Question

I had the following question, where I don't know how they got to the answer (maybe the question is wrong). It is very similar to

I had the following question, where I don't know how they got to the answer (maybe the question is wrong). It is very similar to this one (https://www.chegg.com/homework-help/questions-and-answers/question-15-1-pts-pisa-inc-leased-equipment-tower-company-four-year-lease-requiring-equal--q45729205), but this question contains a residual asset:

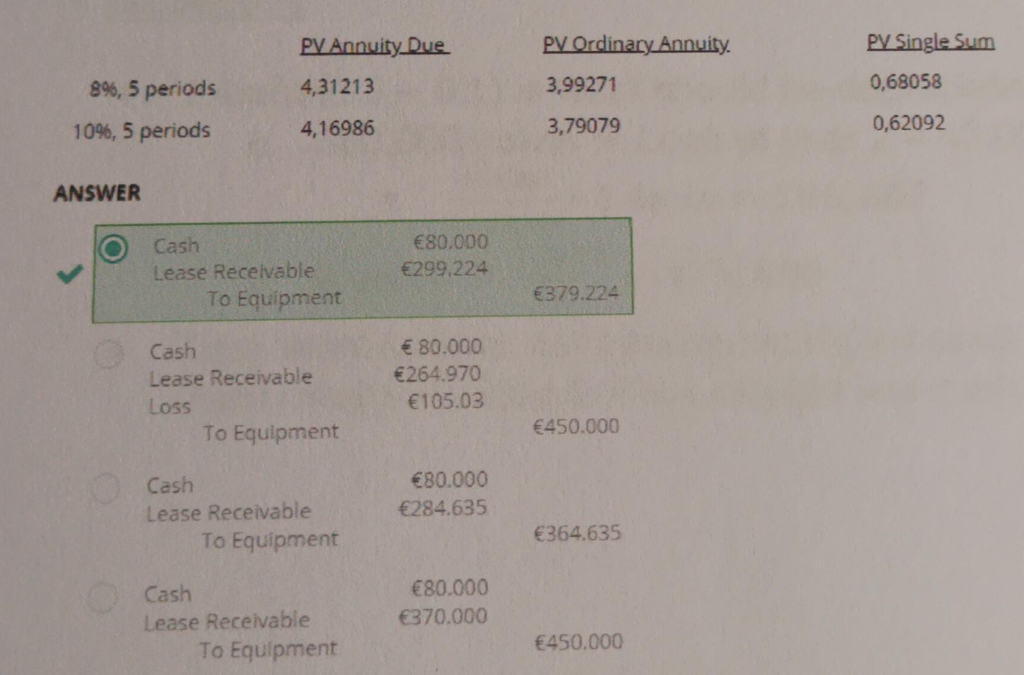

On 1 January 2020, Finance Leasing Company leases equipment to construction company CCB with 5 equal annual payments of 80,000 each, payable beginning 1 January 2020. CCB agrees to guarantee the 50,000 residual value of the asset at the end of the lease term. CCB's incremental borrowing rate is 10%. However, Finance Leasing Company's implicit interest rate and rate on investment is 8%. What journal entry would Finance Leasing Company make at 1 January 2020 assuming this is a finance lease?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started