Question

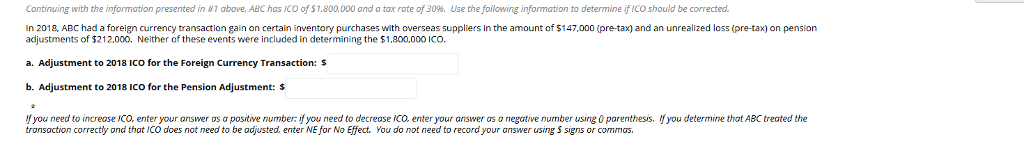

I had this problem and got part of it wrong on my quiz and have to know how to do it for my upcoming test

I had this problem and got part of it wrong on my quiz and have to know how to do it for my upcoming test and was looking for guidance to the answer aswell as letting me know which part I got correct and which part was incorrect.

For Part A I got 102,900 for my transaction gain on foreign currency. I got to this answer by taking the gain of 147,000 pre tax and using the 30% tax rate to get 44,100 then subtracting that from the original gain. 147,000 - 44,100 = 102,900

For Part B I got (148,400) for my loss on the pension adjustment. I got this by doing the same thing i did for the transaction gain by taking the pre tax loss of 212,000 and using the 30% tax rate to get 63,600 then subtracting it from the original loss. 212,000 - 63,600 = 148,400.

Any help in pointing out where I went wrong would be appreciated

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started