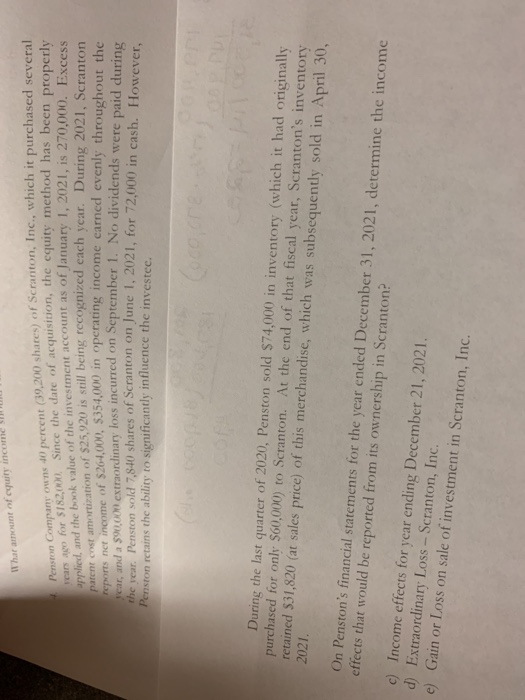

I har amount of equity income Pensa Company own 40 percent (39,200 shares) of Scranton, Inc., which it purchased se or S182.000. Since the date of acquisition, the equity method has been properly years ago for $182,000. inlind and the book value of the investment account as of January 1, 2021, is 270.000. Eyes vation of $25,920 is still being recognized each year. During 2021, Scranton reports net income of $264,000, $354,000 in operating income earned evenly throughout the year, and a $90,00 extraordinary loss incurred on September 1. No dividends were paid during the year. Penston sold 7,840 shares of Scranton on June 1, 2021, for 72.000 in cash. However Penston retains the ability to significantly influence the investee. During the last quarter of 2020, Penston sold $74,000 in inventory (which it had originally purchased for only $60,000) to Scranton. At the end of that fiscal year, Scranton's inventory retained 531,820 (at sales price) of this merchandise, which was subsequently sold in April 30, 2021. On Penston's financial statements for the year ended December 31, 2021. determine the income! effects that would be reported from its ownership in Scranton c) Income effects for year ending December 21, 2021. d) Extraordinary Loss - Scranton, Inc. e) Gain or Loss on sale of investment in Scranton, Inc. I har amount of equity income Pensa Company own 40 percent (39,200 shares) of Scranton, Inc., which it purchased se or S182.000. Since the date of acquisition, the equity method has been properly years ago for $182,000. inlind and the book value of the investment account as of January 1, 2021, is 270.000. Eyes vation of $25,920 is still being recognized each year. During 2021, Scranton reports net income of $264,000, $354,000 in operating income earned evenly throughout the year, and a $90,00 extraordinary loss incurred on September 1. No dividends were paid during the year. Penston sold 7,840 shares of Scranton on June 1, 2021, for 72.000 in cash. However Penston retains the ability to significantly influence the investee. During the last quarter of 2020, Penston sold $74,000 in inventory (which it had originally purchased for only $60,000) to Scranton. At the end of that fiscal year, Scranton's inventory retained 531,820 (at sales price) of this merchandise, which was subsequently sold in April 30, 2021. On Penston's financial statements for the year ended December 31, 2021. determine the income! effects that would be reported from its ownership in Scranton c) Income effects for year ending December 21, 2021. d) Extraordinary Loss - Scranton, Inc. e) Gain or Loss on sale of investment in Scranton, Inc