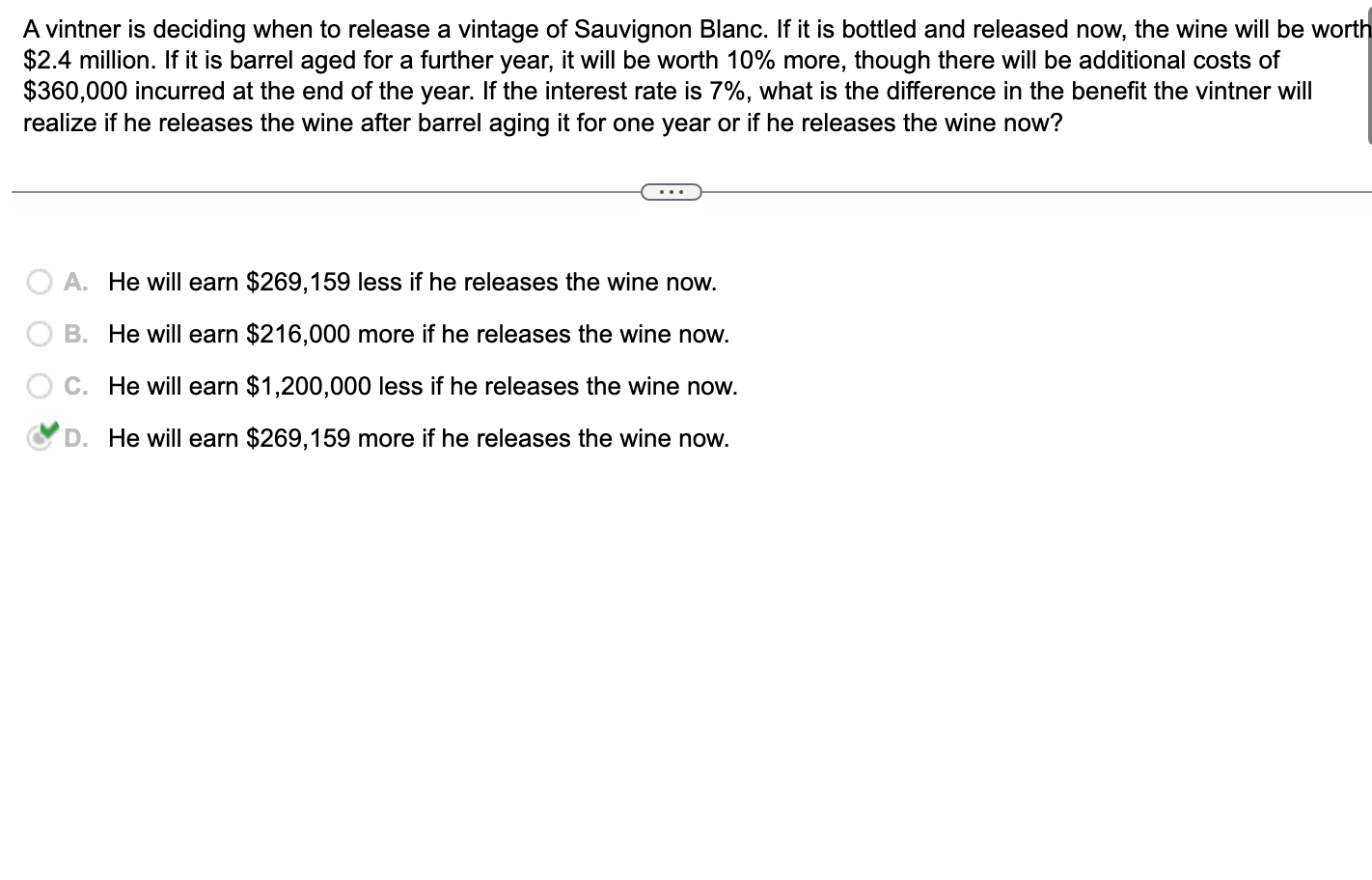

A vintner is deciding when to release a vintage of Sauvignon Blanc. If it is bottled and released now, the wine will be wortl $2.4 million. If it is barrel aged for a further year, it will be worth 10% more, though there will be additional costs of $360,000 incurred at the end of the year. If the interest rate is 7%, what is the difference in the benefit the vintner will realize if he releases the wine after barrel aging it for one year or if he releases the wine now? A. He will earn $269,159 less if he releases the wine now. B. He will earn $216,000 more if he releases the wine now. C. He will earn $1,200,000 less if he releases the wine now. D. He will earn $269,159 more if he releases the wine now

A vintner is deciding when to release a vintage of Sauvignon Blanc. If it is bottled and released now, the wine will be wortl $2.4 million. If it is barrel aged for a further year, it will be worth 10% more, though there will be additional costs of $360,000 incurred at the end of the year. If the interest rate is 7%, what is the difference in the benefit the vintner will realize if he releases the wine after barrel aging it for one year or if he releases the wine now? A. He will earn $269,159 less if he releases the wine now. B. He will earn $216,000 more if he releases the wine now. C. He will earn $1,200,000 less if he releases the wine now. D. He will earn $269,159 more if he releases the wine now Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started